Billionaires Are Selling Meta and Buying This Stock Instead

Billionaire stock transactions can be valuable data for investors. You shouldn't expect to uncover any enormous secrets that reveal infallible strategies shared universally among the ultra-wealthy. However, you can gain important insights about the factors that are influencing sophisticated investors based on the stocks that are being purchased or sold most heavily by hedge funds and billionaires.

Billionaires are taking their gains on Meta

There's been a flurry of recent hedge-fund selling activity for Meta Platforms (NASDAQ: META). Numerous billionaires and high-profile funds, including Steven Cohen, Andreas Halvorsen, Lee Ainslie, Ken Griffin, Jonathan Soros, and David Tepper, have all unloaded a large volume of shares in recent months.

Meta's recent first-quarter earnings report was strong but mostly in line with analyst expectations. The company achieved 27% revenue growth and more than doubled its quarterly profits over the prior year.

Meta reported higher user volume, more advertisement interactions, and more revenue per advertisement. That's a comprehensive set of improvements across its various revenue-driving components.

Meta shares dropped steeply following the earnings report, despite the strong headline figures. The company's second-quarter outlook fell roughly 1.5% below consensus analyst expectations, and it also revised its full-year operating expense forecasts higher. Meta's sales guidance implies 18% annual growth next quarter, which marks a significant slowdown from the most recent results.

It's odd to see such a big sell-off following quarterly earnings that were overall positive or neutral. Meta did phenomenal work to stimulate growth while slashing costs in recent years. Those sorts of improvements are impossible to replicate year after year, but building incrementally on last year's improvements wasn't good enough for many investors.

This is evidence of unsustainably aggressive expectations and a "what have you done for me lately?" attitude from many shareholders. Meta's strong operational results and big returns have attracted a crowd of traders and short-term investors who piled in on the momentum. That's a recipe for volatility, as we saw after the last earnings report.

It's important to note that many of Meta's sellers still maintain large positions and that multiple billionaires and hedge funds have increased their Meta positions lately. Just recognize that the activity is skewed toward selling and reduced positions.

That's likely motivating many long-term investors to reassess their situations. Meta has returned 322% since the start of 2023, crushing the Nasdaq Composite's impressive 73% return over the same period.

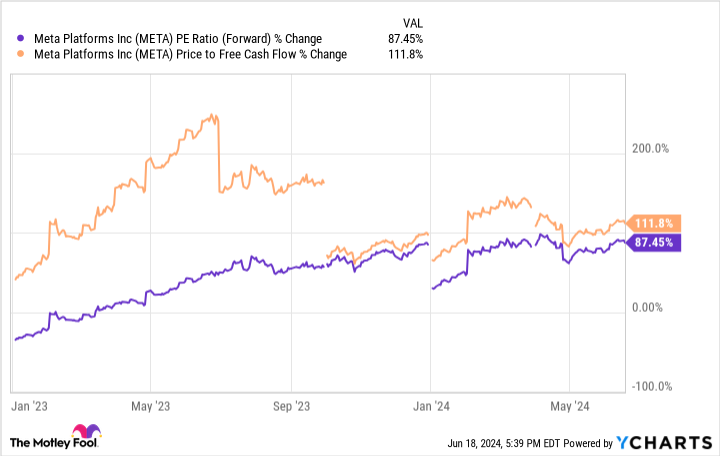

That's led to rapid inflation in the stock's important valuation ratios. Meta's forward price-to-earnings ratio (P/E) and price-to-free-cash flow ratio have roughly doubled year to date, climbing above 25. Neither is particularly expensive relative to the company's growth outlook, but the stock is no longer the glaring value buy it was last year.

META PE Ratio (Forward) data by YCharts.

Volatility is up, analyst expectations are more difficult to meet, growth is slowing, the stock is more expensive, and there's less low-hanging fruit to drive operational improvements. It's not hard to see why some billionaires took this opportunity to lock in their significant gains over the past year and redeploy capital elsewhere.

Apple is getting more attention

It seems that billionaires and hedge funds haven't tired of the "Magnificent Seven" quite yet, with one of Meta's peers attracting attention. Apple (NASDAQ: AAPL) has been a landing spot for some high-profile investors. Stanley Druckenmiller and Andreas Halvorsen opened large new positions, while Yan Huo, Paul Tudor Jones, Ray Dalio, Steven Schonfield, David Shaw, and Ken Griffin added significantly to their existing stakes.

Apple reported a 4% decline in revenue in its most recent quarterly financial report, with noteworthy weakness in the Chinese market and a discouraging outlook for iPhone sales. However, it posted its highest all-time earnings per share (EPS) and beat Wall Street's forecasts for sales and profits.

Like many of its tech peers, Apple has cut operating expenses without hampering sales performance. It's also achieving record service revenues, which are recurring and have higher profit margins than device sales. That's important for predictable cash-flow generation.

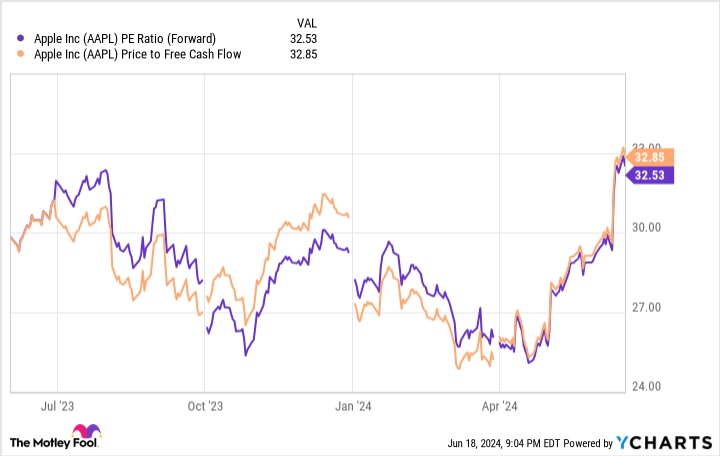

Until May, Apple's recent performance in the stock market was less impressive. Shares fell roughly 10% from the start of 2023 through April 2024. Its forward P/E ratio and price-to-free-cash-flow ratio bottomed at approximately 25 earlier this year.

AAPL P/E Ratio (Forward) data by YCharts.

Apple's most recent financial data wasn't particularly encouraging, compared to Meta's, but there's a clear trend in the assessments by billionaire investors. Meta's rising valuation ratios met Apple's falling ratios, then the two stocks promptly switched courses. The timing of that reversal coincides with noteworthy hedge fund transaction activity.

META PE Ratio (Forward) data by YCharts.

Billionaire investors don't always get it right. However, hedge fund managers and ultra-high-net-worth people have access to resources and information that are often unavailable to the general public.

Transaction data suggests that sophisticated investors were assessing valuation and outlook, leading many to sell Meta and buy Apple. Don't just follow these moves blindly -- make sure that you consider the logic behind the trends.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $772,627!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Meta Platforms. The Motley Fool has a disclosure policy.

Billionaires Are Selling Meta and Buying This Stock Instead was originally published by The Motley Fool