BlueCrest, Millennium Pods Faced Quick Closure After Turmoil

(Bloomberg) -- As losses piled up during the market turmoil in early August, a cohort of traders faced that dreaded moment: a tap on the shoulder from their hedge fund bosses signaling it was time to stop.

Most Read from Bloomberg

Dense Cities With Low Emissions Suffer Most From Air Pollution, Study Finds

Intergenerational Housing Could Help Older Adults Combat Loneliness

As Rural Hospitals Shutter Maternity Wards, Urban Ones Follow

At least six traders at multistrategy investment firms Millennium Management, Balyasny Asset Management and BlueCrest Capital Management saw their positions liquidated or teams shut, according to people familiar with the matter. The closures took place as a rapid unwinding of the yen carry trade and jitters over the US economy sent shockwaves across global markets.

Chiga Murayama, a senior portfolio manager specializing in Japanese government bond trading at BlueCrest, saw his pod shut after he suffered losses, the people said. He and team member Yosuke Motegi have since left their roles.

Ryan Fitzgibbon, who traded industrials and energy stocks at Millennium in Houston, left after losses, along with his Asia colleagues Shao Ying and Zachary Corones, who both ran index-rebalancing strategies. Balyasny’s Hong Kong-based trader Mark Cox, who calls himself the “equity guy” on his LinkedIn profile has left too, the people said, asking not to be identified because the details are private.

The departures are part of a ruthless risk-management move that multistrategy hedge funds frequently make to shield themselves from damaging losses and to continue producing the steady returns they are known for. Traders, organized into distinct teams known as pods, often see capital partially withdrawn after a 5% loss and are sacked following a 7% decline.

“The events of August have indeed highlighted how tight risk limits can impact traders, particularly in periods of heightened market volatility,” said Zurich-based Bruno Schneller, managing partner at Erlen Capital Management. “This dynamic can lead to a cascade of stop-outs across multi-manager platforms, exacerbating market stress.”

Such frequent culling and razor-sharp focus on risk controls have helped to make multistrategy hedge funds the best money-making machine in the industry. They have produced an annualized 9% return since 1998, better than the S&P 500 and with much lower volatility, according to PivotalPath.

Despite the turmoil in early August, markets have largely recovered, and many of these funds are on track to turn a profit for the month. Schonfeld Strategic Partners’ fund made about 1% through Aug. 23, LMR Multi-Strategy Fund advanced 0.9%, while Millennium was up about 0.7% during the period, the people added.

Representatives for the investment firms named in the story declined to comment. Murayama, Motegi, Cox and Fitzgibbon didn’t respond to requests for comment.

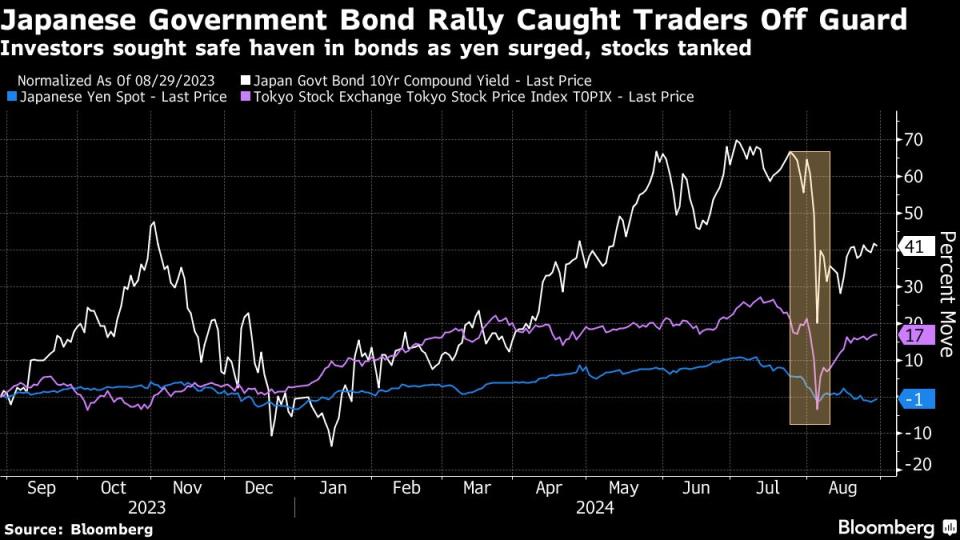

The Bank of Japan raised interest rates for the second time in 17 years on July 31 and indicated more increases were likely to come. The yen continued a sharp rebound against the dollar that began in July, as the unwind of carry trades accelerated. Estimated to run into trillions of dollars, the yen carry trade involves borrowing at low rates in Japan to fund purchases of higher-yielding assets elsewhere.

Japanese stocks lost $1.1 trillion over the first three trading days of August, as the Topix index suffer its biggest collapse since 1959. Panicked investors rushed to the safety of Japanese government bonds. That, together with weak US payroll data and a BOJ policymaker’s assurance that it would not raise rates further in unstable financial markets, smashed the popular hedge fund bets on rising Japanese interest rates. The benchmark 10-year JGB yield slid the most since 1999 as traders sought to cover short positions.

Having previously headed JGB trading at Barclays Plc’s Japan unit and led BNP Paribas SA’s Japan fixed-income trading, Murayama joined BlueCrest in mid-2018, according to his LinkedIn profile. Motegi was a junior portfolio manager working under him, who only joined from Citigroup Inc. in recent months.

Fitzgibbon traded stocks for Millennium under the brand name ATX Capital. Shao and Corones’s trades in index rebalancing — a strategy that seeks to profit from bets on which companies will be added or removed from equity gauges — were hit amid the selloff. Usually, the strategy ends up being long momentum stocks — a bet that they will keep rising — and short value stocks. In July and August, momentum stocks such as those related to artificial intelligence and semiconductors were sold.

It’s not the first time multistrategy hedge fund traders have found themselves on the wrong side of a market selloff.

When yields on government bonds from Australia to the UK and the US abruptly moved in late 2021 amid growing speculation for tighter monetary policy, Balyasny, BlueCrest and ExodusPoint Capital Management each curtailed the betting of two to four traders after they hit maximum loss levels, Bloomberg reported then.

Late last year, ExodusPoint stopped Bhavit Sawjani, a marquee hire and Dubai-based portfolio manager who led a six-member team, from trading following losses of more than $70 million. Earlier this year, Millennium liquidated wagers made by credit trading specialist Jason Feasey after his bets on telecom network Altice caused losses. Feasey left the firm.

--With assistance from Lisa Du.

(Updates with fund returns in eighth paragraph.)

Most Read from Bloomberg Businessweek

Need 100,000 Balloons for a Convention? Here’s the Guy to Call

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

©2024 Bloomberg L.P.