China’s Bank Loan Gauge Contracts for First Time in 19 Years

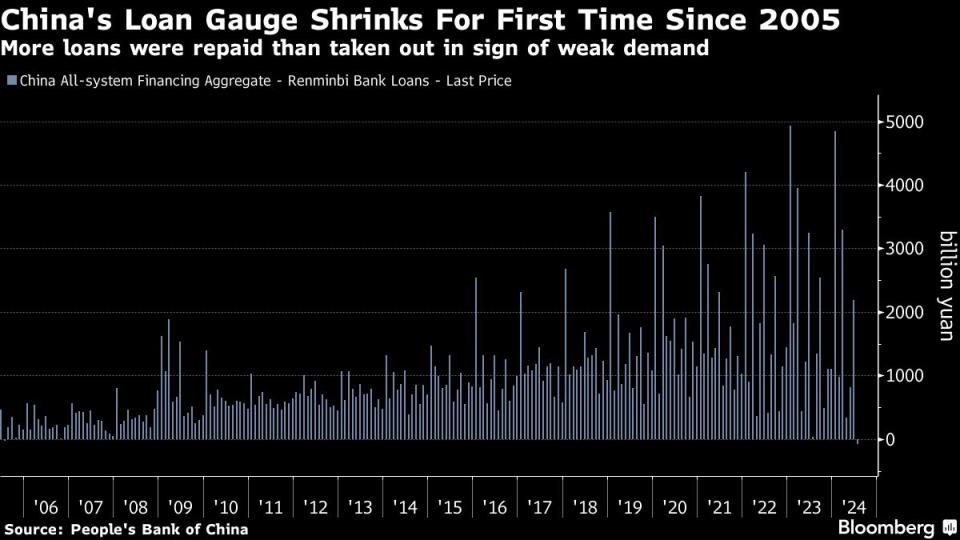

(Bloomberg) -- China’s bank loans to the real economy contracted for the first time in 19 years, a grim milestone that underscores why weak domestic demand has emerged as a major hurdle to the economy’s growth and recovery.

Most Read from Bloomberg

How Chicago’s Gigantic Merchandise Mart Is Still Thriving as Office Space

Gottheimer Calls for Rail Riders to Be Reimbursed for Delays

Los Angeles Sees Remote Work Helping ‘No Car’ 2028 Olympic Games

Yuan-denominated bank loans that exclude those extended to financial institutions shrank by 77 billion yuan ($10.7 billion) at the end of July from a month ago, according to data released Tuesday by the People’s Bank of China. That marked the first drop since July 2005, as more debt was repaid than taken out.

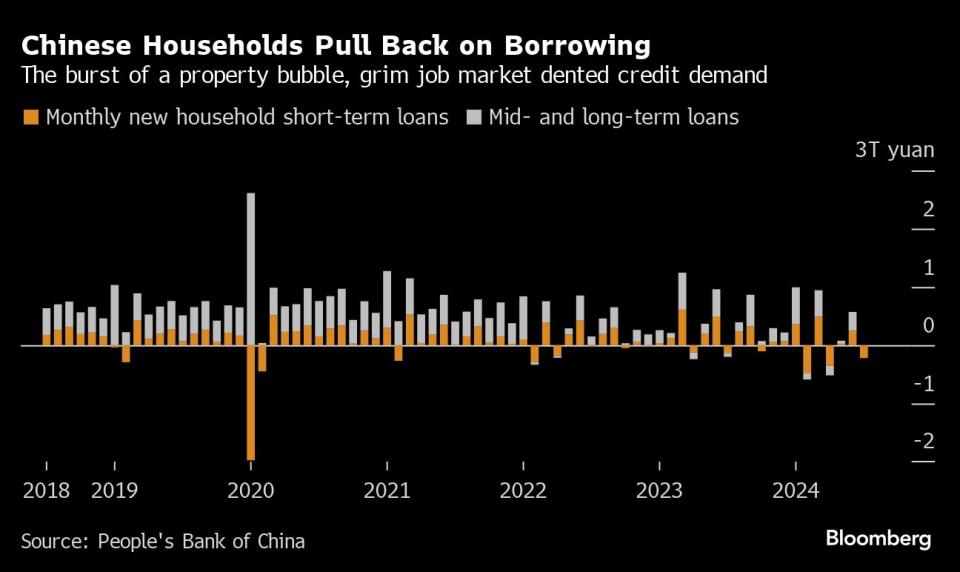

Chinese households and businesses are rushing to repay debt as investment returns dwindle and real borrowing costs — adjusted for falling prices across the economy — remain elevated. That reflects languishing domestic demand, which is putting the annual growth target of around 5% at risk as overseas orders began to soften.

“That was a pretty weak report which shows loan demand remains very weak across households and corporates,” said Michelle Lam, Greater China economist at Societe Generale SA. “That suggests an imminent recovery is still pretty unlikely, and the government needs to do more to ensure they hit this year’s target.”

Cooling credit growth is a worry given that Japan’s decades-long stagnation and deflation was rooted in the decisions of families and companies to focus on paying down debt rather than expanding spending or investment — an economic trap known as a “balance-sheet recession.”

While the debt levels of China’s corporate and household sectors remain stable and show no sign of a rapid contraction, analysts are debating what the world’s No. 2 economy should do to avoid meeting the same fate as Japan. Many have called on the central government in Beijing to expand its borrowing and spending to counter declining private demand.

Apart from weak credit demand, the data likely also reflected authorities’ crackdown on financial arbitrage, including the practice by companies of taking out cheap loans and parking them in banks as high-yielding deposits. The central bank tried to prevent such a use of funds in recent months.

Non-financial companies took out just 152 billion yuan of loans in July, the smallest amount since October 2019. Meanwhile, households repaid a net 222 billion yuan worth of loans, as they cut down on short-term borrowing and mortgages amid a prolonged housing downturn.

Other major indicators showed broader credit expanded less than expected last month.

Aggregate financing, a broad measure of credit, increased 771 billion yuan last month, according to Bloomberg calculations, falling short of a 1 trillion-yuan median forecast by economists. A gauge of new loans, which includes borrowing by financial firms, rose 268 billion yuan, also worse than the 427 billion yuan forecast.

That’s despite the PBOC’s decision to cut a string of interest rates in July in an attempt to boost confidence and demand. Central and local governments are also speeding up bond sales in the coming months, which would help push up the flow of broader credit and offset some of the impact of sluggish borrowing demand.

Restrained credit growth is typical in the month of July, a period when banks aren’t in a rush to meet their quarterly lending targets. The same month last year provided a low base of comparison, as new loans plunged to a 14-year low due to weak borrowing appetite.

The data will be followed by official figures on Thursday that are expected to show the economy failed to pick up meaningfully in July, even though headline retail sales numbers may improve thanks to seasonal factors.

“After today’s numbers, and Thursday’s more importantly, policies will do more on the margin, and there’ll be more space for fiscal and property policies to step up,” said Larry Hu, chief China economist at Macquarie Group Ltd. “But I don’t expect a huge policy easing because the goal is just to achieve 5%.”

What Bloomberg Economics Says ...

“China’s July credit report brings mixed news. On the negative side, the first-ever monthly drop in new loans to the real economy shows just how weak demand from households and businesses is. The good news: fiscal stimulus is pushing up credit growth, especially considering that much of the increase happened before the surprise policy-rate cuts close to the end of the month.”

— Eric Zhu, economist. For full analysis, click here

After years of rapid debt build-up, authorities are finding it difficult to engineer the kind of credit booms that once propelled China out of its downturns. That’s also become less of a priority as Beijing looks to shift the economy toward high-tech manufacturing and away from property and infrastructure-driven growth.

The biggest reason behind the weak credit demand is the property downturn, according to Hu. The effect of rate cuts is limited in this situation, meaning it warrants more fiscal stimulus, he said.

Though the PBOC is expected to cut rates again this year after a surprise reduction in July, economists generally see such moves as signals of a supportive policy stance rather than a remedy for weak demand.

The stock of credit grew 8.3% in August from a year earlier, unchanged from the previous month. Despite much slower credit growth than in previous years, falling prices across the economy mean it’s still growing faster than nominal gross domestic product, reflecting continued financial support to the economy.

(Updates with details throughout.)

Most Read from Bloomberg Businessweek

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

New Breed of EV Promises 700 Miles per Charge (Just Add Gas)

There’s a Gender Split in How US College Grads Are Tackling a More Difficult Job Market

The Fake Indian Cricket League Created for Real Online Betting

©2024 Bloomberg L.P.