Charles Schwab Stock Plummeted 19% in the Days Following Its Earnings Announcement. Here's Why.

Charles Schwab (NYSE: SCHW) has grappled with deposit outflows for the past couple of years, and its recent earnings didn't do much to quell investor concerns. The financial services titan reported earnings on July 16, and investors reacted with a steep sell-off, as the stock plummeted 19% in the following days.

During its earnings call, CEO Walt Bettinger told investors that Schwab would shrink its bank and use third-party banks to help reduce its capital and funding-related risks. Analysts, including those at Bank of America, lowered their price target on the Charles Schwab and believe its earnings upside could be limited over the next couple of years. Here's why.

How rising interest rates impacted Charles Schwab

For years, Charles Schwab has outperformed peers across key metrics like return on equity (ROE) and delivered excellent returns for longtime shareholders. One component of Schwab's strong performance was its use of low-cost deposits as a cheap funding source. This strategy worked well in the early 2010s when interest rates were relatively low with less volatility.

In 2017, Schwab began feeling the effect of rising interest rates, which the Federal Reserve began to raise for the first time since the Great Recession. Then the pandemic hit, the Federal Reserve cut rates, and interest rate risk disappeared for a while. When interest rates rose again in early 2022, Schwab began feeling the heat. During the next couple of years, the Fed raised its federal funds rate from nearly 0% to 5.25% -- a rate not seen since 2007.

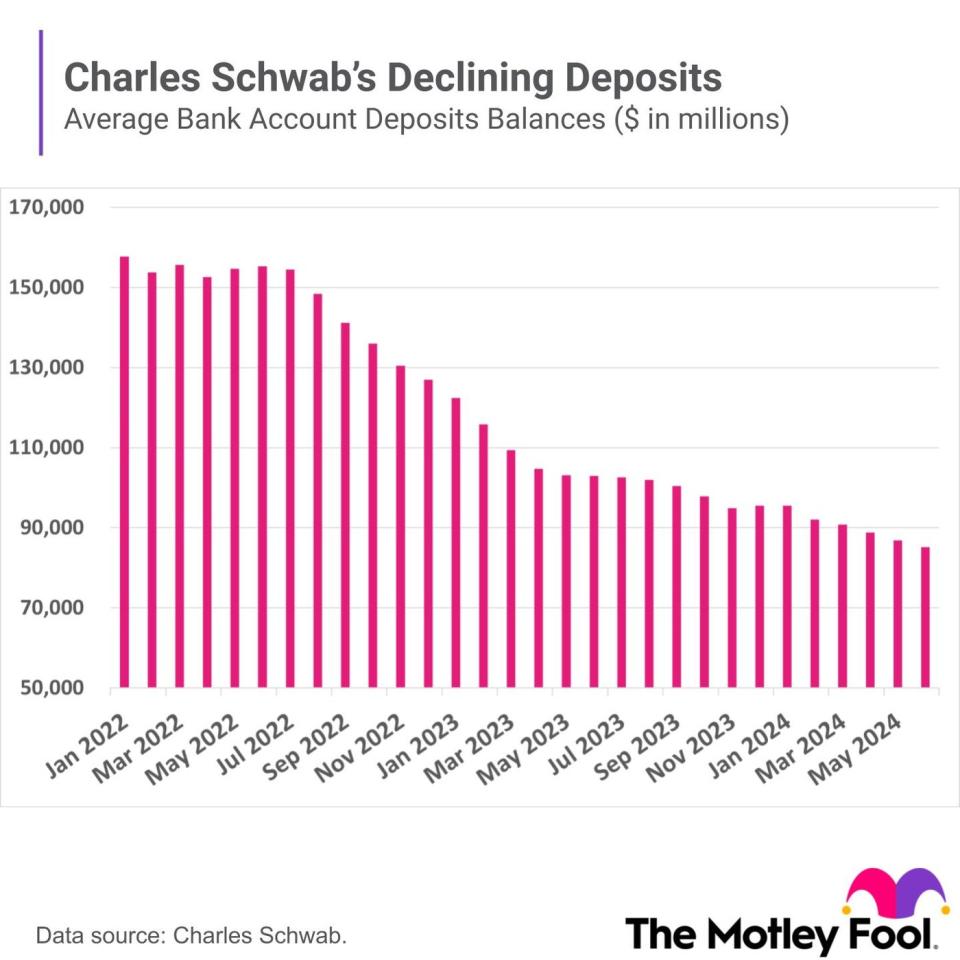

As a result, interest rates rose across assets like high-yield savings accounts, certificates of deposits, and other interest-rate-linked assets, making them more appealing investments. Schwab customers began shifting their funds into higher-yielding assets in a phenomenon called client cash sorting. As a result, Schwab's bank account deposits plummeted from August 2022 to April 2023, falling by $50 billion, or 32%.

These deposit outflows coincided with those from Silicon Valley Bank, the SVB Financial subsidiary seized by regulators in March 2023. This made many nervous that Schwab was next on the chopping block. However, Schwab was better positioned than Silicon Valley Bank, which focused on the start-up and venture capital communities.

However, the fallout revealed the flaw in the company's business model, and Schwab had to borrow from the Federal Home Loan Bank (FHLB) to ensure it had enough liquidity if deposits continued to bleed out. As a result, its deposits dropped, and funding costs increased.

Schwab's second-quarter results didn't do much to ease investor concerns. Net interest revenue fell 6% compared to last year, while bank deposits decreased by 4% and continue to bleed out amid the higher interest rate environment. On top of that, its FHLB borrowings of about $24 billion were flat compared to Q1.

During Schwab's earnings call, CEO Walt Bettinger said the financial services company plans on using third-party banks to send excess deposits to reduce its "capital intensity," improve liquidity, and extend FDIC insurance for clients. The move should help reduce the funding risk that has weighed on the company in recent years.

Some analysts were less than impressed. For example, Bank of America lowered its price target to $66. According to The Fly, BofA noted that this hybrid bank model "marks a 180-degree turn" in Schwab's bank-centric strategy and lowered its earnings per share estimates over the next two years due to weaker deposit growth and higher supplemental funding.

What's next for Charles Schwab?

Strategically, this is the right thing to do for Charles Schwab, which has struggled in the rising-interest-rate environment and had to borrow funds from the FHLB to help smooth things over. According to Bettinger, Schwab's strategy shift will take years to execute through the interest rate cycle, with the long-term goal of reducing the volatility of capital levels and the need to access supplemental borrowing when interest rates rise rapidly.

In the short term, the move will weigh on Schwab, and growth from its bank will be muted. Schwab stands to benefit from the Federal Reserve lowering interest rates over the next year, which should allow it to pay down funding sources. However, this strategic shift will drag earnings as it executes its plan to reduce its bank deposit footprint, leaving the stock vulnerable to further volatility as it undergoes this transition.

Should you invest $1,000 in Charles Schwab right now?

Before you buy stock in Charles Schwab, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Charles Schwab wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $688,005!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. SVB Financial provides credit and banking services to The Motley Fool. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Charles Schwab. The Motley Fool recommends the following options: short September 2024 $77.50 calls on Charles Schwab. The Motley Fool has a disclosure policy.

Charles Schwab Stock Plummeted 19% in the Days Following Its Earnings Announcement. Here's Why. was originally published by The Motley Fool