Colgate (CL) Benefits From Innovation & Pricing Actions

Colgate-Palmolive Company CL is in a good spot, thanks to its robust business strategies. Strong pricing and funding-the-growth and other productivity initiatives have been bolstering the company’s performance for a while. Its innovation strategy and shareholder-friendly moves also bode well. In addition, the accelerated revenue-growth management plans have been bolstering sales.

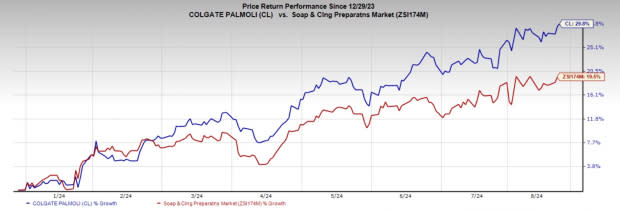

Shares of this renowned consumer goods company have gained 29.8% in the year-to-date period compared with the industry’s 19.5% growth.

Let’s Find Out More

Colgate’s innovation strategy is focused on growing in adjacent categories and product segments. This strategy also focuses on the premiumization of its Oral Care portfolio through major innovations. Backed by premium innovation, products including CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste have been performing well. At-home whitening and professional whitening products bode well. Its Oral Care business has also been performing well.

Some other notable efforts include the continued expansion of the Naturals and Therapeutics divisions as well as the Hello Products LLC buyout. The company has been seeing market share growth for its Hill’s Science Diet and Hill’s Prescription Diet across the specialty channels, driven by its science-led innovation and improved brand support.

Further, the company expanded its premium skincare portfolio with the buyout of the Filorga skincare business. It is witnessing strong market share gains in North America and Europe. The company has revamped its innovation model, leveraged global strength across price tiers and invested in marketing. These efforts, along with its robust capabilities, led to solid brand health and household penetration.

Image Source: Zacks Investment Research

Colgate’s pricing and productivity initiatives have been driving its margins for quite some time now. The company has been implementing aggressive pricing for the last few quarters, which boosted margins in second-quarter 2024. The gross profit margin expanded 300 basis points (bps) to 60.8% on an adjusted basis while adjusted earnings advanced 18% year over year during the reported quarter. Meanwhile, pricing improved 4.2% year over year in the second quarter, backed by positive pricing across all divisions, except for North America. Colgate’s organic sales growth reflected augmented volume and higher pricing.

Management forecasts gross profit margin expansion on both GAAP and adjusted basis, driven by continued pricing gains, benefits from revenue growth management initiatives and strength in the funding-the-growth program. Colgate expects 2024 adjusted earnings per share to increase in the band of 8-11% compared with mid to high-single-digit growth stated earlier.

Regarding its shareholder-friendly efforts, Colgate is committed to rewarding shareholders via share buybacks and dividend payouts. Markedly, the company has paid uninterrupted dividends since 1895.

Final Thoughts

On the flip side, Colgate has been witnessing inflationary pressures and a tough macroeconomic environment for quite some time now. During the second quarter, Hill’s Pet Nutrition segment’s volume was impacted by lower volumes from private labels. Foreign currency fluctuations are also acting as headwinds. The sales view for 2024 includes the increased negative impact of currency translations.

Nevertheless, this Zacks Rank #3 (Hold) company has been making prudent initiatives to tackle the aforesaid challenges. Analysts seem optimistic about Colgate. The Zacks Consensus Estimate for 2024 sales and earnings per share (EPS) is currently pegged at $20.2 billion and $3.57, respectively, indicating growth of 3.9% and 10.5%.

Key Picks

Freshpet, Inc. FRPT, a pet food company, has a trailing four-quarter average earnings surprise of 118.2%. FRPT currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Freshpet’s current financial-year sales and EPS indicates growth of 24.8% and 177.1%, respectively, from the prior-year reported levels.

Vital Farms VITL, which provides pasture-raised products, currently sports a Zacks Rank of 1. The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and EPS indicates growth of 24.9% and 66.1%, respectively, from the prior-year reported levels.

VITL has a trailing four-quarter earnings surprise of 102.1%, on average.

Post Holdings POST, a consumer-packaged goods company, is involved in the production of refrigerated, foodservice and nutrition product categories. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for POST’s current financial-year sales and EPS indicates growth of 14.2% and 6.9%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

Freshpet, Inc. (FRPT) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report