Colgate Stock Trades Near 52-Week High: What's Next for Investors?

Colgate-Palmolive Company CL has experienced steady growth over the past year, fueled by its strong leadership in the oral care market and science-driven innovations that have bolstered its core and premium product lines. The company has benefited from robust pricing strategies, funding-the-growth efforts and other productivity initiatives. Additionally, enhanced revenue-growth management plans have contributed to the increase in Colgate’s organic sales.

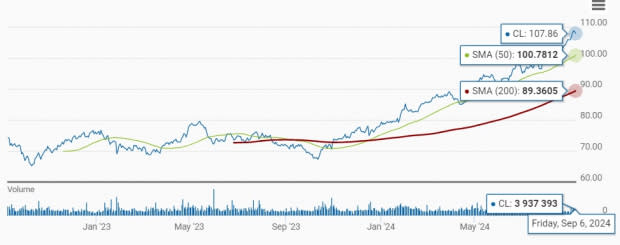

As a result, this New York City-based global leader in the oral care hygiene market hit a new 52-week high of $109.30 on Sep 5, 2024. Currently trading at $107.86, the stock rolled down just 1.3% from its 52-week high. Moreover, the stock price reflects a 59.5% premium from its 52-week low of $67.62.

Notably, the Colgate stock has rallied as much as 45.8% in the past year compared with a 19.9% increase each for the broader industry and the S&P 500 index. Moreover, the Consumer Staples sector has risen 6.7% in the same period.

Colgate Price Performance

Image Source: Zacks Investment Research

CL is trading above its 50 and 200-day moving averages, indicating robust upward momentum and price stability. This technical strength reflects positive market perception and confidence in CL’s financial health and prospects.

CL Stock Trades Above 50 & 200-Day Moving Average

Image Source: Zacks Investment Research

Strategies Support Colgate’s Stock Rally

CL’s business strategy focuses on strengthening its leadership in key product categories by innovating within its core businesses, exploring adjacent category growth, and expanding into new markets and channels. Colgate is recognized as a top consumer goods company with a global household penetration rate of 61.6%.

The company’s innovation strategy aims to expand into adjacent categories and product segments, with a focus on the premiumization of its Oral Care portfolio through major innovations. This approach has bolstered the performance of products like CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste. The at-home and professional whitening products are also showing positive results, contributing to the strong performance of its Oral Care business.

In response to the growing consumer preference for organic and natural ingredients, the company is expanding its Naturals range, including Naturals toothpaste. It continues to expand its Naturals and Therapeutics divisions. The acquisition of Hello Products LLC has further strengthened Colgate’s market position. The company has also seen market share growth for Hill’s Science Diet and Hill’s Prescription Diet in specialty channels, driven by science-led innovation and enhanced brand support.

Colgate has expanded its premium skincare portfolio with the acquisition of the Filorga skincare brand, resulting in significant market share gains in North America and Europe. The company has revamped its innovation model, leveraged global strengths across price tiers and increased marketing investments. These efforts, along with strong capabilities, have contributed to solid brand health and increased household penetration.

On its last quarter’s earnings call, Colgate increased its forecast for organic sales and base business earnings per share for 2024 while reaffirming its overall sales outlook. The company expects net sales growth of 2-5% for 2024, driven by a more optimistic view on organic sales. CL anticipates organic sales growth of 6-8% for 2024, up from the previously mentioned 5-7%.

CL’s Upward Estimate Trajectory

The Zacks Consensus Estimate for CL’s 2024 EPS has been unchanged in the past 30 days, whereas the same for 2025 has increased by a penny in the same period.

For 2024, the Zacks Consensus Estimate for Colgate’s sales and EPS implies 3.9% and 10.5% year-over-year growth, respectively. The consensus mark for 2025 sales and earnings indicates 3.9% and 8.6% year-over-year growth, respectively.

Image Source: Zacks Investment Research

Colgate’s Premium Valuation

With the stock steadily ticking up, the company is trading at a forward 12-month P/E multiple of 28.52X, exceeding the industry average of 24.13X and the S&P 500’s average of 20.68X. Currently, Colgate’s stock valuation seems pricey.

Image Source: Zacks Investment Research

Investors could face significant downside risks if the company's future performance does not meet expectations. The consumer goods market is becoming increasingly competitive, and CL’s innovation and market expansion may not be enough to drive significant growth. Economic headwinds and increased competition could hinder the company’s ability to maintain its current growth trajectory.

Decoding Challenges Faced by CL

Colgate has been experiencing several significant challenges, including ongoing inflationary pressures and a challenging macroeconomic environment. Rising raw material costs and increased packaging expenses continue to weigh on the company’s profitability. In the second quarter of 2024, the Hill’s Pet Nutrition segment experienced a decline in volume due to lower private label sales.

Foreign currency fluctuations are creating further headwinds. The company’s sales outlook for 2024 factors in the increased negative impacts of currency translations. While the company has maintained its guidance of a mid-single-digit negative impact from currency fluctuations, it anticipates a greater negative effect within this range, driven by recent adverse movements in the Mexican peso and the Brazilian real.

Conclusion

Colgate’s consistent rise in the stock market, along with its robust business model and strong market leadership, presents a positive outlook for the stock. However, it is essential to consider the effects of market conditions, including inflation, macroeconomic headwinds and currency volatility, before making an investment decision.

Given the stock’s high valuation and recent rally, investors might be cautious about entering at current levels, suggesting higher risks. For those already invested, staying with this Zacks Rank #3 (Hold) stock could be a prudent choice, considering its strong long-term potential.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely The Chef's Warehouse CHEF, Ollie's Bargain Outlet OLLI and Flowers Foods FLO.

The Chef's Warehouse offers specialty food products in the United States. CHEF presently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 33.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for CHEF’s current financial year’s sales and EPS indicates growth of 9.7% and 12.6%, respectively, from the year-ago reported figures.

Ollie's is a value retailer of brand-name merchandise at drastically reduced prices. OLLI currently has a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 7.9%, on average.

The Zacks Consensus Estimate for OLLI’s current financial-year sales and earnings suggests growth of 8.7% and 12.7%, respectively, from the year-ago reported figures.

Flowers Foods emphasizes providing high-quality baked items, developing strong brands, making innovations to improve capabilities and undertaking prudent acquisitions. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for FLO’s current financial-year sales and earnings indicates growth of 1.1% and 4.2%, respectively, from the year-earlier actuals. FLO has a trailing four-quarter earnings surprise of 1.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report