Energy ETFs Lag As Oil Gives Up 2024 Gains

The price of oil hit its lowest level since January this week, weighing on oil and energy exchange-traded funds.

Front month West Texas Intermediate crude oil futures contracts closed at $71.93 per barrel on Wednesday, their lowest price since hitting $70.77 on Jan. 8.

Global oil demand is on track to increase by less than 1 million barrels per day this year and next year, according to the International Emergency Agency, less than half the pace of 2023.

Demand growth is slowing at the same time that supply is expected to accelerate, with growth of 730,000 barrels per day in 2024 and 1.9 million barrels per day in 2025, according to the IEA.

“In June, Chinese oil demand contracted for a third consecutive month, driven by a slump in industrial inputs, including for the petrochemical sector," the IEA wrote in its latest Oil Market Report. "By contrast, demand in advanced economies, especially for US gasoline, has shown signs of strength in recent months.”

Based on the IEA’s forecast for supply in demand in 2025, the agency says that global oil inventories could increase by an average of 860,000 barrels per day.

The expectations of an oversupplied market are partly to blame for oil’s recent weakness. Concerns that demand could weaken further if economies in China, the U.S. and elsewhere slow more than expected could also be weighing on the commodity.

USO Outperforms, XLE Lags

Despite the fact that oil has given up most of its gains for the year—WTI is up by 2%, while Brent is up by 0.2%—ETFs tied to oil futures have delivered decent returns.

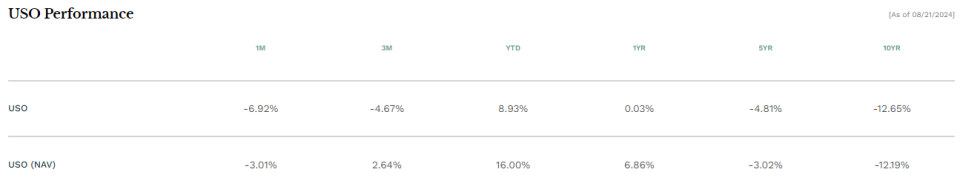

The United States Oil Fund (USO) and the United States Brent Oil Fund (BNO), which track WTI and Brent, respectively, are up by 10% and 9%.

The outperformance can be attributed to futures curves in backwardation, a phenomenon that benefits ETFs that hold and roll futures contracts.

Meanwhile, the Energy Select Sector Fund (XLE) is higher by 7.7% on a year-to-date basis, in-line with the oil ETFs, but a sharp underperformance versus the SPDR S&P 500 ETF Trust (SPY), which is up 18%.

Energy is one of four stock market sectors with a gain of less than 10% this year.