Examining Three German Stocks Estimated To Be Undervalued In July 2024

As of July 2024, Germany's DAX index has experienced a notable decline of 3.07%, reflecting broader European market pressures amidst rising U.S.-China trade tensions and economic uncertainties. This challenging environment may present opportunities to identify stocks that are potentially undervalued. In such a market, discerning investors might look for companies with solid fundamentals like strong balance sheets or consistent cash flows, which could be poised for recovery as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Stabilus (XTRA:STM) | €42.60 | €78.94 | 46% |

Allgeier (XTRA:AEIN) | €16.75 | €26.02 | 35.6% |

technotrans (XTRA:TTR1) | €16.95 | €29.17 | 41.9% |

ecotel communication ag (XTRA:E4C) | €12.75 | €19.93 | 36% |

Stratec (XTRA:SBS) | €41.40 | €81.34 | 49.1% |

CHAPTERS Group (XTRA:CHG) | €24.00 | €43.23 | 44.5% |

MTU Aero Engines (XTRA:MTX) | €253.20 | €420.19 | 39.7% |

R. STAHL (XTRA:RSL2) | €18.40 | €29.08 | 36.7% |

Your Family Entertainment (DB:RTV) | €2.48 | €4.55 | 45.5% |

Dr. Hönle (XTRA:HNL) | €17.65 | €34.65 | 49.1% |

Let's review some notable picks from our screened stocks.

adidas

Overview: Adidas AG operates globally, designing, developing, producing, and marketing athletic and sports lifestyle products across multiple regions; as of the latest data, the company has a market capitalization of approximately €41.14 billion.

Operations: Adidas generates revenue from various regions, with €5.16 billion from North America, €3.20 billion from Greater China, and €2.31 billion from Latin America.

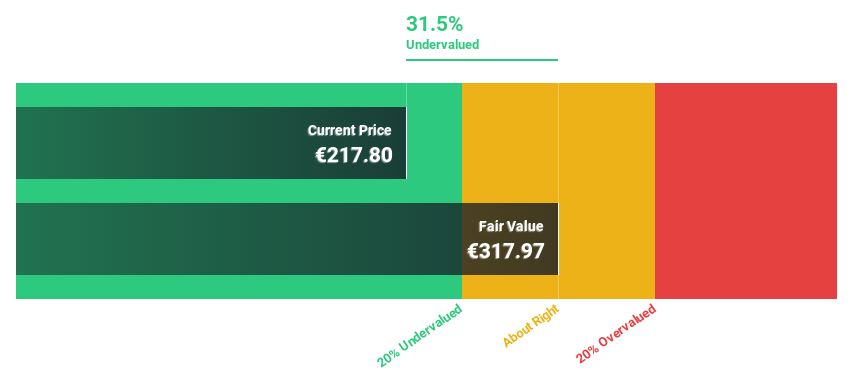

Estimated Discount To Fair Value: 34.3%

Adidas AG, priced at €230.4, is significantly undervalued based on a discounted cash flow analysis with a fair value estimate of €350.49, indicating a potential undervaluation of over 20%. The company's earnings are expected to surge by 41% annually, outpacing the German market's growth rate. Recently, Adidas raised its 2024 earnings guidance following robust quarterly performance and now anticipates higher revenue growth and operating profit around €1 billion despite currency headwinds impacting profitability.

The analysis detailed in our adidas growth report hints at robust future financial performance.

Take a closer look at adidas' balance sheet health here in our report.

M1 Kliniken

Overview: M1 Kliniken AG operates a network offering aesthetic medicine and plastic surgery services across Germany, Austria, the Netherlands, Switzerland, the UK, Croatia, Hungary, Bulgaria, Romania, and Australia with a market capitalization of approximately €287.55 million.

Operations: The company generates revenue primarily through its Trade and Beauty segments, with earnings of €245.49 million and €70.83 million respectively.

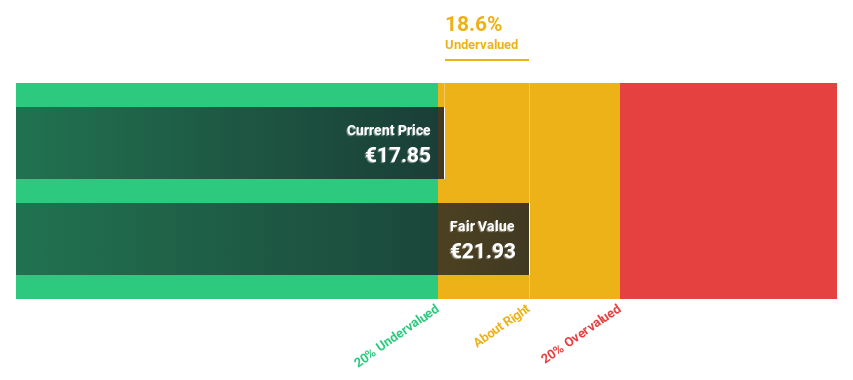

Estimated Discount To Fair Value: 27%

M1 Kliniken AG, with a current price of €15.7, trades below the estimated fair value of €21.5, reflecting a significant undervaluation based on discounted cash flow metrics. The company's earnings have shown robust growth, increasing by 138% last year to €10.27 million and are projected to grow at 24.4% annually over the next three years—surpassing the average market forecast in Germany. Despite this strong profit expansion and revenue growth forecasted at 7.9% annually, its dividend coverage remains weak due to substantial volatility in share price and low free cash flows relative to dividends paid.

SAP

Overview: SAP SE operates globally, offering a wide range of applications, technology, and services through its subsidiaries, with a market capitalization of approximately €227.97 billion.

Operations: The company generates €31.81 billion from its Applications, Technology & Services segment.

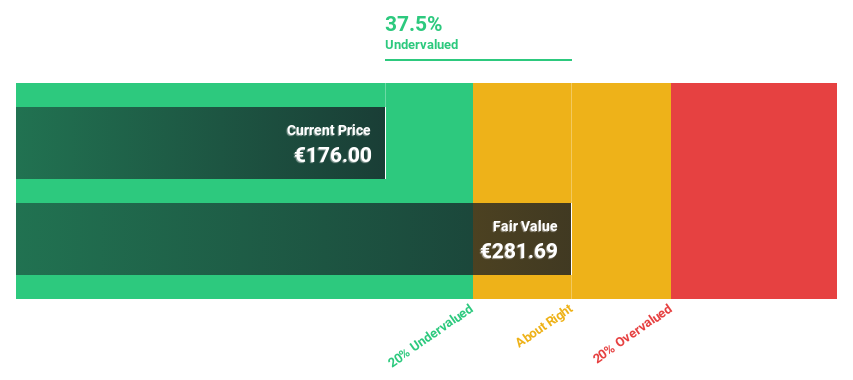

Estimated Discount To Fair Value: 26.7%

SAP SE, priced at €196.74, is notably undervalued with a fair value estimation of €268.44, reflecting significant potential based on discounted cash flow analysis. Despite recent substantial one-off items affecting its financial results, SAP's earnings are expected to grow robustly at 34.42% annually over the next three years, outpacing the German market's forecast growth rate of 18.8%. However, its projected return on equity remains modest at 16.4% in three years' time. Additionally, recent strategic partnerships and expansions into cloud services underscore SAP's ongoing efforts to enhance its operational efficiencies and market position.

According our earnings growth report, there's an indication that SAP might be ready to expand.

Click here and access our complete balance sheet health report to understand the dynamics of SAP.

Seize The Opportunity

Gain an insight into the universe of 25 Undervalued German Stocks Based On Cash Flows by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADS XTRA:M12 and XTRA:SAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com