Butterfly Equity to buy US wine group The Duckhorn Portfolio

US private-equity firm Butterfly Equity has struck a deal to buy wine group The Duckhorn Portfolio.

Butterfly Equity, which has investments in the food and beverage sectors, said its all-cash bid values the California-based business at $1.95bn.

“This announcement is excellent news for the future of our company and for stockholders of The Duckhorn Portfolio, who will receive a substantial premium,” Deirdre Mahlan, the Sonoma-Cutrer brand owner’s CEO and chairperson, said.

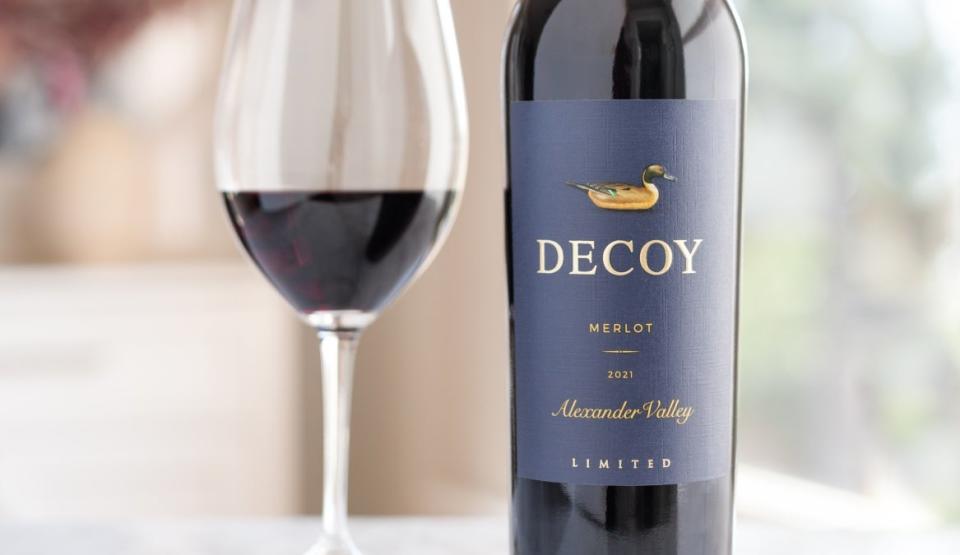

Under the terms of the deal, The Duckhorn Portfolio’s shareholders will receive $11.10 per share in cash. The Decoy wine maker said that represented a “premium” of just over 65% to the volume-weighted average share price of its common stock during the 90-day trading period ending on Friday (4 October).

The Duckhorn Portfolio’s shareholders include Brown-Forman, which acquired just over 21% of the business when the spirits giant sold Sonoma-Cutrer to the company last November.

Just Drinks has approached Brown-Forman for comment.

Mahlan, who joined The Duckhorn Portfolio last year, added: “Butterfly believes strongly in The Duckhorn Portfolio and is fully invested in helping us achieve our next phase of growth.”

Butterfly’s portfolio includes US companies including juices and smoothies maker Generous Brands and avocado products group Chosen Foods.

“As a leading pure-play luxury wine producer, Duckhorn has, in our view, the best portfolio and strongest fundamentals in the industry,” Butterfly partner Vishal Patel said. “We believe the company’s curated suite of luxury wine brands, structurally advantaged business model and world-class team have laid the foundation for a powerful, scalable platform, which will continue to drive growth both organically and through strategic acquisitions.”

Butterfly and The Duckhorn Portfolio expect the deal to be finalised “this winter”.

They said the deal includes a “customary” 45-day period in which The Duckhorn Portfolio can solicit rival offers.

Shareholders representing a majority of the “outstanding voting power of the Duckhorn common stock” have entered into agreements to vote “certain of their shares of company stock” in favour of the deal with Butterfly “subject to certain conditions”.

Alongside the news of the takeover, The Duckhorn Portfolio also filed its annual financial results for the year to the end of July.

The company’s net sales were $405.5m, up 0.7% on a year earlier. However, excluding Sonoma-Cutrer, net sales declined 4.6%.

Net income stood at $56m, versus $69.3m the year previous.

Mahlan said “the successful integration” of the “marquee brand” of Sonoma-Cutrer, “coupled with the continuing execution against our strategic initiatives, positions the business for solid growth and profitability into fiscal 2025 and beyond”.

"Butterfly Equity to buy US wine group The Duckhorn Portfolio" was originally created and published by Just Drinks, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.