Down Nearly 60% From Its High, Is Celsius Holdings Stock a Bargain Buy?

Celsius Holdings (NASDAQ: CELH) has been a top growth stock to own in recent years. Its energy drinks have been growing in popularity, and as a result, sales and profits have also been taking off, making Celsius an attractive investment to buy and hold.

But recently, the stock has been struggling. It has been in a free fall as investors have become concerned about its future growth prospects. The stock is not only down 60% from its highs this year, it's also trading near its 52-week low.

Is now a good time to buy this beaten-down growth stock, or could there be more pain ahead for investors?

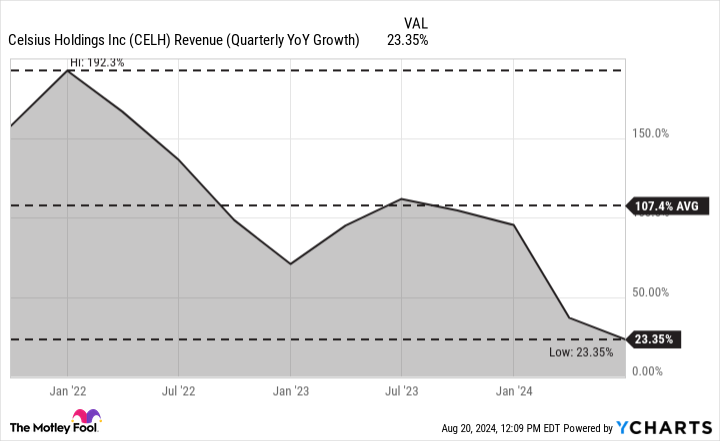

The company's growth rate has been slowing

What has made Celsius' stock a hot buy with investors is the company's strong sales growth. From just $130.7 million in sales in 2020, its top line has soared to more than $1.3 billion in 2023. It's only a matter of time before that level of growth starts to taper off, and in recent quarters, there have been signs that is indeed happening. While a 23% growth rate is still impressive, investors may be concerned that the days of ultra-high growth may be over.

The stock is trading at a drastically lower premium

Investors are often willing to pay a premium for a fast-growing business, and that is evident through a high price-to-earnings (P/E) multiple. As Celsius' growth rate has slowed, the premium investors have been willing to pay has also come down. At a P/E of under 40, the stock is looking cheaper than it has in the past.

The earnings multiple is still high, however. The average stock in the S&P 500 is trading at a P/E of only 23. But in Celsius' case, it's also growing at a faster rate than your average stock, and a premium is warranted. The question is how much is justifiable.

Analyst price targets have been coming down in recent months as well. But with a consensus price target of around $65, that still implies an upside of more than 60%. However, this is based on analyst estimates for where they think the beverage stock may go within the next year. As price targets change, the implied upside will adjust as well.

Ultimately, it may come down to how strong economic conditions are, and how strong demand proves to be for the company's products. In a recession, demand for energy drinks, which are a largely discretionary purchase, may come down, which could adversely affect the outlook for the business and further affect its growth rate. That would undoubtedly be bad news for the stock.

Should you buy Celsius stock today?

Celsius has been growing at an impressive rate in recent years, but with some potentially adverse economic conditions ahead, the business may continue to experience slowing growth in future quarters.

While it can be a good buy in the long run, I'd hold off on buying Celsius stock today. Its valuation remains high despite its recent sell-off, and investors aren't getting much of a margin of safety with the stock should the business struggle. Now that the business' top line has become significantly larger, it may not be as easy to maintain a high growth rate, anyway.

The safest option would be to take a wait-and-see approach with the stock to see how the company can adapt to changing conditions, and whether it can find a way to accelerate its growth rate.

Should you invest $1,000 in Celsius right now?

Before you buy stock in Celsius, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Celsius wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Celsius. The Motley Fool has a disclosure policy.

Down Nearly 60% From Its High, Is Celsius Holdings Stock a Bargain Buy? was originally published by The Motley Fool