BlackRock Reshapes Two Muni Bond Funds for ETF Market

BlackRock Inc., the world’s largest asset manager, is converting a municipal bond mutual fund into an ETF and revamping another, following a trend among issuers seeking to capitalize on growing demand for exchange-traded funds.

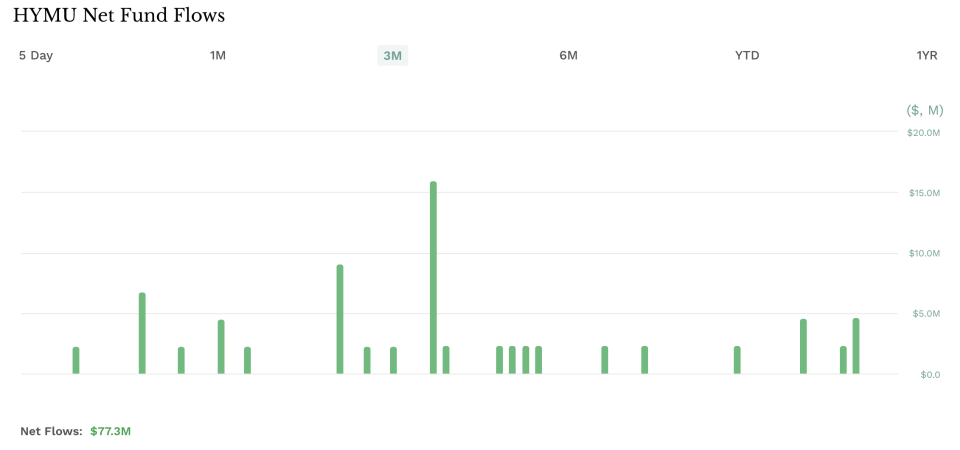

The New York-based firm plans to convert its $1.7 billion BlackRock High Yield Municipal Fund into an ETF and revamp its existing $195.84 million BlackRock High Yield Muni Income Bond ETF (HYMU) into an iShares-branded product. The mutual fund conversion, set to close on Feb. 7, will result in the creation of the iShares High Yield Muni Active ETF, according to a filing with the Securities and Exchange Commission.

ETFs are snatching an ever-increasing market share from mutual funds—so far this year ETFs raked in $588.1 billion and mutual funds bled $217 billion, Morningstar said recently. To accommodate demand issuers have converted dozens of mutual funds to ETFs since the first transition from Guinness Atkinson in March 2021, and Bloomberg ETF analyst Eric Balchunas has said that $1 trillion worth of mutual funds may convert to ETFs, which are easier to trade, by 2033.

ETF industry analyst CFRA estimates that 85 funds with current assets of $139 billion have converted to ETFs.

"We estimate this number to keep growing unless the SEC approves the creation of ETF share classes for mutual funds, which does not appear imminent," CFRA head of ETF data and analytics Aniket Ullal said in an emailed comment.

BlackRock ETF Expansion

Shareholders must hold their mutual fund shares through a brokerage account capable of accepting ETF shares to receive the new iShares High Yield Muni Active ETF as part of the reorganization, New York-based BlackRock said.

“These actions expand and complement BlackRock’s active ETF offering, providing more choice and flexibility to our clients seeking high-yield, tax-exempt solutions,” a BlackRock spokesperson said in a statement. “Active ETFs are becoming an integral part of investor portfolios around the world, with financial advisors increasingly incorporating them into their models-based practice."

To facilitate the mutual fund conversion, BlackRock is implementing several changes, including limiting new purchases of certain fund shares and removing sales charges on purchases and redemptions of fund shares.

BlackRock is also renaming its existing BlackRock High Yield Muni Income Bond ETF (HYMU) to the iShares Short Duration High Yield Muni Active ETF, effective June 30, 2025, as per another SEC filing.

The revamped HYMU will maintain a weighted average effective duration of less than 5 years under normal market conditions, with the possibility of extending to 6 years in certain circumstances.

The fund's management fee will be reduced from 0.45% to 0.4%, with BlackRock contractually agreeing to waive a portion of its management fees to 0.35 through June 30, 2026.

Despite the move towards ETFs, the spokesperson emphasized that mutual funds still have a place in their offerings. “We continue to see use cases for mutual funds and view ETFs and other investment vehicles as complementary as they often serve different client segments,” the spokesperson said.

ETFs Gain Popularity

BlackRock’s move comes as ETFs continue to gain popularity among investors. The U.S. ETF industry assets reached a record $9.7 trillion in August, with net inflows of $66.3 billion that month, according data from ETFGI.

The firm’s iShares unit is already the world’s biggest ETF issuer. With 438 ETFs traded on U.S. markets, BlackRock ETFs have total assets under management of $3.04 trillion, according to etf.com data.

BlackRock’s largest ETF, the $521 billion iShares Core S&P 500 ETF (IVV), is poised to surpass the longtime asset leader, the SPDR S&P 500 ETF Trust (SPY), over the next year.

Read More: VOO, IVV Gain Ground on SPY in S&P 500 ETF Race