Down 49% This Year, Lululemon Could Sink Even Deeper -- Here's Why Wall Street Analysts Are Downgrading the Stock

In June, the management team of Lululemon Athletica (NASDAQ: LULU) spoke to investors about its need for new and innovative athletic apparel products, and excitingly talked up the pending launch of its new Breezethrough leggings. In July, the Breezethrough line was abruptly pulled from shelves after customers panned them as unflattering.

After Lululemon pulled Breezethrough, some Wall Street analysts responded by pulling their buy ratings for the stock. Lululemon stock is now down nearly 50% from the high it reached less than one year ago. And the price targets from analysts have been coming down as well.

For example, JPMorgan analyst Matthew Boss lowered his price target for Lululemon stock from $457 per share to $338 per share, according to The Fly, citing elevated execution risk for the company. In other words, it launched what was supposed to be an innovative new product but was instead a quick flop. Simply put, Lululemon needs to execute better than that.

Is this a big overreaction?

Lululemon generated nearly $10 billion in trailing-12-month revenue and expects to generate revenue of $10.7 billion to $10.8 billion in its fiscal 2024. In other words, this is a huge business, with or without Breezethrough yoga apparel. And it's unlikely that the failed launch will change the top-line number much. Therefore, Wall Street would appear to be overreacting.

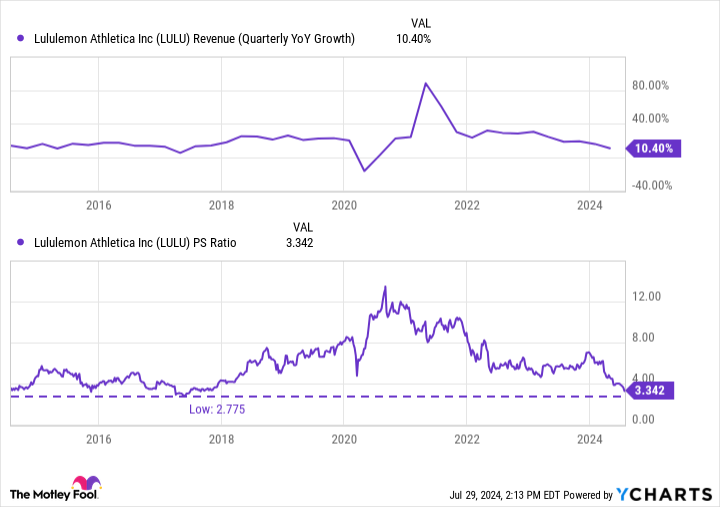

That said, one of Lululemon's problems at the moment is a dramatically reduced growth rate. Its price-to-sales (P/S) valuation has been roughly cut in half in recent months. But that lower valuation reflects its slower growth rate. In other words, the stock is cheaper than it's been because the company's top-line growth is evaporating.

Lululemon stock has also been more cheaply valued than it is today at times when its growth rate was similar to what it is right now. In other words, unless its sales growth picks up, there could be more downside ahead.

This is where new product innovation comes into the conversation. Lululemon's Breezethrough lineup was made with a new fabric called hydrogen yarn, made in collaboration with carbon capture start-up LanzaTech. These products differed from the company's main offerings, which could have provided something to stimulate growth.

The good news for Lululemon investors is that issues with Breezethrough appear to be solely a matter of the leggings' design -- there doesn't seem to be anything wrong with the fabric itself. Therefore, management reportedly intends to simply redesign the products and relaunch the line soon.

The not-as-good news for Lululemon investors is that management had been guiding for better sales growth in the second half of fiscal 2024 in comparison to the first half. But management likely had factored sales of its new products into that equation. Now that the Breezethrough line has been pulled from shelves, the chain might not hit its goals this year.

What to do now

With Lululemon trading at roughly 21 times its trailing earnings, I'll stop short of saying that the stock is cheap. True, it hasn't sported an earnings ratio this low in more than 10 years. But at the end of the day, this is an apparel stock, and those usually deserve lower valuations. Moreover, its growth is challenged right now, which is another reason for a lower price tag.

That said, Lululemon is the kind of stock that I love to give the benefit of the doubt to -- the type that I buy with the mindset of a patient, long-term investor. The company is profitable, debt free, and has a long history of growth. Financially speaking, these kinds of businesses are hard to sink. And management teams that have found ways to grow in the past have the requisite experience to find ways to grow again in the future.

I wouldn't be surprised if Lululemon stock continued to slide in the coming weeks and months -- many investors are losing interest because it's not an exciting story right now. But a $10 billion business is nothing to sneeze at, it's not indebted to anyone, and it will earn profits this year. This business will be fine. And eventually, management could find ways to reaccelerate growth and get the stock moving upward again.

Should you invest $1,000 in Lululemon Athletica right now?

Before you buy stock in Lululemon Athletica, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lululemon Athletica wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase and Lululemon Athletica. The Motley Fool has a disclosure policy.

Down 49% This Year, Lululemon Could Sink Even Deeper -- Here's Why Wall Street Analysts Are Downgrading the Stock was originally published by The Motley Fool