Dip Buyers Plow Record Cash Into Megacap Fund Dominated by Tech

(Bloomberg) -- Investors are back lavishing millions onto megacaps as the high-flying tech stocks resume their climb, shrugging off the vestiges of last week’s market meltdown.

Most Read from Bloomberg

In DNC, Chicago’s Embattled Transit System Faces a High-Profile Test

How Chicago’s Gigantic Merchandise Mart Is Still Thriving as Office Space

Gottheimer Calls for Rail Riders to Be Reimbursed for Delays

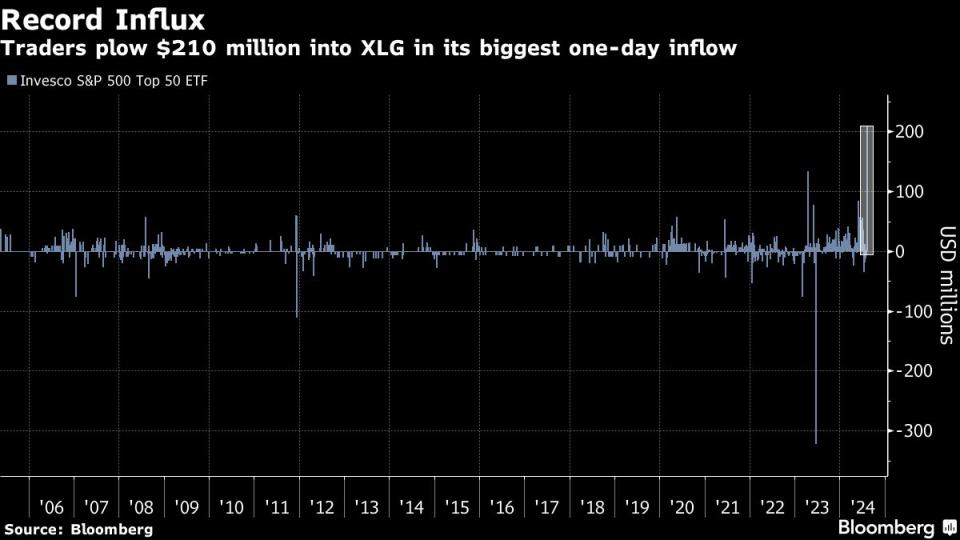

Traders poured a net $210 million into the Invesco S&P 500 Top 50 ETF (ticker XLG) on Monday, the biggest one-day influx in the fund’s nearly 20-year history, data compiled by Bloomberg show. The record inflow — and fourth straight one — pushed the ETF’s assets up by 4% to $5.3 billion, with nearly half of that attracted in the past year alone.

The rush into XLG, which tracks the 50 largest companies in the S&P 500 index, underscores investors’ unwavering faith in large-cap growth stocks — dominated by tech — which propelled the stock market to multiple record highs earlier this year.

Among the fund’s biggest holdings are Apple Inc., Meta Platforms Inc., Nvidia Corp., Alphabet Inc., Amazon.com Inc. and Microsoft Corp. — the leaders of the so-called Magnificent Seven which have accounted for the bulk of the market’s gains this year. An index tracking their performance has surged more than 30% this year.

“XLG is a popular vehicle for investors looking for exposure to mega-cap names with the ease of trading and liquidity of an ETF,” Nick Kalivas, Invesco’s head of factor and core equity ETF strategy, said. “We are not surprised that it has seen an increase in interest as a tool for mega-cap allocation.”

For much of this year, tech stocks have led the equity bull run propelled by enthusiasm surrounding artificial intelligence. Concerns over stretched valuations and when AI investments will eventually pay off — on top of worries that the Federal Reserve has waited too long to slash benchmark interest rates — caused some of these very stocks to buckle in recent days, though the Nasdaq 100 is rallying again this week.

“Tech still has a lot to offer, especially in terms of quality,” Cayla Seder, macro multi-asset strategist at State Street, said. “Tech is one of the best across the equity space whether that be from the perspective of margins, cash flows, ROE, etc. Therefore, dip-buying in quality parts of the market as we enter a period of economic uncertainty makes a lot of sense.”

--With assistance from Vildana Hajric.

Most Read from Bloomberg Businessweek

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

New Breed of EV Promises 700 Miles per Charge (Just Add Gas)

There’s a Gender Split in How US College Grads Are Tackling a More Difficult Job Market

©2024 Bloomberg L.P.