Everyone Is Talking About Caterpillar Stock. Is It a Good Long-Term Option?

Caterpillar (NYSE: CAT) stock is down almost 14% from its all-time high, presenting a potential entry point for long-term investors. The question remains: Is now the right time to seize this opportunity? Here's what you need to know before considering a position.

The long-term case for investing in Caterpillar

Although it may be seen as an old-economy stock, Caterpillar might surprise many investors due to its exposure to a couple of new economy themes. The first is the energy transition and its impact on Caterpillar sales, and the second is its use of technology (e-commerce and digital capability) to grow its less cyclical services revenue.

Both elements are critical components of the investment case for the stock.

Caterpillar and the energy transition

The company's machinery, energy, and transportation (ME&T) businesses (Caterpillar also has a finance arm for customers and dealers) operate out of three segments, all relevant to the energy transition.

The construction industries segment manufactures machinery for infrastructure and building construction activity. Consequently, its machinery is used to build renewable energy infrastructure and the necessary electricity networks for transmission and distribution.

Its resources segment makes mining machinery and making aggregates. As such, end demand is driven by capital spending in the mining commodity industry and infrastructure spending (aggregates for road building).

Demand for mining commodities such as copper, nickel, cobalt, and zinc is likely to increase due to their extensive usage in electric vehicles (EVs), solar panels, and electricity transmission and distribution networks.

Finally, the energy and transportation segment provides equipment used in generating energy for electric vehicles.

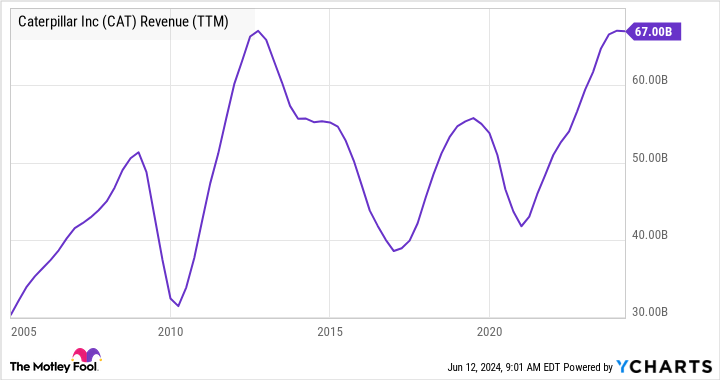

These end-demand drivers encourage investors to believe that Caterpillar's notoriously cyclical revenue (see chart below) is likely to continue to grow in an uptrend rather than decline dramatically as in previous cycles.

Reducing risk through services growth

The chart above shows Caterpillar's trailing-12-month revenue as being around $67 billion, and an increasing part of it is coming from its less cyclical services revenue. Caterpillar is on track to double its services revenue from $14 billion in 2016 to $28 billion in 2026.

A large part of the growth in services revenue comes from targeted investments in e-commerce capability to enable online parts sales, as well as using data analytics and machine learning to better predict service events. That's highly useful for its customers as it reduces machinery downtime and enables Caterpillar's dealers to grow their parts sales.

Is it enough to make Caterpillar stock a buy?

The growing services revenue supports the argument that Caterpillar deserves a valuation expansion. In other words, investors should be willing to pay a higher multiple because Caterpillar's earnings are becoming less cyclical.

That said, Caterpillar is still a highly cyclical company, reflected in management's guidance for free cash flow (FCF) to range between $5 billion and $10 billion through the cycle. That range might lead you to take the midpoint of $7.5 billion as a benchmark and price the stock on a multiple of that figure. A valuation of 20 times FCF is acceptable for a mature industrial company, and that implies a share price of $305 -- less than the $329 it trades on at the time of writing.

If you think that the shift to renewable energy, infrastructure investments, and a potential surge in mining commodities will result in a sustained increase in demand for Caterpillar, then it may be a good idea to invest in the stock. This is because the company's free-cash-flow guidance, which currently stands at $5 billion to $10 billion, is likely to see an upgrade in this scenario.

What it means to investors

All told, Caterpillar is an attractive stock for investors who believe its revenue has significant upside potential. Still, Caterpillar is one for the monitor list for investors who like value situations or are unwilling to invest unless they see value based on the company's own guidance.

Should you invest $1,000 in Caterpillar right now?

Before you buy stock in Caterpillar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Caterpillar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Everyone Is Talking About Caterpillar Stock. Is It a Good Long-Term Option? was originally published by The Motley Fool