European Stocks Edge Higher With Focus on US Inflation, Nvidia

(Bloomberg) -- European stocks inched higher on Tuesday as investors shied away from making big bets ahead of US inflation data and Nvidia Corp. earnings later this week.

Most Read from Bloomberg

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

How the Cortiços of São Paulo Helped Shelter South America’s Largest City

The Stoxx 600 Index was up 0.2% by the close after fluctuating between small gains and losses through the session. Personal care and travel and leisure stocks outperformed, while consumer products lagged.

Among individual stocks, Associated British Foods Plc recouped declines that were sparked by a rating downgrade from Deutsche Bank. Daimler Truck Holding AG fell as Goldman Sachs cut its recommendation on the stock to neutral. Bunzl Plc shares jumped after the distribution group raised its full-year profit guidance.

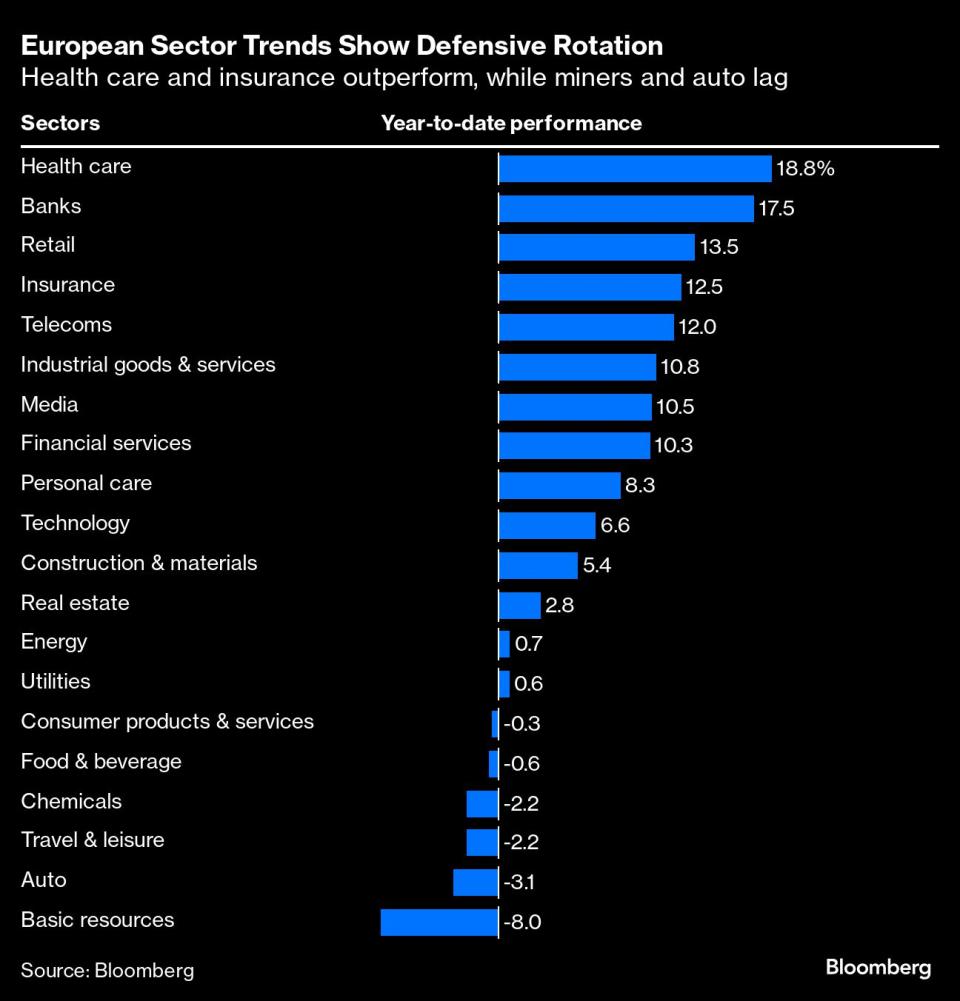

Europe’s equity benchmark is nearing a record high on dovish signals from the Federal Reserve around the outlook for interest rates. Still, investors remain defensive, with health care stocks and insurance among the most preferred sectors while autos and miners are lagging.

This week’s focus will be on the US personal consumption expenditures index, due Friday, for further clues on how much the Fed is likely to cut interest rates. Investors will also watch Nvidia’s quarterly earnings on Wednesday to assess the strength of artificial intelligence-related sectors.

“In a week of light data on the macro front, European stocks will likely be driven more than usual by the developments in the US,” said Panmure Liberum strategist Joachim Klement. “We are still optimistic that Nvidia will beat expectations, but any sign of weakness in the numbers could lead to setbacks not just in US tech stocks, but European tech companies as well.”

France’s CAC 40 Index was down 0.3%. French President Emmanuel Macron is continuing consultations on appointing a viable prime minister after ruling out a government led by leftist candidate Lucie Castets in favor of a possible centrist coalition.

For more on equity markets:

Indicators Are Muddying the Waters for Equities: Taking Stock

M&A Watch Europe: Saras, Volue, Harbour Energy, Telecom Italia

Klarna Investors Take Stock of Valuation Ahead of IPO: ECM Watch

US Stock Futures Little Changed; Heico, Apple Fall

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.