Key ECB Measure of Wage Growth Slows Before Likely Rate Cut

(Bloomberg) -- A key measure of euro-zone wage growth eased — providing further assurance to European Central Bank officials seeking to lower interest rates next week.

Most Read from Bloomberg

World's Second Tallest Tower Spurs Debate About Who Needs It

The Plan for the World’s Most Ambitious Skyscraper Renovation

Madrid to Ban E-Scooter Rentals, Following Lead Set in Paris

Compensation per employee rose by 4.3% in the second quarter — down from 4.8% in the first three months of the year, according to calculations by Bloomberg Economics based on Eurostat data published Friday. In June, the ECB had predicted pay growth of 5.1% for the period.

The data are among the last to arrive before an expected reduction in interest rates by the ECB next Thursday. Should inflation continue to abate, borrowing costs will be lowered every quarter until they reach 2.5%, according to a Bloomberg survey.

Workers’ salaries have been rising rapidly to offset painfully higher living costs. That’s proved a headache for the ECB, which worries that the catch-up will keep consumer-price gains elevated.

While inflation has slowed in recent months, pressures in the services sector — where wages play a larger role — have remained stubborn. Recent data, though, have been more promising, revealing a marked slowdown in negotiated salaries last quarter.

The volatility is partly down to Germany, where some workers received large one-off payments to compensate for inflation at the start of the year. Some, including Executive Board member Isabel Schnabel, have warned that wage growth may pick up again in the third quarter.

But there’s also hope of further moderation down the line. ECB Chief Economist Philip Lane said last week that pay gains are set to slow sharply in 2025 and 2026 — increasing the confidence that inflation can be brought back to the 2% target next year.

Officials have also been keeping a close eye on corporate profits and workers’ productivity to get a full sense of price pressures in the euro zone. The latter kept declining in the second quarter — an issue that policymakers have increasingly highlighted as a concern.

What Bloomberg Economics Says...

“The most comprehensive measure of wage growth that we have for the euro area showed a marked slowdown in the second quarter. That’s reassuring news for the ECB, which needs to see domestic cost pressure ease to be confident of getting inflation to target on a sustainable basis. A downward revision to 2Q24 GDP growth creates additional impetus to ease.”

—Jamie Rush and David Powell. For full react, click here

Profits already reduced domestic price pressures in the three months through March and that trend strengthened in the second quarter, Bloomberg Economics said. That supports the ECB’s view that companies are able to absorb rising labor costs.

“We are not seeing the ‘tit-for-tat’ risk that Christine Lagarde has referred to being a risk in earlier instances,” said Piet Haines Christiansen, an economist at Danske Bank. “Today’s data supports the disinflationary track in the euro area, though the ECB is expected to still be cautious on communicating an aggressive easing cycle at next week’s meeting.”

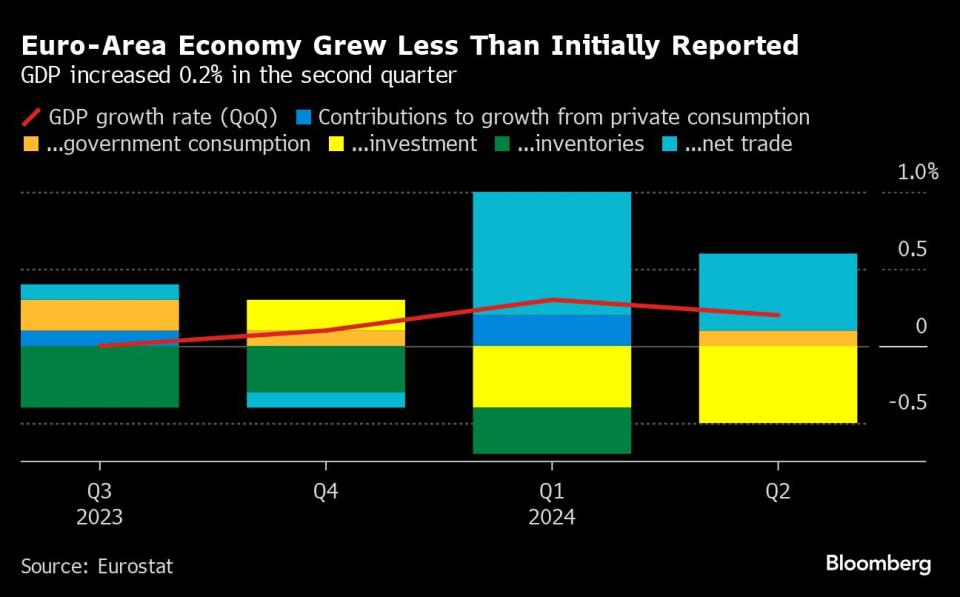

Separate data published Friday showed that euro-area output grew less than initially reported in the period, with gross domestic product rising 0.2% — down from 0.3%.

(Updates with Bloomberg Economics after eighth paragraph)

Most Read from Bloomberg Businessweek

‘They Have Stolen Our Business’: When You Leave Russia, Putin Sets the Terms

Howard Lutnick Emerges as Trump’s No. 1 Salesman on Wall Street

How Local Governments Got Hooked on One Company’s Janky Software

Americans Eat 42 Pounds of Cheese a Year. $4 Billion Says They Want More

©2024 Bloomberg L.P.