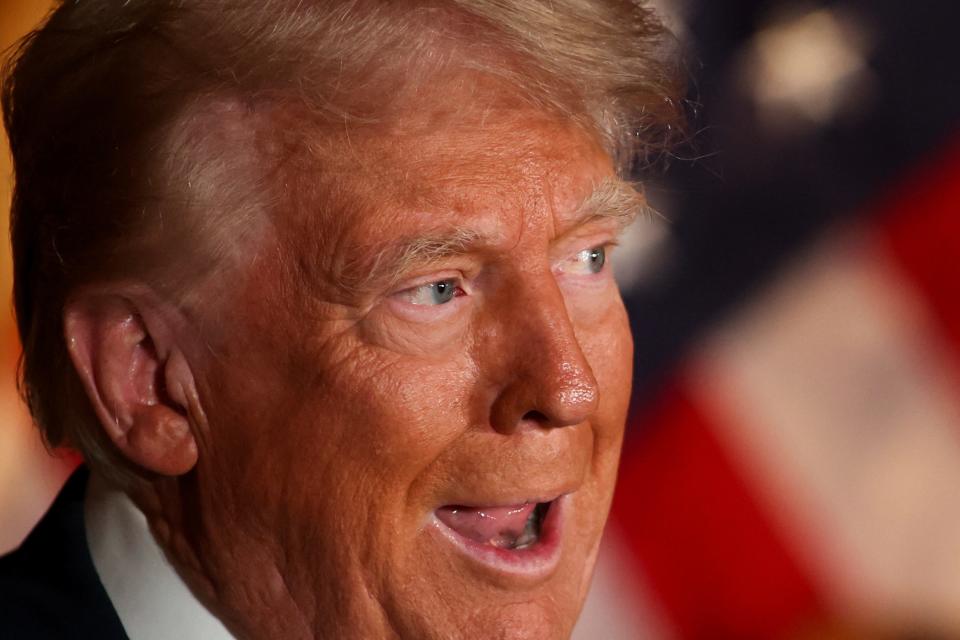

DJT sinks to new low: Why Trump Media investors are feeling less bullish

As a trading concern, Donald Trump’s social media company has become a way for investors to bet on the former president’s odds of retaking the White House.

Since going public through a special-purpose acquisition company merger in March, shares of Trump Media & Technology Group have fluctuated wildly alongside its namesake’s political fortunes.

Following Vice President Kamala Harris’ ascension to the top of the Democratic ticket, Trump has slipped in the polls and so, too, have shares of Trump Media, which owns the GOP nominee’s social media bullhorn of choice, Truth Social.

The stock drifted to a new post-merger low Tuesday, closing at $20.99. In the last 30 trading days, it has lost more than 40% of its value.

What happens if Trump sells DJT shares

In regulatory filings, Trump Media has telegraphed how critical Trump is to the company’s brand, warning that its value “may diminish” if Trump’s popularity falters.

Now another factor is weighing on the stock. Trump is less than a month away from being able to cash out his paper wealth. Trump Media has also cited Trump's divestment of DJT stock as one of the top risks to its business.

Trump Media is a major contributor to Trump’s net worth. Its market value is hovering around $4 billion even though the company is losing money and has nearly no revenue.

Your wallet, explained. Sign up for USA TODAY's Daily Money newsletter.

Trump owns about 60% of the company's outstanding stock. He is expected to be able to start selling shares as soon as Sept. 20 when a six-month lockup period that has prevented insiders from unloading their holdings is expected to lift.

Trump has not indicated if he intends to sell shares in Trump Media and his campaign declined to comment.

Cashing in shares could help Trump pay his mounting legal bills but could antagonize supporters who have shoveled money into the stock and could be viewed as a vote of no confidence in the company.

The prosecutor in Trump’s federal election interference case secured a new indictment against Trump on Tuesday.

What more Trump Media shares mean for investors

Another key factor in the Trump Media stock decline is a deal Trump Media reached in July with Yorkville Advisors to register and sell up to $2.5 billion worth of new shares, says University of Florida finance professor Jay Ritter.

On the one hand, the deal could boost cash per share on the company’s balance sheet from $1.50 per share to about $4.50 per share, Ritter said.

“This increase would reduce the downside potential for the stock,” he said.

But there’s a caveat.

“Any upside for the company is dependent on coming up with a business strategy to generate revenue and profits,” Ritter said. “So far, the company has failed to find a successful strategy.”

What's more, additional shares issued through the Yorkville agreement could be putting downward pressure on the stock price, according to Ritter.

Even if Trump does not sell shares when the lock-up period ends, other insiders may, increasing the public float even more, he added.

“The price might be drifting down partly in anticipation of these share sales,” Ritter said.

This article originally appeared on USA TODAY: DJT decline: Why Trump Media is falling out with investors