Should You Buy Super Micro Computer Before the Stock Split?

Super Micro Computer (NASDAQ: SMCI) has been one of the biggest winners of the artificial intelligence (AI) boom.

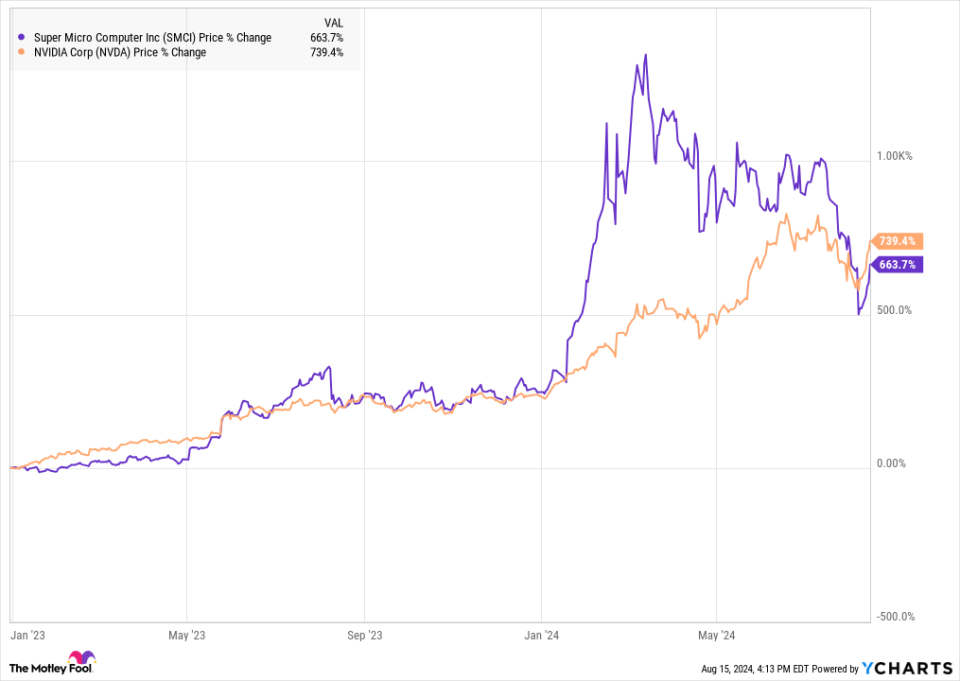

Even after the pullback in recent months, Supermicro, as the company is also known, is still up nearly 700% from the start of 2023, nearly matching Nvidia as the chart below shows.

The company, which makes high-density servers that are particularly well suited to running AI applications, has accomplished that by putting up Nvidia-like growth numbers with revenue jumping 144% in its recently reported fiscal-fourth quarter.

In response to the stock surge, Supermicro recently decided to reward investors with a 10-for-1 stock split, which goes into effect on Oct. 1. The company said it was splitting the stock to make it more accessible.

Should you buy Super Micro Computer before the stock split? Let's take a look at the evidence.

Recent performance is mixed

There's no question that Supermicro is experiencing surging growth, but there's been a blemish on the company's record, and it's one reason the stock tumbled after the recent earnings report. Gross margin has been falling even as revenue has surged. In the fourth quarter, the company reported a gross margin of just 11.2%, down from 17% in the quarter a year ago. That translated into lower operating margins for Supermicro as well, falling to 6.5% from 10.3%.

The good news is that the company expects gross margin to recover, saying that supply chain bottlenecks have driven up prices for new components, but that should recede over the next year. Management also said that long-term gross margins will benefit from lower manufacturing costs in production in Malaysia and Taiwan. It also plans to expand in the Americas and in Europe.

If margins recover next year, the stock should move higher.

Will the stock split help?

Investors should understand that a stock split doesn't do anything to change the fundamental value of a stock; it just divides the proverbial pie into more pieces, making individual shares cheaper.

There's also some evidence that stocks have outperformed the S&P 500 in the 12 months following their stock splits, according to research from Bank of America, which found that stocks that split gain 25% on average compared to just a 9% gain for the S&P 500. That could be because stock splits tend to follow strong momentum in the share price and result in part from management's confidence in the business.

However, at least some evidence seems to contradict those findings. Nvidia, for example, the stock leading the AI boom and a close partner of Supermicro, issued a 10-for-1 stock split on June 7. Since then, the stock is up just 1.5%, slightly behind the S&P 500's 3.5%.

Chipotle stock peaked just before its 50-for-1 stock split on June 26 and has since fallen 21%.

Celsius Holdings, the energy drink maker, is down 20% since its 3-for-1 split last November, and Broadcom, the networking chip specialist, is down 3% since its July 15 10-for-1 split, compared to a 0.5% dip for the S&P 500 during that same timeframe.

Clearly, a stock split isn't a guarantee of outperformance even if stock splits have outperformed historically on average.

Should you buy Supermicro before Oct. 1?

Whether you're an AI stock investor or a stock-split investor, the good news is that Supermicro's pullback creates an attractive opportunity to buy the stock as it's down nearly 50% from its peak in March when it was admitted to the S&P 500.

Super Micro Computer now trades at a price-to-earnings ratio (P/E) of 31, which looks like a bargain for a stock that still has a ton of growth potential and expects to see margins expand over the coming years.

Supermicro has a number of competitive advantages that should help it continue to thrive in the AI server market, including a close relationship with Nvidia and expertise with high-density servers. Plus, the company is a leader in direct liquid cooling (DLC), a key technology for optimizing hardware performance. CEO Charles Liang recently said, "We are targeting 25% to 30% of the new global datacenter deployments to use DLC solutions in the next 12 months, with most deployments coming from Super Micro."

The stock split alone isn't a good reason to buy the stock, but with Supermicro's strong growth prospects, attractive valuation, and larger, long-term opportunity in AI, buying before the stock split looks like a brilliant move.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $758,227!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 22, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has positions in Bank of America, Broadcom, and Chipotle Mexican Grill. The Motley Fool has positions in and recommends Bank of America, Celsius, Chipotle Mexican Grill, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Should You Buy Super Micro Computer Before the Stock Split? was originally published by The Motley Fool