Buyback Blackout Adds Extra Layer of Uncertainty for US Stocks

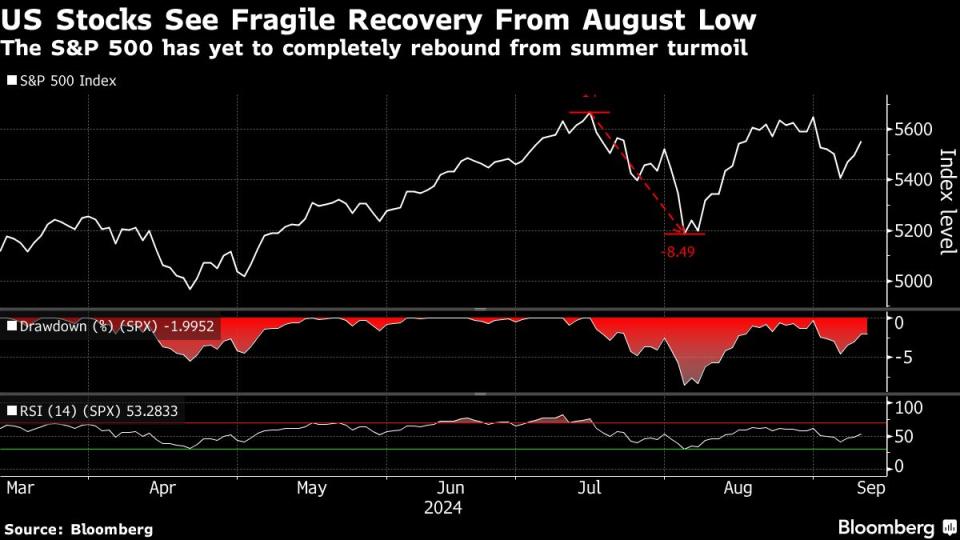

(Bloomberg) -- The uneven recovery in US stocks after the August-meltdown is set to lose an important catalyst as corporate buybacks enter a blackout period.

Most Read from Bloomberg

Housing’s Worst Crisis in Decades Reverberates Through 2024 Race

An Affordable Nomadic Home Design Struggles to Adapt to Urban Life

For Tenants, AI-Powered Screening Can Be a New Barrier to Housing

US companies face an embargo on repurchases starting Friday in the run-up to the third-quarter reporting season. Investors say the restriction is making the outlook for equities even more clouded at a time when the Federal Reserve is nearing its first interest-rate cut in four years and uncertainty about the US elections and economy abounds.

Buybacks — which Deutsche Bank AG says are driving as much as 10% in annual returns for the S&P 500 — became a crucial source of support for stocks as companies bought the dip after the US benchmark’s early-August slump. Repurchase volumes surged to three times the normal level, figures from Morgan Stanley Investment Management showed.

“Markets are emotionally scarred from the first week in August,” said Rory McPherson, chief investment officer at Magnus Financial Discretionary Management. “With buybacks in a blackout period, it puts even more emphasis on the Fed to come through with the rate cut.”

The recovery that followed last month’s selloff has been jittery. Plagued by concerns about a possible US recession as the labor market cooled, the benchmark tumbled again this month and remains about 1% below a record-high in July.

The next few weeks will remain treacherous.

With swap markets pricing in more than 100 basis points of monetary policy easing by year-end, any sign of a more hawkish outlook by Fed officials has the scope to upset stocks again.

“Recession risks are still out there,” said Matt Stucky, chief equity portfolio manager at Northwestern Mutual Wealth Management. “You take away a strong source of bids for equities in the form of buybacks, you face a risk that volatility is going to kick up higher.”

Options traders are pricing in moves of about 1.2% in either direction for the S&P 500 when the Fed delivers its rate decision next Wednesday, according to JPMorgan Chase & Co. strategists. That’s slightly above an average move of 1.1% seen after meetings over the past year.

For Evercore ISI strategist Julian Emanuel, piling into the shares of companies executing buyback plans is a top strategy to navigate a rate-cutting cycle. Firms with a high rate of buybacks have outperformed those with a low rate every time when the Fed eased policy since 1990, an analysis by his team showed.

Election Risks

Goldman Sachs Group Inc. estimates that corporates have so far executed $960 billion in buybacks out of an authorized $1.15 trillion. Technology behemoths have dominated activity, with five of the so-called Magnificent Seven stocks contributing about 30% of the S&P’s total buybacks in the first quarter, according to figures from Roundhill Investments.

Looking further ahead, the closely contested US election between Vice President Kamala Harris and former President Donald Trump is adding another layer of risk, due to the outcome’s implications for tax proposals and trade policies.

“The US presidential election is likely to become more of a focus for investors,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “Given also that the last two weeks of September are seasonally the worst of the calendar year, we expect equity markets to remain range-bound.”

Not everyone is pessimistic.

The absence of buybacks wouldn’t imply a rough time for equities as the Fed’s actions would be the main focus, said Marija Veitmane, senior multi-asset strategist at State Street Global Markets.

“I’m quite relaxed about the blackout now,” she said. “To me, the key driver is the Fed put.”

Still, at Morgan Stanley IM, portfolio manager Andrew Slimmon said a slowing economy warrants caution.

“The market is short-term overbought as we’re entering this seasonally treacherous time of the year,” Slimmon wrote in a note. “The market is now expecting a perfect landing by the Fed, but be patient.”

--With assistance from Christian Dass and Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

College Football Players Learn an Ugly Truth About Getting Paid

EV Leases Go as Low as $20 a Month to Help Dealers Clear Their Lots

China Can Avoid Japan’s Lost Decades If It Follows Korea’s Path

The Vegas Sphere’s First Live Sporting Event Will Be an Expensive One

©2024 Bloomberg L.P.