Euronext Paris Showcases Three Leading Dividend Stocks

Amidst a backdrop of fluctuating global markets, France's CAC 40 Index recently experienced a notable decline, reflecting broader European economic pressures and uncertainties. This environment underscores the importance of stability and reliability in investment choices, qualities often exemplified by leading dividend stocks on the Euronext Paris.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 7.03% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.82% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.66% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.69% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.20% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.07% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.02% | ★★★★★☆ |

Samse (ENXTPA:SAMS) | 6.08% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.47% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 8.93% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative operates in France, offering a range of banking products and services to a diverse clientele, with a market capitalization of approximately €0.97 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates €505.07 million from its retail banking operations in France.

Dividend Yield: 5.6%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a compelling dividend yield of 5.59%, ranking in the top 25% of French dividend payers. With a payout ratio of 30.9%, its dividends are well-covered by earnings, indicating sustainability. The firm has demonstrated reliability and growth in its dividend payments over the last decade, despite trading at 64.2% below estimated fair value, suggesting potential undervaluation.

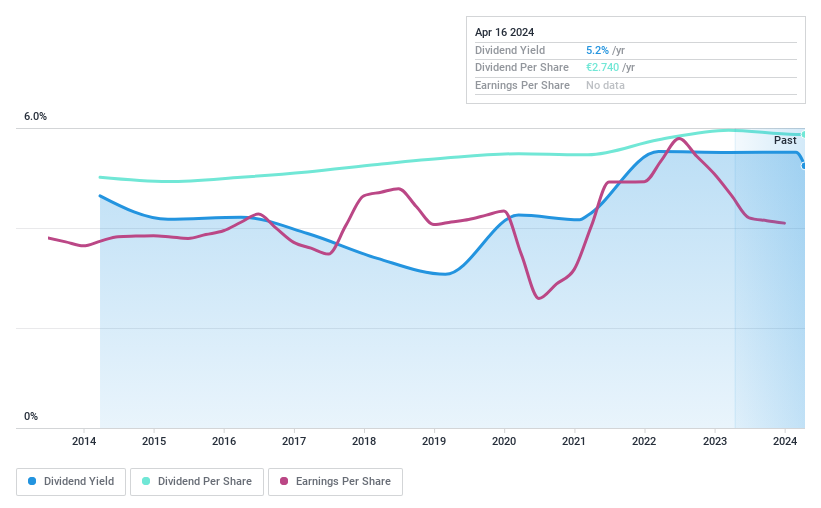

Publicis Groupe

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. offers marketing, communications, and digital business transformation services across various global regions, with a market capitalization of approximately €24.75 billion.

Operations: Publicis Groupe S.A. generates €15.35 billion in revenue primarily from its Advertising and Communication Services segment.

Dividend Yield: 3.4%

Publicis Groupe S.A. recently raised its 2024 revenue guidance following a strong first half, with sales increasing to €7.65 billion from €7.11 billion year-over-year and net income up to €773 million from €623 million. Despite a low dividend yield of 3.45% compared to the French market's top quartile at 5.33%, the company has shown commitment to growing dividends, evidenced by a recent 17% increase in its annual payout to €3.40 per share. Dividends are reasonably covered by earnings and cash flows, with payout ratios of 54.7% and 64.2%, respectively, though the dividend track record has been unstable over the past decade.

Samse

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA, operating in France, specializes in distributing building materials and tools with a market capitalization of approximately €0.56 billion.

Operations: Samse SA generates revenue primarily through two segments: trading (€1.74 billion) and do-it-yourself retail (€0.43 billion).

Dividend Yield: 6.1%

Samse has a dividend yield of 6.08%, ranking in the top 25% in France, supported by a low payout ratio of 44.8% and cash payout ratio of 36.8%. Despite this, dividends have shown volatility over the past decade without consistent growth, posing risks for stability-minded investors. Trading at a P/E ratio of 7.4x—below the French market average—Samse offers value but with caution due to its unstable dividend history and modest earnings growth forecast at 4.03% annually.

Dive into the specifics of Samse here with our thorough dividend report.

Our expertly prepared valuation report Samse implies its share price may be lower than expected.

Summing It All Up

Click through to start exploring the rest of the 35 Top Euronext Paris Dividend Stocks now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CRLA ENXTPA:PUB and ENXTPA:SAMS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com