Here’s what to blame for the spike in grocery prices, according to a New York Fed analysis

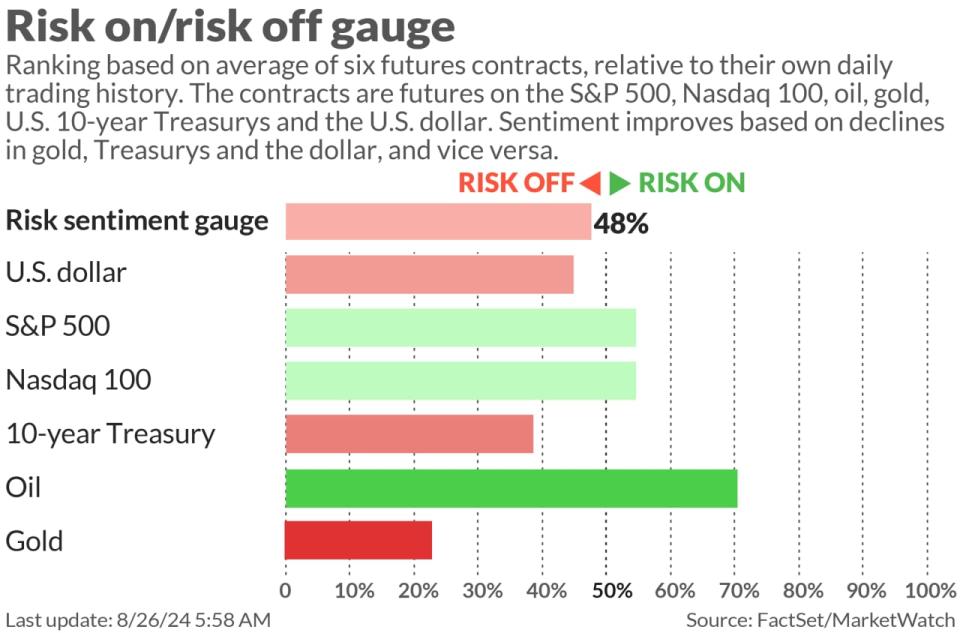

Stocks, bonds, gold and bitcoin — pretty much everything but the U.S. dollar — soared Friday when Fed Chair Jerome Powell not only declared that the time has come for policy to adjust but that further increases in the unemployment rate would be unwelcome. Markets looked set for a calmer session Monday, a period of tranquillity that may run until Nvidia reports its results on Wednesday.

In the meantime, it’s worth looking at food prices, which have become a potent political issue in the presidential campaign. Vice President Kamala Harris outlined a plan, still lacking many concrete details, that would ban corporate price gouging on food and groceries. Part of the food-prices issue also can be seen in an antitrust trial, beginning Monday, over Kroger’s KR planned takeover of rival grocery-store chain Albertson’s ACI.

Most Read from MarketWatch

A New York Fed analysis — written ahead of the Harris proposal — said rising profit margins aren’t really to blame.

The analysis, written by economic research advisor Thomas Klitgaard, did acknowledge that margins have gone up. Citing government data, he said margins at food and beverage retail stores have from 2.9% in 2019 to 4.4% in 2023. But that’s equivalent to roughly $10 billion of a $100 billion increase in revenue, he noted.

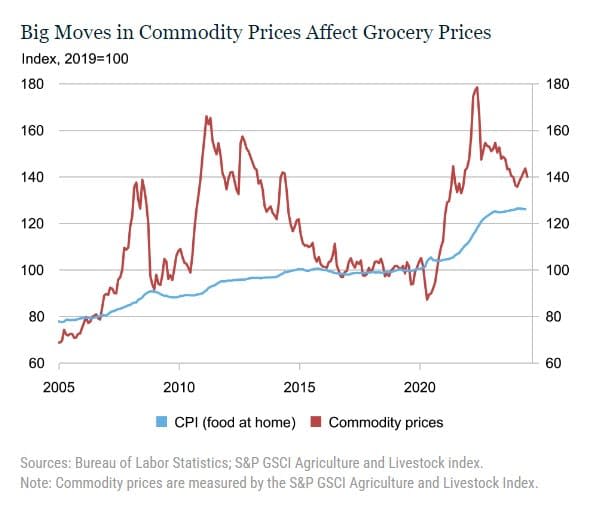

Instead, he laid the blame on two factors. One was the huge spike in agricultural and livestock prices. “Looking at the whole period [from 2005] shows that grocery prices seem to only respond noticeably when commodity prices make big moves, like the jumps in 2008 and 2011 and the collapse in 2015. The rationale is that there are many other input costs dictating food prices so it takes unusual swings in commodity prices to affect grocery prices,” he said.

Klitgaard didn’t examine why commodity prices went up so much, but part of the reason was Russia’s war against Ukraine, which hurt fertilizer supplies as well as wheat supplies.

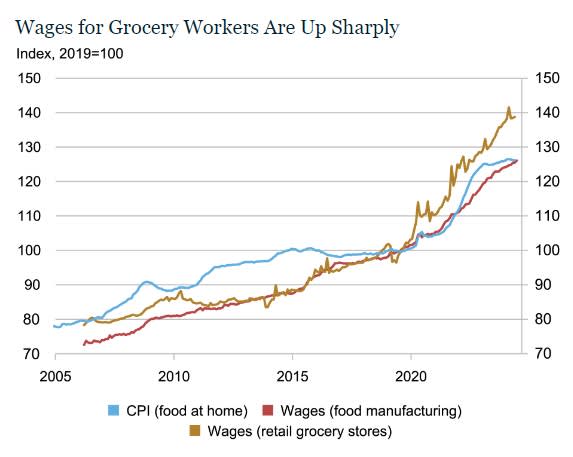

The other factor behind the surge in food prices was the large wage increases for grocery workers. Since 2019, industry wages have risen by 15 percentage points more than those in the food-manufacturing sector, or than the workforce as a whole. These are still low-paying jobs — about $13 an hour less than the private-sector average — but less low-paying than before.

Now food-price inflation is coming down. “This analysis suggests that the significant moderation in food inflation since the start of 2023 is due to still-high wage inflation for grocery workers being offset by the retreat in commodity prices,” Klitgaard said.

The market

U.S. stock futures ES00 NQ00 rose, though they suggest the S&P 500 SPX may not gain the 0.6% needed to finish at a record closing high. The yield on the 10-year Treasury BX:TMUBMUSD10Y slipped 2 basis points to 3.78%. Oil futures CL00 rose after strikes by 100 Israeli jets and hundreds of Hezbollah rockets on Sunday.

Key asset performance | Last | 5d | 1m | YTD | 1y |

S&P 500 | 5634.61 | 1.45% | 3.22% | 18.13% | 27.89% |

Nasdaq Composite | 17,877.79 | 1.40% | 3.00% | 19.10% | 31.54% |

10-year Treasury | 3.793 | -8.30 | -38.60 | -8.79 | -41.09 |

Gold | 2558.9 | 0.64% | 7.45% | 23.51% | 31.36% |

Oil | 75.58 | 2.40% | -0.45% | 5.96% | -5.50% |

Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

NASA tapped SpaceX rather than Boeing’s BA Starliner to return two astronauts to Earth.

Intel INTC is reportedly working with Morgan Stanley to defend itself from activist investors, CNBC reported.

PDD Holdings PDD stock tumbled as the Temu owner reported revenue below analyst expectations.

Uber Technologies UBER was fined 290 million euros ($324 million) over the transfer of European driver information data to the U.S.

IBM IBM is reportedly shutting its China research-and-development department, the Wall Street Journal reported.

Durable-goods orders shot up 9.9% in July, though they fell 0.2% excluding the volatile transportation category.

Best of the web

Jamie Dimon has now been floated for a Treasury role by both parties.

Why Nippon Steel’s $15 billion takeover of U.S. Steel is in peril.

France extends detention of Telegram CEO Pavel Durov.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

Ticker | Security name |

NVDA | Nvidia Corp. |

TSLA | Tesla Inc. |

HOLO | MicroCloud Hologram Inc. |

GME | GameStop Corp. |

AAPL | Apple Inc. |

TSM | Taiwan Semiconductor Manufacturing Co. Ltd. |

NIO | Nio Inc. |

AMD | Advanced Micro Devices Inc. |

AMC | AMC Entertainment Holdings Inc. |

PLTR | Palantir Technologies Inc. |

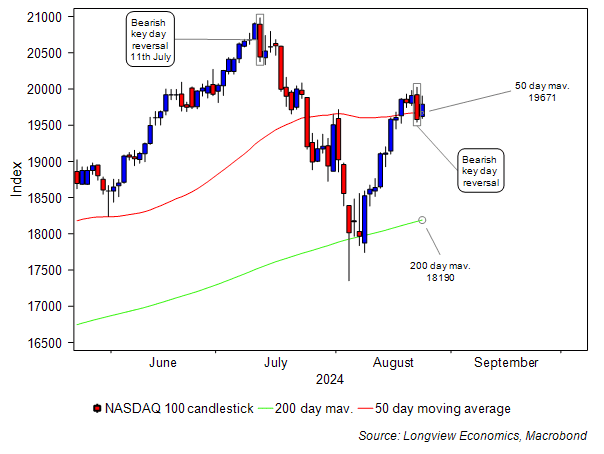

The chart

A bearish key day reversal in the Nasdaq 100 was not negated by Friday’s rally, according to an analysis from Longview Economics. The Philadelphia Semiconductor Index SOX also remains technically engulfed by Thursday’s price action, they said. Longview still advised shorting Nasdaq 100 futures NQ00.

Random reads

Hong Kong’s sex ed advice: play badminton.

Adults are getting into the lemonade-stand business.

Matching dinosaur footprints were found on opposite sides of the Atlantic.