Diesel benchmark up third straight week, but demand figures look weak

Retail diesel prices measured by the Department of Energy/Energy Information Administration average retail price now have moved higher for three consecutive weeks, but it doesn’t appear to be on the back of higher consumption.

The weekly DOE/EIA diesel price, used as the basis for most fuel surcharges, climbed 4.4 cents a gallon Monday to $3.813. Three weeks of increases followed nine weeks of declines.

And while it was not a factor in the retail prices surveyed by the EIA to produce its closely watched number, ultra low sulfur diesel (ULSD) prices on the CME commodity exchange rose almost 10 cents a gallon Monday, climbing to $2.6147. It’s the highest settlement since April 16.

As has been the case the past few weeks with a general overall rising trend in oil markets, there is little specific news that has been behind the upward push. Analysts are citing a grab bag of general reasons, with the approach of Hurricane Beryl now in the mix though the storm is steering far clear of any oil and gas production areas in the Gulf of Mexico.

The upward trend in diesel — as well as other oil markets — is coming even as a new set of data has emerged that shows diesel demand flat to weakening.

Weekly EIA data on U.S. production, consumption and inventories is considered preliminary, while the monthly figures released on a two-month lag are seen as more definitive.

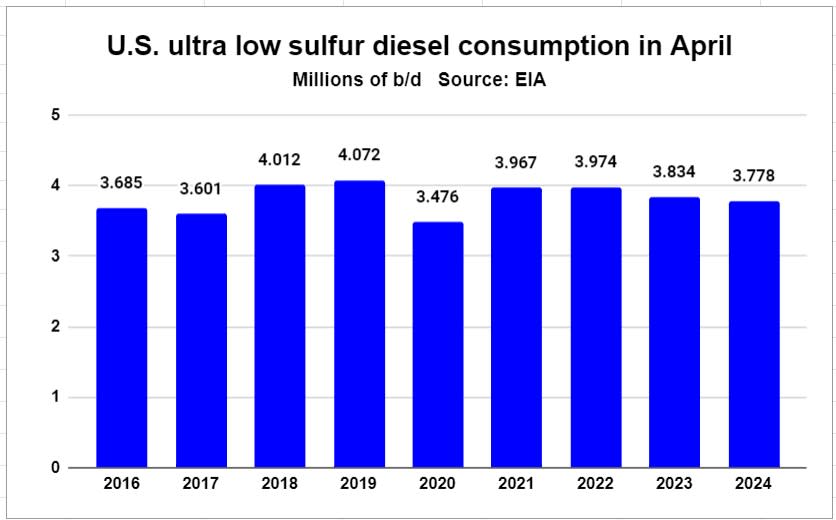

The April report released Friday shows that ULSD consumption in April of 3.778 million barrels a day was the lowest for that month since 2017, excluding the pandemic year of 2020.

And while it was higher than the March figure of 3.633 million barrels a day, that number for April was the fourth-lowest since the end of 2020, when consumption was headed up as the economy moved toward the great freight market of 2021-2022.

In April 2017, ULSD consumption was 3.601 million barrels a day. In between, it got as high as just over 4 million two times and was just under 4 million a few times.

What that means is that even as more freight is moving on the road, diesel consumption appears to have flatlined.

It might be that fuel mileage gains are offsetting any increase in traffic. For example, Mike Roeth, head of the North American Council for Fuel Efficiency, wrote in late 2022 that fuel efficiency in Class 8 trucks had improved to 6.24 mpg from 5.97 mpg in the prior three years. That may not seem like much, but it adds up in a market that had been mostly holding in the 3.8 million- to 4 million-barrel-per-day level.

And others have touted that it is possible to reach 10 mpg on an open highway, but that is a recent development.

The trend isn’t unique to diesel. April gasoline consumption of 8.831 million barrels per day was the lowest for April since 2012, excluding April 2020. However, unlike diesel, that market has been impacted by some degree of electrification of passenger vehicles.

More articles by John Kingston

Numbers at major truck lender BMO show worsening credit conditions

Virginia carrier’s win against union may ultimately give labor a boost at NLRB

NFI CEO Brown indicted in sweeping New Jersey case against political giant

The post Diesel benchmark up third straight week, but demand figures look weak appeared first on FreightWaves.