CXW: Strong History of Contract Retention; Preview 2Q24 Results

By M. Marin

NYSE:CXW

READ THE FULL CXW RESEARCH REPORT

2Q24 results after market close August 7, 2024 …

CoreCivic (NYSE:CXW) will report 2Q24 results after market close on August 7, 2024, and host a conference call at 10:00 a.m. CT / 11:00 a.m. ET on August 8, 2024. We forecast 2Q24 revenue of $481.4 million compared to $463.7 million in 2Q23, an expected 3.8% year-over-year advance. The consensus estimate is $481.9 million. On the higher projected revenue, we model adjusted EPS of $0.14 compared to $0.12 in 2Q23 and consensus of $0.13.

The company has registered recent momentum in its business, including rising average compensated occupancies at CXW facilities and normalizing costs. Average compensated occupancy in 1Q24 was 75.2%, up from 70.1% in 1Q23. While we see the pending termination of services at the South Texas Family Residential Center as a short-term challenge for CXW in terms of EPS reduction – CXW expects the annualized EPS impact to be a reduction of about $0.38 to $0.41; we estimate the 2024 EPS impact will be about $0.15 to $0.16 –we believe the contract termination does not reflect on the company’s relationship with ICE, its largest customer. In fact, according to the WSJ, the decision to terminate the contract primarily reflects the high cost of operating the facility, which unlike the majority of CXW’s ICE contracts, has been operated under a costlier Family Residential Standards (FRS) model because the facility was initially designed to house families seeking asylum. Specifically, the company originally entered into the contract in 2014 as ICE sought to provide solutions for the high volume of families seeking to enter the U.S. at the time. Although subsequently in 2021, the facility transitioned primarily to detention of single adults, it continued to operate under the FRS model.

Overall new business activity has been strong…

Moreover, longer-term, we remain optimistic about operating improvements going forward and we expect further renewals, extensions and new business agreements for CXW with ICE in the future. The company has also closed new or renewed several contracts in recent months. Recent contracts include, among others, a new management contract with Montana to house up to 120 inmates at its1,896-bed Saguaro Correctional Facility in Eloy, Arizona, which marks multiple contracts with the Montana Department of Corrections. CXW also signed a new management contract with Wyoming for up to 240 beds at its 2,672-bed Tallahatchie County Correctional Facility in Tutwiler, Mississippi and a new management contract with Hinds County, Mississippi for up to 250 beds at this facility. Another is with Harris County, Texas for up to 360 beds at the company’s Tallahatchie County Correctional Facility and a contract with the U.S. Marshals Service at the 4,128-bed Central Arizona Florence Correctional Complex.

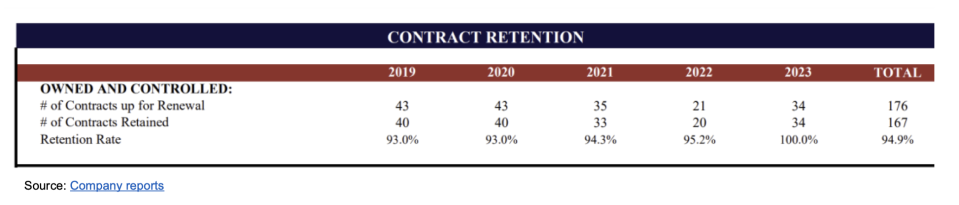

Reflecting growing demand for capacity, CXW is engaged in ongoing discussions with existing and potential partners. The company has indicated that government entities, including federal, state, and local agencies, have registered higher demand for occupancy and CXW is engaged in a number of discussions with multiple government entities. At the same time, retention rates remain high, reflecting the limited supply of and older state of many government owned correctional facilities, the programs the company offers inmates and the cost effectiveness of its services, among other factors. Over the past 5-years, retention rates on owned and controlled facilities is over 95%.

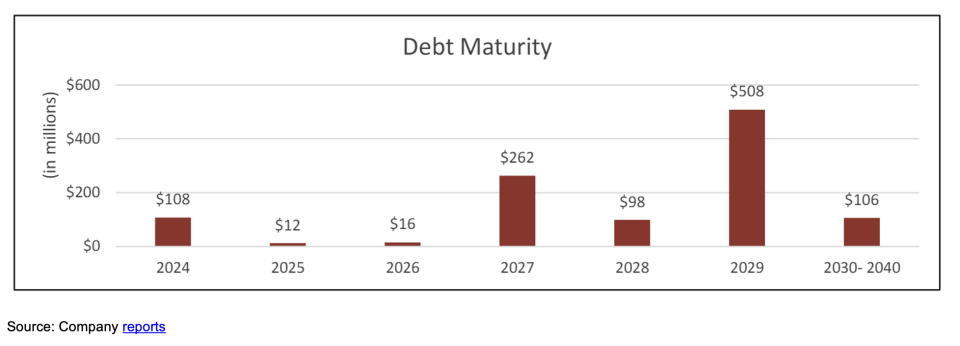

Company has pushed out debt maturities; strengthened balance sheet via deleveraging measures …

CXW has strengthened its balance sheet significantly, reducing debt by more than $1.1 billion since first putting the deleveraging strategy in place in 2020. CXW’s leverage ratio reached 2.7x by the end of 1Q24, placing it within the target range of 2.25x to 2.75x. With no major debt maturities before 2029 as illustrated below other than some $262 million maturing in 2027 (which carry a 4.75% stated interest rate and therefore we do not expect the company to refinance in advance), CXW also repurchased 2.7 million shares in 1Q24. CXW has indicated the likelihood that it will prioritize debt reductions rather than share buybacks in the near-term.

The company recently completed a debt issuance to extend maturities and was able to maintain its cost of capital on senior notes at 8.25% even with the uncertain interest rate and economic outlook. Demand for CXW’s notes strong and the amount of notes offered was upsized to an aggregate $500 million principal, from a previously announced $450 million. CXW had $111.4 million of cash at the end of 1Q24 and $257 million available under its revolver.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.