Coca-Cola vs. PepsiCo: Which Stock Is Better for Dividend Investors?

Coca-Cola (NYSE: KO) and PepsiCo (NASDAQ: PEP) are two top food stocks that also make safe long-term investments. But for dividend investors, it can be hard trying to pick between these two stocks, since there are many similarities between them. They offer high yields, lots of safety, and comparable growth prospects. Let's take a closer look at these stocks and see which one of them may be the better dividend stock to buy right now.

Coca-Cola vs. PepsiCo: Key dividend stats

A good place to start when comparing these two is on key metrics related to their dividend payments. Here's how they stack up against one another when looking at their yields and payout ratios, and dividend growth rates and streaks.

Metric | Coca-Cola | PepsiCo |

|---|---|---|

Dividend yield | 2.9% | 3.1% |

Payout ratio | 77% | 75% |

5-year dividend growth | 21% | 42% |

Dividend growth streak (years) | 62 | 52 |

Source: Company filings, Yahoo Finance.

Their yields are comparable, and so too are their payout ratios. And as long as both businesses continue to grow, their dividend payments are likely to rise as well. Both stocks are Dividend Kings, and while Coca-Cola has a longer streak overall, that's not going to be a game changer for dividend investors. PepsiCo has been raising its payout at a higher rate than Coca-Cola over the past five years, and with a slightly lower payout ratio, it's possible that its rate hikes may continue to be more generous.

Coca-Cola vs. PepsiCo: Key financial metrics

An important consideration for investors is what the financials look like for both businesses and the potential for their earnings to rise higher in the years ahead. That can ultimately determine which company is on a better path to generating more profit growth, and which one will have greater room to raise its dividend payments at a higher rate in the future.

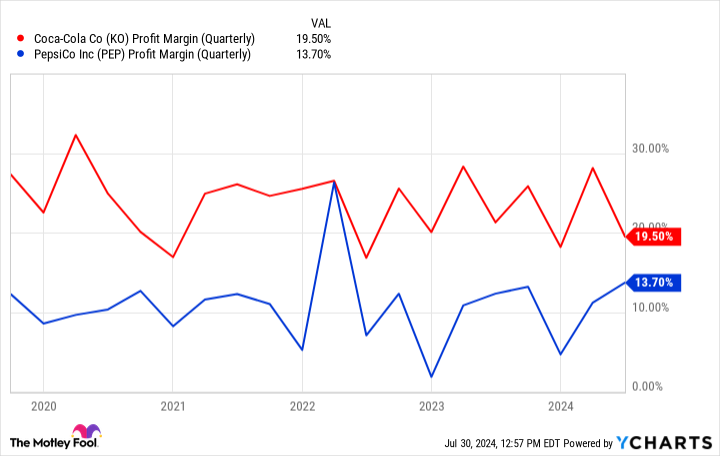

One advantage that Coca-Cola has is that it generates better margins than PepsiCo, and that can make it easier for the company to grow its bottom line.

KO Profit Margin (Quarterly) data by YCharts.

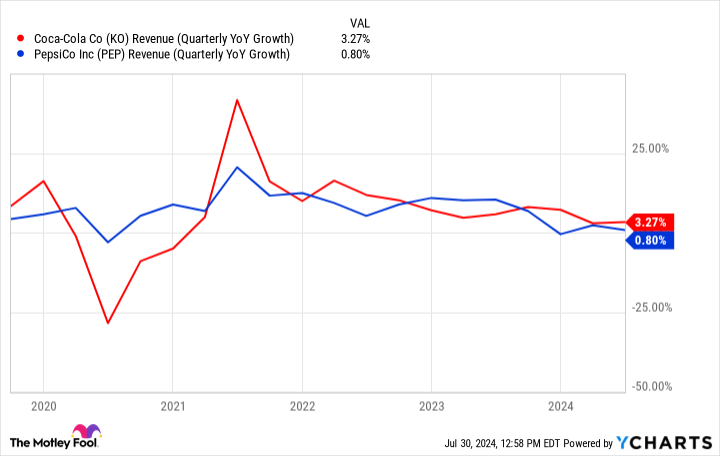

The growth rate for these two stocks has been mixed. They both have comparable growth opportunities in the future, as the brands are often interchangeable with one another. And the lack of a clear winner in terms of growth highlights that point.

KO Revenue (Quarterly YoY Growth) data by YCharts.

Coca-Cola vs. PepsiCo: Valuation

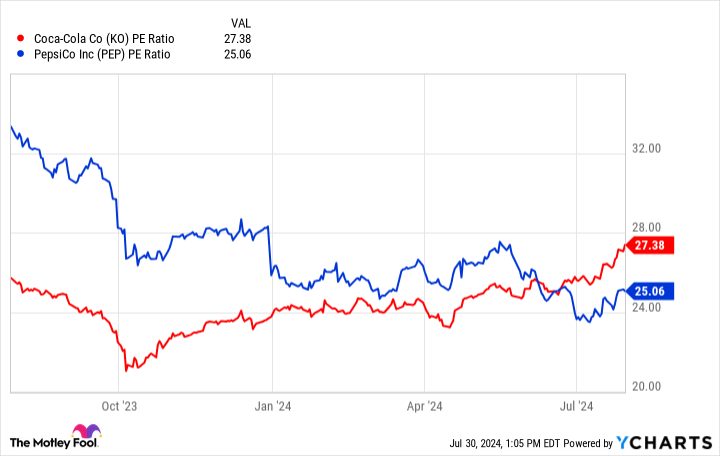

When comparing stocks, a natural area to also look at is their respective valuations. While an investment may be attractive, it could lose its appeal if it trades at an extremely high premium. Here's how Coca-Cola and PepsiCo compare in terms of their respective price-to-earnings ratios.

PepsiCo has a slight advantage in being a bit of a cheaper stock than Coca-Cola right now, however there needs more investigation why the former has gradually been getting cheaper over the last twelve months, as the above chart suggests. It's possible the market isn't seeing growth prospects for PepsiCo as attractive as it used to be a year ago, unlike its rival's.

What's the better overall dividend stock for investors?

Based on all the charts and data, I'm inclined to say that Coca-Cola makes for the better stock to buy. There isn't a lot separating the two stocks in terms of their dividend payments, and with comparable payout ratios, their future dividend growth rates will depend on how successful the two businesses are in growing their respective brands.

And that's where Coca-Cola starts to separate itself out from PepsiCo. The higher profit margins of Coca-Cola, in comparison to PepsiCo, can make it much easier for the former to increase its earnings in the future. With hundreds of brands in its portfolio, Coca-Cola has many avenues it can go down to unlock more growth opportunities. Strong profit margins will be key in helping the business make the most of the additional revenue growth.

PepsiCo is a bit of a cheaper buy, but it's not trading at large enough of a discount where the scales sufficiently tip in its favor. Although both dividend stocks can be a good options for investors, I'd go with Coca-Cola.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Coca-Cola vs. PepsiCo: Which Stock Is Better for Dividend Investors? was originally published by The Motley Fool