Cybersecurity Boom Benefits Palo Alto Networks

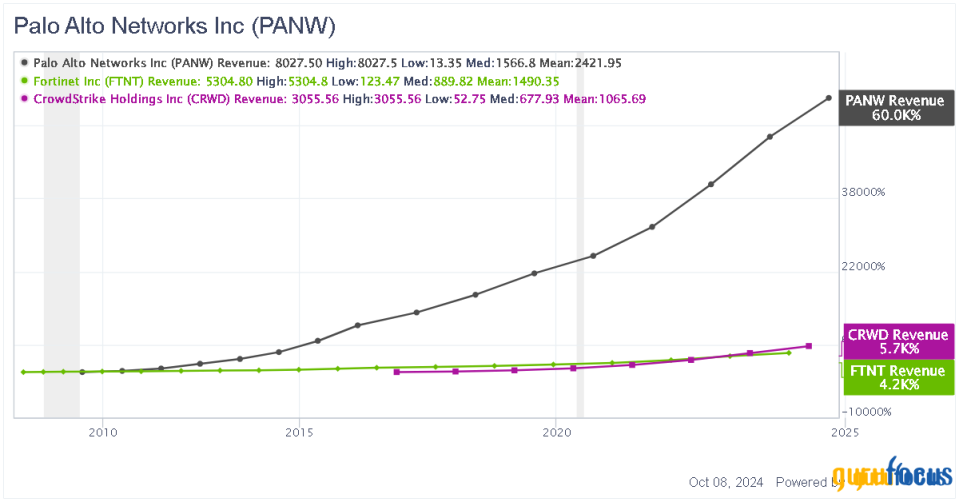

The cybersecurity industry is growing rapidly as cyberattacks are increasing in number with more complexity of IT environments. This trend may benefit the companies' stocks as you may see here below:

As cybersecurity attacks arise and cause data breach and financial loss, many companies started to guard themselves with cybersecurity software. Palo Alto Networks (NASDAQ:PANW) , which stands as a market leader with the biggest share in the industry, saw its stock rise from $50s in 2019 to $300s in 2024.

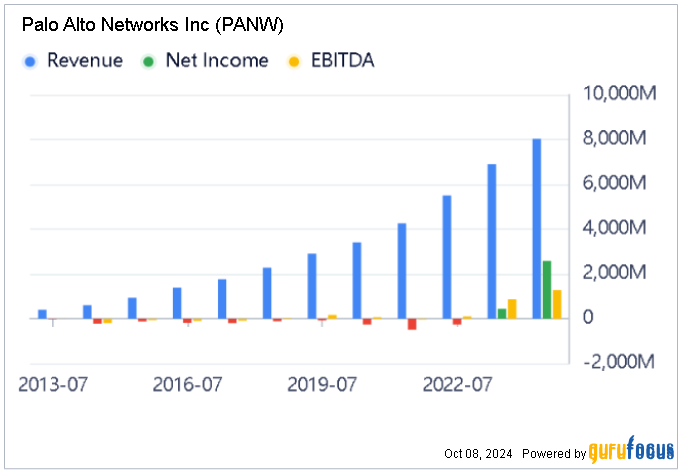

In today's era, having good cybersecurity is necessary for corporations, especially those that engage with online transactions like e-commerce, bookings websites, online gambling sites, messengers, and list goes on. The Q4FY24 presentation's of Palo Alto Networks also mentions that ransomware public extortion activity is up by more than 50% from 2022. The trend of increase cybersecurity demand has caused PANW to get its profitability turned around positively in 2022 after years of loss.

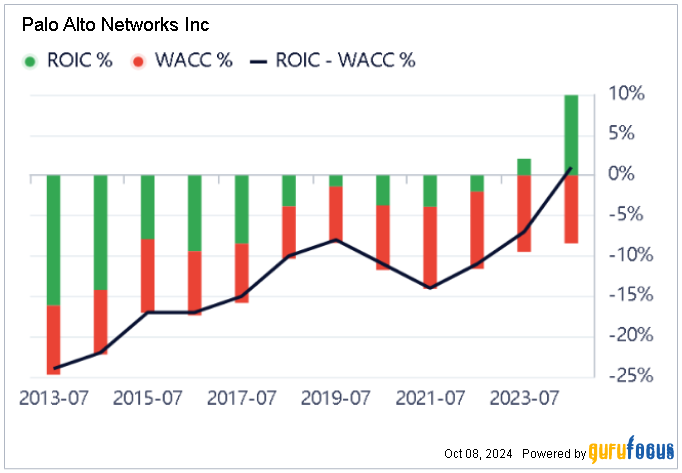

With the increase in cyberattcks, we can expect higher demand for PANW's products that leads to higher net incomes in the end. The visual ROIC-WACC of PANW below may show the turn around better.

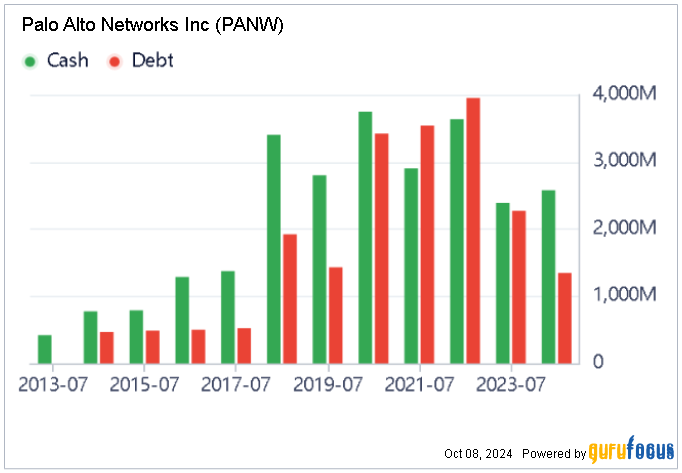

A positive ROIC indicates that the company is finally generating profit from its investments. While lower WACC means less money spent to finance its operations. And as the profitability raise, we also see better financial health of PANW.

The performance has turned around in 2022 and now PANW pockets some profits with lower debt and higher cash. Now, with the revenue growth rate in five years of 18.2% per year, more and more investors have confidence to hold the stocks and cause the stock to grow higher, skyrocketing to the point of overvaluation.

At the time this article is made, the P/E is 49.04x and compared to the industry median that is only 26.73x. The forward P/E of 56.7x also suggests that PANW's current price is more expensive than its median industry peers that stands at 21.59x.

So, basically PANW is a good stock that has experienced its turn around in profitability, with improvement in financial health and now having its momentum as the industry trend takes flight and the only matter is the price that is seen as overvalued.

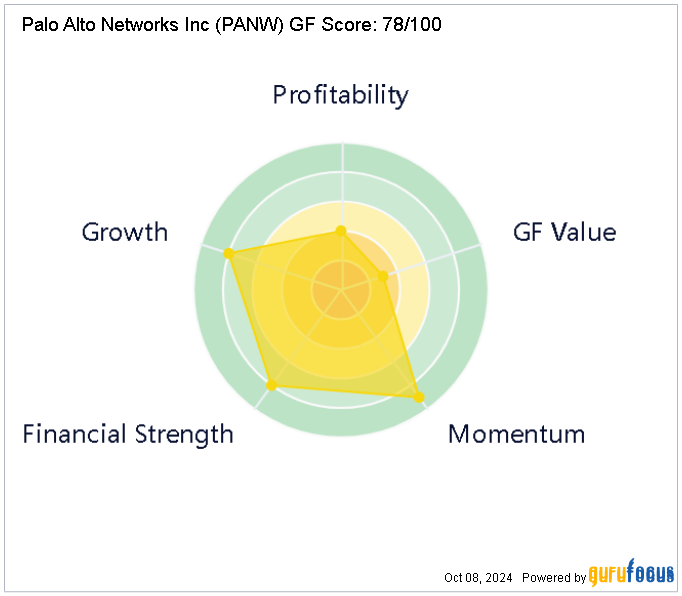

You see, you can get all the information above just by seeing this single chart of GF Score that maps the profitability, growth, financial strength and momentum, all in one chart.

The above chart suggests that PANW has its momentum, meaning that the stock is technically on the rise, gaining its financial strength and having good revenue growth but with a slightly high stock price. This single chart can be a good start to your more detailed stock research.

You can download it now by visiting GuruFocus today and dive deeper into Palo Alto's performance with Charts & Guru Insights.

This article first appeared on GuruFocus.