Is This Company Still a Strong Buy After Tripling the S&P 500's Returns?

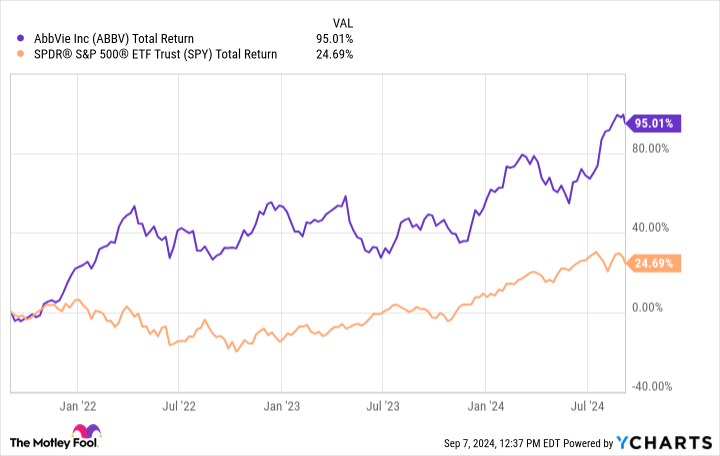

While seemingly everyone is focused on artificial intelligence (AI) and tech stocks, other companies are quietly producing enormous returns for investors. This is the case with pharmaceutical giant AbbVie (NYSE: ABBV), which more than tripled the total returns of the S&P 500 during the past three years.

Here are several reasons why.

Why AbbVie is a terrific investment

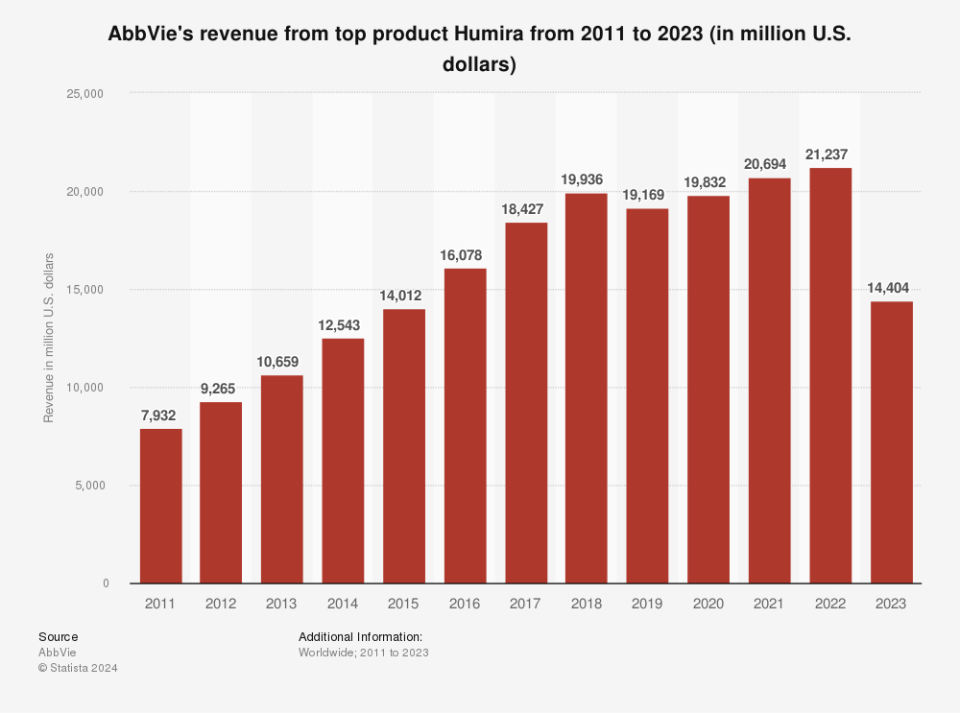

AbbVie is known as the maker of arthritis treatment Humira, the best-selling prescription drug of all time. Humira grossed well over $200 billion in all-time sales and peaked at over $21 billion in 2022. However, as you can see in the graph below, nothing lasts forever.

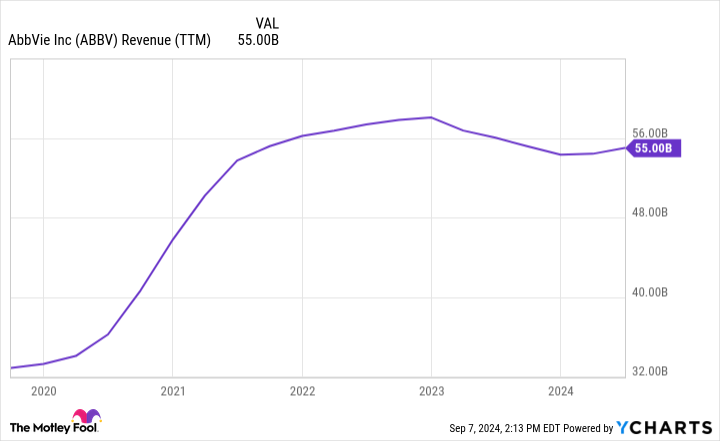

So what happened in 2023? Much less expensive biosimilars were approved for sale, which caused a sharp decline in Humira's sales for AbbVie. AbbVie's management knew this was coming and did a masterful job of diversifying the portfolio, starting with the 2019 acquisition of Allergan. Drugs like Botox, Juvederm, Vraylar, Linzess, and others were added to AbbVie's portfolio. In 2021, $11.4 billion, or 21% of total sales, were provided by products in Allergan's portfolio.

AbbVie also developed two more blockbuster drugs, Skyrizi and Rinvoq, which AbbVie expects to gross more than $16 billion this year and $27 billion in 2027. Finally, AbbVie continues making strategic acquisitions, such as the recent pickup of ImmunoGen and its commercial-stage cancer treatment drug, Elahere. AbbVie expects Elahere to be approved for additional treatments soon as well.

Because of these moves, AbbVie's revenue didn't significantly decline despite Humira's loss of exclusivity, as shown below (and it's on the rise again).

It's easy to see why AbbVie investors have done so well, but what about in the years ahead?

Is AbbVie stock a buy now?

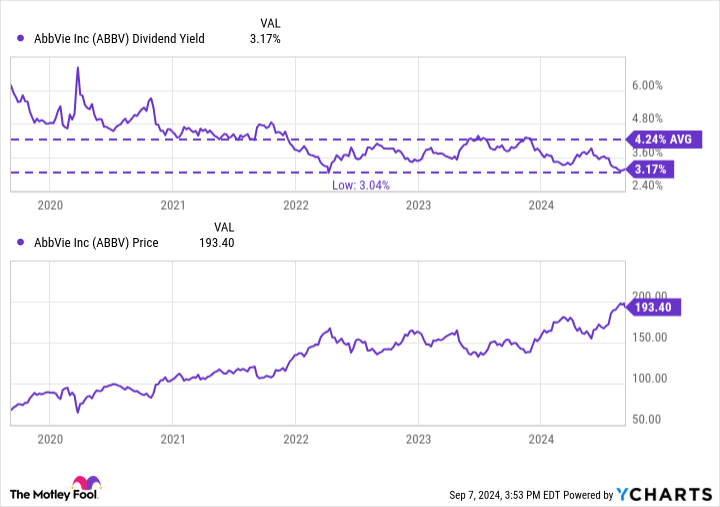

Along with the above, AbbVie is an investor favorite because it has raised its dividend yearly since its inception. It currently pays $1.55 quarterly for a yield of about 3%. However, now may not be the most advantageous time to purchase AbbVie's stock. As shown below, the dividend yield is near a five-year low due to the recent share price increase.

The yield is also 34% below its recent average, suggesting optimism is already priced into the stock. AbbVie is one of my most successful investments, but I only buy it when the dividend yield nears 4%.

AbbVie is a terrific company and an excellent stock for income investors because of its consistently rising payout. However, the stock is best to hold for now as there are likely better times to come for accumulating the shares.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Bradley Guichard has positions in AbbVie. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is This Company Still a Strong Buy After Tripling the S&P 500's Returns? was originally published by The Motley Fool