Deckers (NYSE:DECK) Q1 Earnings: Leading The Footwear Pack

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how footwear stocks fared in Q1, starting with Deckers (NYSE:DECK).

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 8 footwear stocks we track reported a strong Q1; on average, revenues beat analyst consensus estimates by 4.1%. while next quarter's revenue guidance was in line with consensus. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, but footwear stocks have shown resilience, with share prices up 8% on average since the previous earnings results.

Best Q1: Deckers (NYSE:DECK)

Established in 1973, Deckers (NYSE:DECK) is a footwear and apparel conglomerate with a portfolio of lifestyle and performance brands.

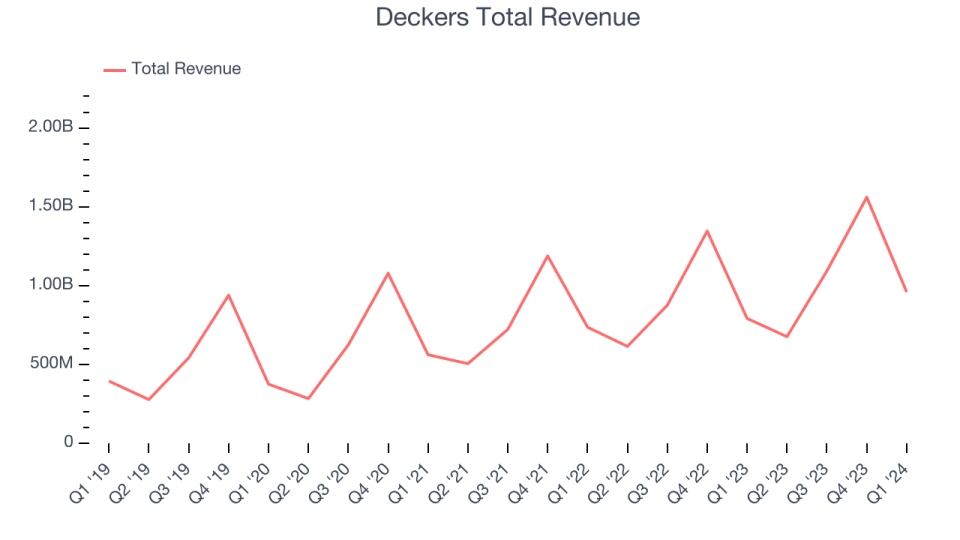

Deckers reported revenues of $959.8 million, up 21.2% year on year, topping analysts' expectations by 8%. It was a very strong quarter for the company: Deckers blew past analysts' constant currency revenue and EPS expectations, driven by huge outperformance at its Hoka ($533 million of revenue vs estimates of $496 million) and UGG ($361 million of revenue vs estimates of $318 million) brands. On the other hand, its full-year EPS forecast was underwhelming.

"Deckers achieved record results during fiscal year 2024, as we delivered revenue growth of 18% and increased earnings per share by 51%, reflecting a continued dedication to maintain exceptional levels of profitability as our brands scale," said Dave Powers, President and Chief Executive Officer.

Deckers pulled off the fastest revenue growth of the whole group. The stock is up 17.6% since the results and currently trades at $1,064.

Is now the time to buy Deckers? Access our full analysis of the earnings results here, it's free.

Crocs (NASDAQ:CROX)

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

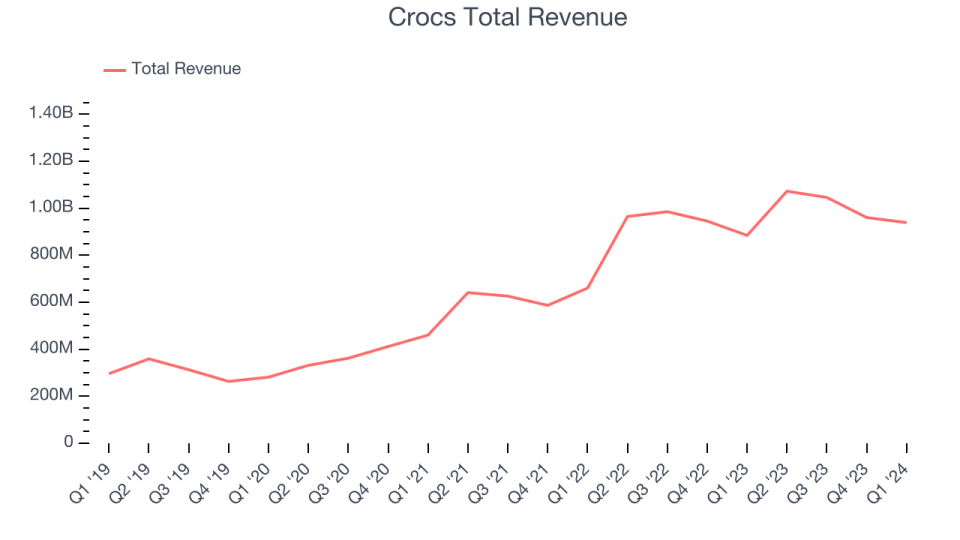

Crocs reported revenues of $938.6 million, up 6.2% year on year, outperforming analysts' expectations by 6.1%. It was a very strong quarter for the company, with an impressive beat of analysts' revenue and earnings estimates.

The stock is up 21.2% since the results and currently trades at $153.61.

Is now the time to buy Crocs? Access our full analysis of the earnings results here, it's free.

Genesco (NYSE:GCO)

Spanning a broad range of styles, brands, and prices, Genesco (NYSE:GCO) sells footwear, apparel, and accessories through multiple brands and banners.

Genesco reported revenues of $457.6 million, down 5.3% year on year, exceeding analysts' expectations by 2.7%. It was an impressive quarter for the company, with optimistic revenue and earnings guidance for the full year.

The stock is up 0.7% since the results and currently trades at $27.5.

Read our full analysis of Genesco's results here.

Wolverine Worldwide (NYSE:WWW)

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $390.8 million, down 24.5% year on year, surpassing analysts' expectations by 8.1%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but a miss of analysts' operating margin estimates.

Wolverine Worldwide scored the biggest analyst estimates beat but had the slowest revenue growth and slowest revenue growth among its peers. The stock is up 14.9% since the results and currently trades at $13.12.

Read our full, actionable report on Wolverine Worldwide here, it's free.

Skechers (NYSE:SKX)

Synonymous with "dad shoe", Skechers (NYSE:SKX) is a footwear company renowned for its comfortable, stylish, and affordable shoes for all ages.

Skechers reported revenues of $2.25 billion, up 12.5% year on year, surpassing analysts' expectations by 2.3%. It was a rare 'beat and raise' quarters you love to see. Skechers blew past analysts' constant currency revenue expectations. Looking forward to the full year, the company raised its revenue and EPS guidance for 2024 and both are comfortably ahead of analysts' expectations.

Skechers pulled off the highest full-year guidance raise among its peers. The stock is up 25.1% since the results and currently trades at $73.54.

Read our full, actionable report on Skechers here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.