Dogecoin Traders Appear to Short Token as Meme Coin Frenzy Eases

The crypto market’s biggest meme token is starting to attract short bets amid a general decline in the meme sector, which may spell worry for the meme sector.

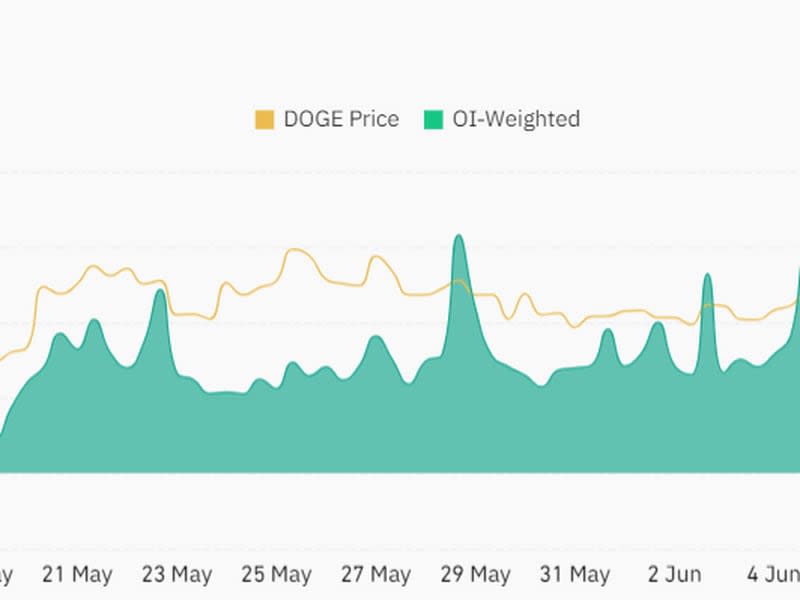

Coinalyze data shows that Dogecoin {{DOGE}} funding rates have started to turn negative since Tuesday, reaching -0.0027% as of Thursday – reaching levels previously seen in October 2023. Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets.

While these rates are not unusually large, they indicate a bearish mood in the market when continually declining alongside a drop in prices. DOGE has lost 12% over the past week, erasing all gains since March.

DOGE open interest, or the number of unsettled futures contracts, have decreased from nearly $800 million on Monday to $611 million as of Thursday, also indicating a drop in demand for the tokens.

The rates briefly turned red over a few eight-hour trading sessions in March, but not for an extended period as seen this week so far.

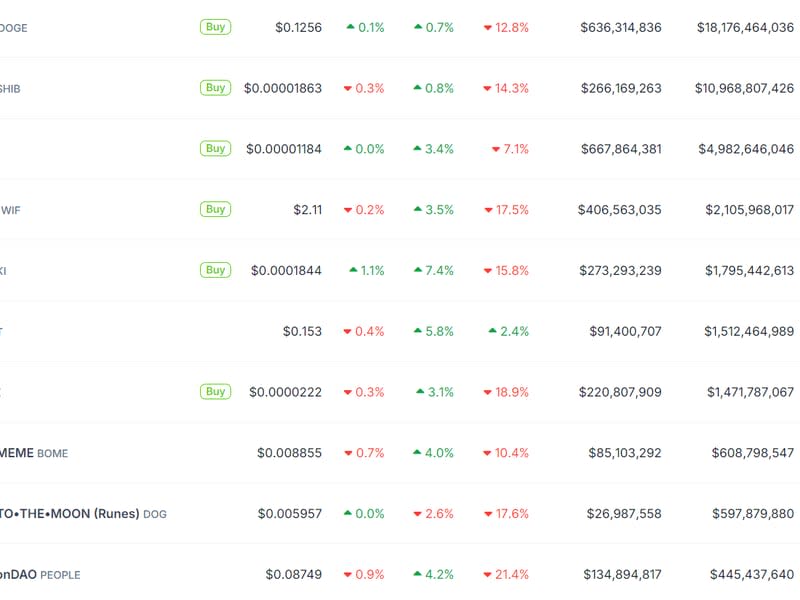

Tokens across the meme coin sector have recorded losses of as much as 40% over a seven-day period as traders caution a move away from riskier tokens to bitcoin and stablecoins.

“When the price of Bitcoin falls, memecoins tend not only to follow, but to lose an even greater share of their value,” shared Neil Roarty, analyst at investment platform Stocklytics, in a Thursday email to CoinDesk. “Any plans for a memecoin summer may have to be put on hold.”

As reported earlier this week, DOGE futures traders recorded their worst day since May 2021 as the token saw $60 million in longs liquidated, unusually more than for bitcoin (BTC) futures.

These drops came as bitcoin (BTC) prices suffered in the past few weeks amid $2 billion in sales from large holders, net outflows from U.S.-listed exchange-traded funds (ETFs), and dollar strength.