Decoding Occidental Petroleum Corp (OXY): A Strategic SWOT Insight

Occidental Petroleum Corp exhibits robust production capabilities with a balanced mix of oil, natural gas liquids, and natural gas.

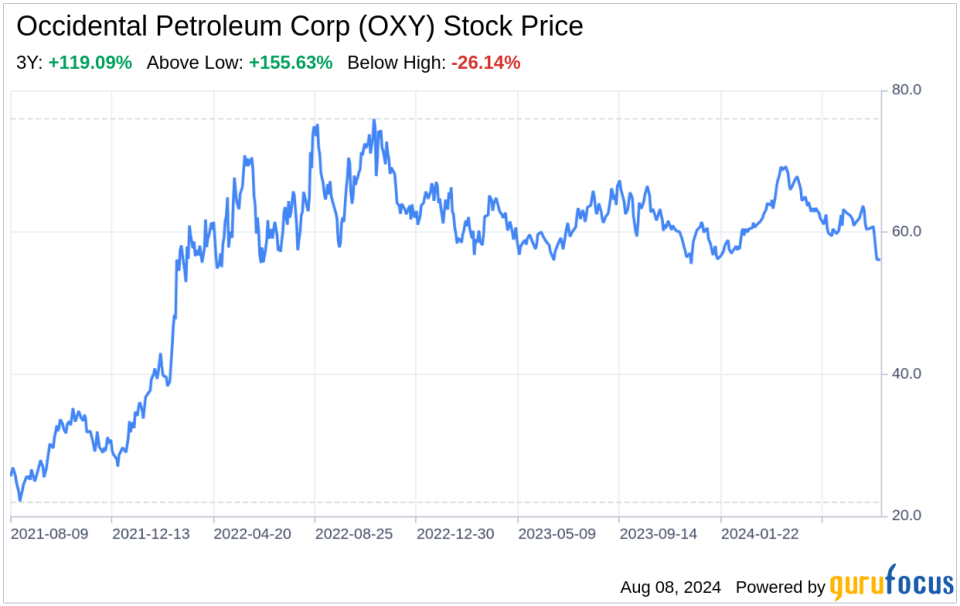

Despite market volatility, OXY maintains a strong financial position with significant net income growth.

Strategic acquisitions and divestitures reflect a dynamic approach to optimizing its asset portfolio.

Environmental regulations and geopolitical risks present ongoing challenges for the company.

Occidental Petroleum Corp (NYSE:OXY), an independent exploration and production company, has recently filed its 10-Q on August 7, 2024. This SWOT analysis delves into the company's financials and operational highlights, providing investors with a comprehensive view of its strengths, weaknesses, opportunities, and threats. With operations spanning the United States, Latin America, and the Middle East, OXY reported net proved reserves of nearly 4 billion barrels of oil equivalent. In 2023, the company's net production averaged 1,234 thousand barrels of oil equivalent per day, with a balanced 50% split between oil and natural gas liquids and natural gas. The latest financial tables reveal a year-over-year increase in net income attributable to common stockholders, rising from $605 million in Q2 2023 to $992 million in Q2 2024. This growth is a testament to OXY's operational efficiency and market strategy.

Strengths

Robust Production and Reserve Base: OXY's strength lies in its substantial production capabilities and reserve base. With nearly 4 billion barrels of oil equivalent in net proved reserves and a daily production average of 1,234 thousand barrels of oil equivalent, the company has a strong foundation for sustained growth. This robust reserve base ensures long-term stability and the ability to capitalize on market upswings.

Financial Performance: The company's financial health is a significant strength. OXY's net income saw a considerable increase from $860 million in the first half of 2023 to $1,170 million in the same period of 2024. This financial resilience, even in the face of market fluctuations, positions OXY favorably among its peers and provides the financial flexibility necessary for strategic investments and shareholder returns.

Weaknesses

Debt and Interest Expenses: Despite a strong balance sheet, OXY's level of debt remains a concern. Interest and debt expenses, net, have increased from $230 million in Q2 2023 to $252 million in Q2 2024. Managing this debt is crucial to maintaining financial health and ensuring operational flexibility.

Operational Risks: The company faces operational risks, including the impact of third-party shut-ins, as seen in the Eastern Gulf of Mexico, which can affect production volumes. These risks highlight the need for robust risk management strategies to mitigate potential production disruptions.

Opportunities

Strategic Acquisitions: OXY's recent acquisition of CrownRock L.P. enhances its portfolio in the Permian Basin, which is expected to be immediately cash flow accretive. This strategic move not only strengthens its asset base but also presents new opportunities for growth and market expansion.

Low-Carbon Ventures: The company's investment in low-carbon technologies and carbon capture projects aligns with global sustainability trends and offers a pathway to diversify revenue streams. These ventures position OXY as a forward-thinking player in the energy transition.

Threats

Environmental Regulations: OXY operates in a highly regulated industry, with stringent environmental laws that can impose significant costs and liabilities. The evolving regulatory landscape, including the Inflation Reduction Act and international tax reforms, could impact the company's financials and operational strategies.

Geopolitical Risks: The company's international operations expose it to geopolitical risks, including conflicts in the Middle East and global economic conditions. These risks can affect commodity prices and supply chains, necessitating a proactive approach to risk management.

In conclusion, Occidental Petroleum Corp (NYSE:OXY) demonstrates a strong operational and financial foundation, with significant production capabilities and a robust reserve base. The company's strategic acquisitions and investments in low-carbon ventures present opportunities for growth and diversification. However, managing debt levels and operational risks, along with navigating a complex regulatory environment and geopolitical uncertainties, remain critical for OXY's continued success. Investors should weigh these factors carefully when considering OXY's long-term prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.