Exploring 3 High Growth Tech Stocks In The United Kingdom

Over the last 7 days, the United Kingdom market has remained flat, though it has risen 5.3% in the past 12 months with earnings forecast to grow by 14% annually. In this context, identifying high growth tech stocks that align with these positive trends can be crucial for investors seeking robust opportunities in a dynamic sector.

Top 10 High Growth Tech Companies In The United Kingdom

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Gaming Realms | 11.57% | 22.07% | ★★★★★☆ |

STV Group | 13.15% | 46.78% | ★★★★★☆ |

Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

YouGov | 14.29% | 29.79% | ★★★★★☆ |

Facilities by ADF | 52.00% | 144.70% | ★★★★★☆ |

Redcentric | 4.89% | 63.79% | ★★★★★☆ |

Windar Photonics | 67.08% | 130.82% | ★★★★★☆ |

IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 47 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Redcentric

Simply Wall St Growth Rating: ★★★★★☆

Overview: Redcentric plc offers IT managed services for both public and private sectors in the United Kingdom, with a market cap of £204.72 million.

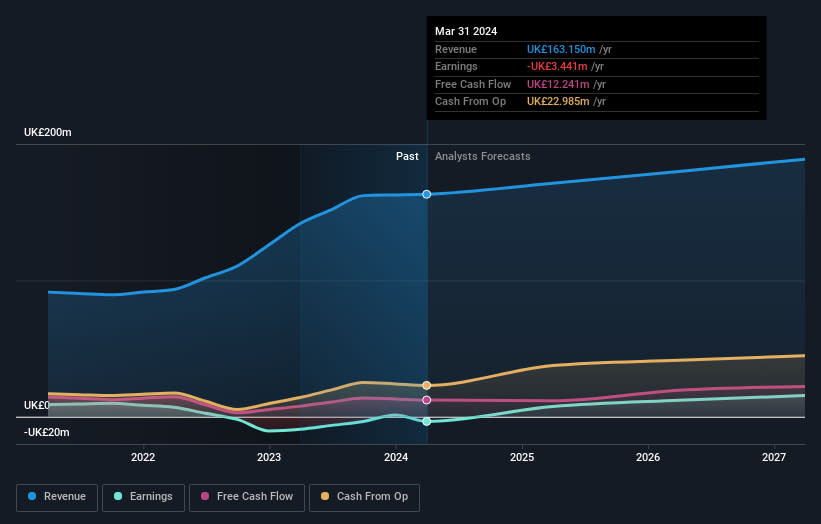

Operations: The company generates revenue primarily through the provision of managed IT services to customers, totaling £163.15 million.

Redcentric's trajectory in the tech sector, particularly within the UK, is marked by a blend of challenges and growth prospects. Despite its current unprofitability, with a net loss shrinking from £9.25 million to £3.44 million year-over-year as of March 2024, the company's revenue growth outlook appears robust at 4.9% annually—outpacing the UK market average of 3.7%. Significantly, earnings are expected to surge by an impressive 63.8% per year moving forward. This anticipated profitability coupled with a positive free cash flow underscores potential for recovery and growth in its operational performance. Moreover, Redcentric's commitment to innovation is evident from its R&D investments which are pivotal for staying competitive in high-tech industries where rapid evolution is commonplace. The firm’s recent financial adjustments and strategic management changes signal a proactive approach towards stabilizing and expanding its market position, even as it navigates through profitability challenges.

Take a closer look at Redcentric's potential here in our health report.

Assess Redcentric's past performance with our detailed historical performance reports.

Ascential

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ascential plc offers specialist information, analytics, and e-commerce optimization platforms across various regions including the UK, Europe, the US, Canada, China, Asia Pacific, the Middle East, Africa, and Latin America with a market cap of £1.15 billion.

Operations: Ascential plc generates revenue primarily from its Marketing segment (£148.40 million) and Financial Technology segment (£79.70 million). The company operates across multiple regions, offering specialized services in information, analytics, and e-commerce optimization platforms.

Ascential plc, a UK-based specialist in events, intelligence, and advisory services, has demonstrated resilience with a 4% annual revenue growth forecast—slightly ahead of the UK market average of 3.7%. This growth is bolstered by a robust earnings projection of 17.5% annually. The company's commitment to innovation is underscored by significant R&D investments which amounted to £14 million last year, representing an increase from previous years and accounting for approximately 4% of their total revenue. These strategic investments are crucial for Ascential as they adapt to evolving market demands and maintain competitive advantage in their sector. Additionally, the recent approval for amendments to its articles of association signals proactive governance adjustments aligning with future growth trajectories.

Click to explore a detailed breakdown of our findings in Ascential's health report.

Gain insights into Ascential's past trends and performance with our Past report.

Spirent Communications

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Spirent Communications plc offers automated test and assurance solutions across the Americas, Asia Pacific, Europe, the Middle East, and Africa with a market cap of £989.13 million.

Operations: Spirent Communications plc generates revenue primarily from its Networks & Security segment, contributing $258.50 million. The company operates across multiple regions, including the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Spirent Communications, amidst a challenging fiscal period with a net loss of $6.7 million for the first half of 2024, contrasts its financial downturn with strategic advancements in Wi-Fi technology. The company's recent launch of enhanced Octobox Wi-Fi testing solutions positions it at the forefront of addressing critical needs as ISPs and manufacturers adapt to Wi-Fi 7 standards. Despite a revenue dip to $197.3 million from last year's $223.9 million, Spirent's R&D focus remains robust, crucial for sustaining its competitive edge in rapidly evolving tech landscapes. This blend of innovation amidst financial recalibration highlights Spirent’s resilience and adaptability in the high-stakes tech sector.

Taking Advantage

Gain an insight into the universe of 47 UK High Growth Tech and AI Stocks by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:RCN LSE:ASCL and LSE:SPT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com