Could Investing $10,000 in Cava Make You a Millionaire?

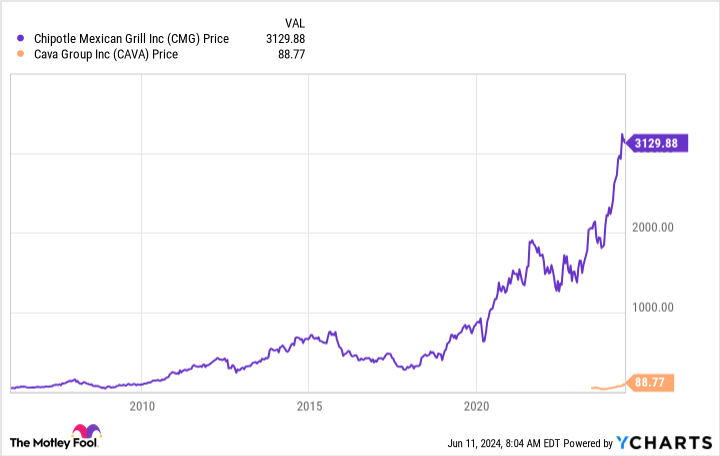

Cava Group (NYSE: CAVA) is often compared to Chipotle Mexican Grill. It's an apt comparison given the operating model of the two restaurant chains. But it also hints at the long-term opportunity for Cava if it can keep expanding its store base. Cava could be a key part of a millionaire-making portfolio, but it's still a stock you'll want to treat with a bit of caution.

What's the business opportunity with Cava?

Like Chipotle, Cava's business model is to offer freshly prepared fast casual food via an assembly line style creation process. Perhaps the biggest difference between the two restaurants is that Chipotle makes Mexican food and Cava makes Mediterranean food. But in this comparison is the hint of long-term opportunity.

Chipotle Mexican Grill has around 3,500 locations. Cava ended the first quarter of 2024 with just 323 locations. A little math will tell you that there's room for Cava to grow its footprint tenfold if you believe it has the same opportunity ahead of it as Chipotle. Even if Cava can't get that big, it still looks like there's a long runway for growth ahead.

For example, in the first quarter Cava opened 14 new locations. That rounds up to around 60 new locations a year. At that pace, it would take 50 years to open 3,000 new restaurants. That's back-of-the-envelope math and doesn't take into consideration an increased ability to open new locations over time as the company grows in scale. But it further highlights that Cava is still in the early stages of exploiting its potential growth opportunity. With that as a mindset, and looking at the massive stock appreciation of Chipotle as it grew its business, investing $10,000 in Cava could very clearly be a key piece of a millionaire-making portfolio.

Caution is warranted with young restaurant concepts

That said, even with what looks like a huge opportunity ahead, it probably wouldn't be wise to back up the truck to load it up with Cava stock. There are some very important warning signs to consider with up-and-coming restaurant brands. For starters, consumers love new things and early indications of demand aren't always good indications of long-term demand.

For example, Cava's same-store sales in 2023 came in at a white-hot 17.9%! That's impressive, but it just isn't a sustainable figure over the long term. It was most likely driven by newfound attention for the Cava brand. And that is proven by the fact that same-store growth in the first quarter of 2024 was just 2.3%. Before you run for the hills, 2.3% isn't bad. It's just OK. But it does look terrible when compared to 17.9%.

What investors need to monitor here is how same-store sales trend in the future. If same-store sales dip into negative territory for an extended period it would suggest that Cava is growing its store footprint at the expense of its existing locations. Basically, new locations are either cannibalizing the old ones, or, worse, management is so focused on opening restaurants that the operation of the existing stores suffers from a lack of attention. This happens with painful frequency in the restaurant business.

Cava is a growth stock

Cava looks like it has a huge amount of growth potential. The question is really around whether or not management can execute effectively enough to live up to that potential. There's a chance it can, but there's also a chance it can't.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group. The Motley Fool has a disclosure policy.

Could Investing $10,000 in Cava Make You a Millionaire? was originally published by The Motley Fool