Edwards Lifesciences Soars on TTVR Approval, But Challenges Remain

Edwards Lifescience (NYSE:EW), a medical device company that specializes in cardiovascular, today by soaring 6% to $68.49 per share at the time this article was written. Technical analysis suggests that it's the moment of strong buy.

The market reacted after EW received its commercial approval of their transcatheter tricuspid valve replacement (TTVR) device thanks to their TRICSEND II trial that marks a significant milestone to the company. The TRISCEND II trial was a clinical study to evaluate the safety and effectiveness of TTVR devices. The positive outcomes of the trial helps them get commercial approval for their TTVR device. This is important because this device generates the most of EW's total sales over years. And commercial approval allows the device to be commercially available for patients in need, and that means broader reach of sales.

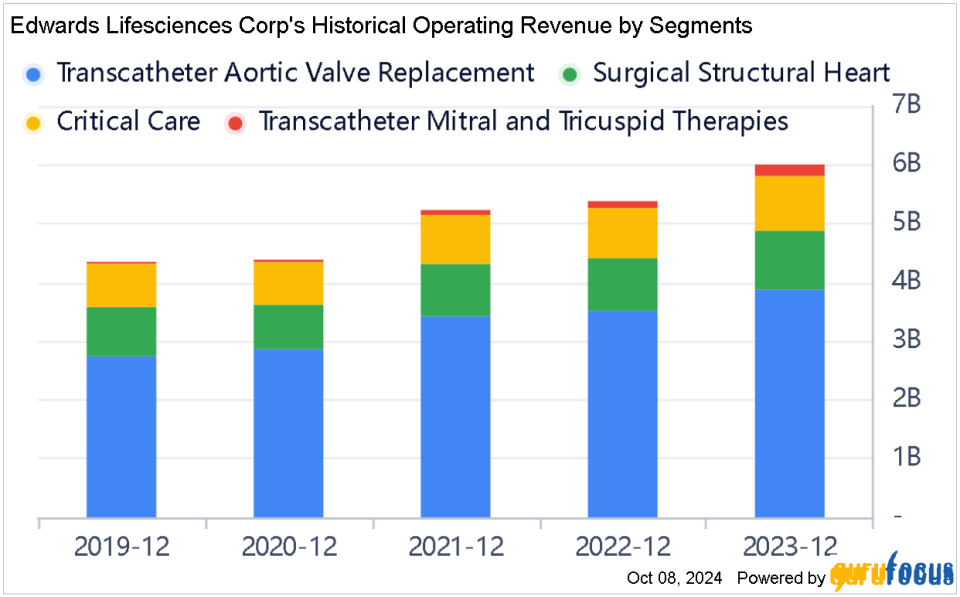

EW has four segments, there is Transcatheter Aortic Valve Replacement (TAVR) segment that represents 64.61% of sales, and in the second place there is Surgical Structural Heart that accounts 16.64% of all sales, followed by Critical Care with 15.46% sales and the last is Transcatheter Mitral and Tricuspid Therapies that makes only 3.29% of the sales. Below is the chart that depicts sales from year to year of each segments.

Good news in TAVR, as the most generating segment, can be translated into better overall sales in the future.

However the management gave a comment on October 7th, 2024 that in 2025 the company is anticipated to sell their Critical Care business which currently makes 15.46% of the annual total sales. That definitely will lower their margins and earnings.

But, if the EW's biggest contributor, which happens to reach a significant milestone recently, can make more sales that can cover the reduced income that caused by the divestiture of Critical Care business then there's nothing to worry about.

Moreover their Early TAVR trial in asymptomatic aortic stenosis signaling a positive-expected result. This also supports their biggest revenue generator. When the result is out and happens to be favorable, then the market concerns can be relieved and investors can gain confidence again.Don't just read the latest news - make informed investment decisions. Visit GuruFocus today and dive deeper into Edward Lifesciences' performance with Charts & Guru Insights.

This article first appeared on GuruFocus.