Domino's Stock Falls 18% in 3 Months: Should You Buy the Dip?

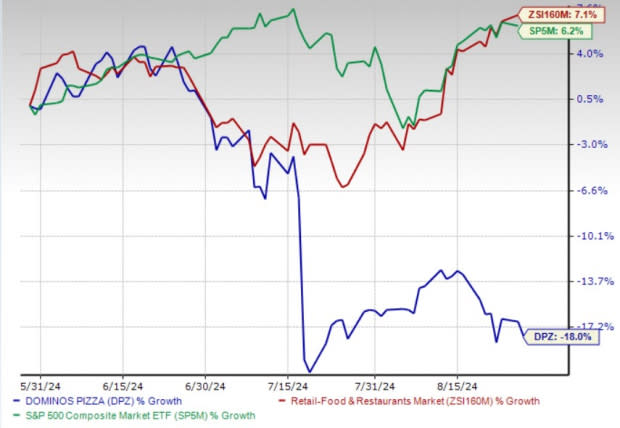

Shares of Domino's Pizza, Inc. DPZ have disappointed investors in the past three months, underperforming the S&P 500 and its Industry. The company’s struggle in international markets for opening and closing stores and high costs has significantly dented the stock.

In the past three months, Domino's stock has declined by 18% against the industry’s 7.1% rise. In sharp contrast, the S&P 500 increased 6.2% during the same period. As of Aug 27, the stock closed at $418.41, significantly below its 52-week high of $542.75 but above its 52-week low of $330.05. The company also underperformed other industry players like McDonald's Corporation MCD, up 16.1%, Yum! Brands, Inc. YUM, down 0.1%, and Starbucks Corporation SBUX, up 28.3%, in the past three months.

Image Source: Zacks Investment Research

What’s Hurting DPZ?

Domino's faced a notable setback in its international markets during the recent quarter, with global net new units significantly underperforming the company's and analysts' expectations. This underperformance was mainly caused by slower net growth in Japan and France, regions managed by one of Domino's key master franchisees.

DPZ had set its international unit targets based on agreements with its master franchisees, but the company observed that the number of new store openings and closures during the quarter diverged significantly from plans discussed after the first quarter. This unexpected decline raises concerns about the transparency and reliability of Domino's planning process. As a result, the company decided to suspend its guidance on future unit growth.

Inflationary pressures in commodity and labor costs continue to hurt the company. The industry players expect to witness higher costs for quite some time due to labor shortages. It has been witnessing labor challenges in a handful of markets. During second-quarter fiscal 2024, the general and administrative expenses (as a percentage of revenues) expanded 100 basis points to 10.5% year over year, driven by higher labor costs and expenses for the company’s Worldwide Rally that takes place every two years.

The company anticipates a high inflationary environment for food and labor to persist for some time. For the third and the fourth quarter of fiscal 2024, the company expects supply chain margins to be roughly flat and down, respectively, year over year, factoring in an inflationary food basket for the rest of the year, with a full-year range of up 1-3%.

Can DPZ Bounce Back?

Although the company’s near-term stock performance is disappointing, the new loyalty program, menu innovation and the Hungry for MORE strategy bode well.

The company is benefiting from the Hungry for MORE strategy, which primarily focuses on generating MORE sales, MORE stores and MORE profits. The strategic imperatives of this strategy include showcasing the most delicious food (M), driving operational excellence (O), delivering renowned value (R) and engaging best-in-class franchisees (E).

The company is also benefiting from its partnership with Uber to drive sales. For the first six months of fiscal 2024, its same-store sales largely benefited from the sales mix from Uber, which grew to 1.4% in the first quarter and 1.9% in the second quarter. DPZ is optimistic about the incrementality of Uber sales throughout the fiscal 2024. The company expects the U.S. comps to be more than 3% in the fiscal 2024, with the third and the fourth quarter’s comp expectations being 3% or above. Uber sales are expected to grow on the back of accretive marketing and increasing awareness, with Domino’s expecting to finish the fiscal 2024 with an overall sales mix of 3% or more.

Domino’s consistently focuses on diversifying its menu offerings through innovation to reach peak customer satisfaction and expand its market position. During the fiscal second quarter, the company newly launched the New York-Style pizza, which it intends to permanently keep on the menu. This menu offering is said to be outside the deliciousness idea of the prior Domino's Pizza Offerings. This innovation aims to increase sales and enhance flavor with unique toppings. The company’s Mix & Match offer includes a thin crust option and Domino's Rewards members can redeem 60 points for a free medium two-topping New York-style pizza. This move demonstrates Domino’s’ commitment to value and customer loyalty.

Estimate Movement & Valuation

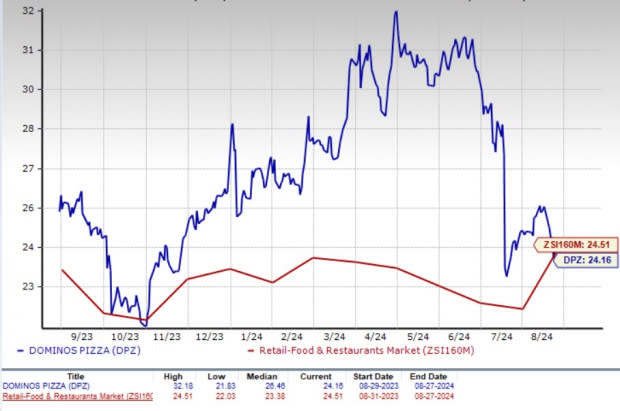

Estimates for DPZ’s 2024 earnings have moved up from $16.00 to $16.23 in the past 60 days. The company’s earnings and sales in 2024 are expected to witness growth of 10.7% and 7.3%, respectively, year over year.

Image Source: Zacks Investment Research

The stock is trading at 24.16 times forward earnings, which is slightly lower than the industry average of 24.51 and below its one-year median of 26.46.

Image Source: Zacks Investment Research

Buy, Sell, or Hold – DPZ

Despite Domino's recent stock decline, there are compelling reasons for existing investors to hold onto their shares. Domino's commitment to innovation, such as the introduction of the New York-Style pizza, demonstrates its focus on customer satisfaction and market expansion. The Zacks Rank #3 (Hold) company's earnings estimates for 2024 have also been revised upward, indicating potential growth despite current headwinds.

For new investors, it may be wise to wait for more stability in the company’s international operations and for inflationary pressures to ease before making a fresh investment. The current challenges and uncertainties suggest that there could be better entry points in the future as DPZ's works to overcome its recent obstacles.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

McDonald's Corporation (MCD) : Free Stock Analysis Report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report