Big Tech, Health-Care and High-Yield Stocks Are Dip-Buying Targets

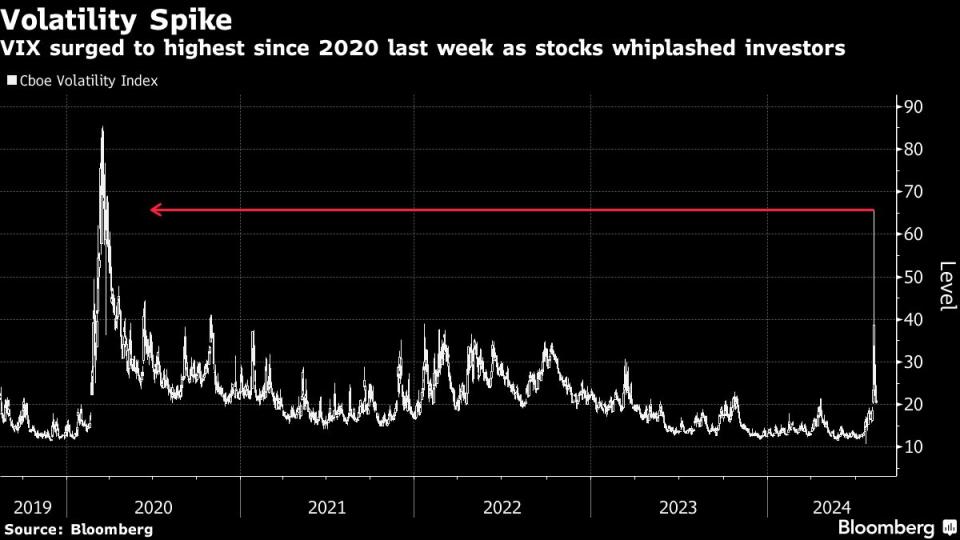

(Bloomberg) -- A dizzying start to August, which saw US stocks whiplashed by economic jitters, lackluster earnings and the unwinding of the global yen carry trade, has left Wall Street searching for corners of the market that may have been unfairly punished.

Most Read from Bloomberg

How a Tiny Midwestern Town Became a Mecca for Modern Architecture

How Chicago’s Gigantic Merchandise Mart Is Still Thriving as Office Space

Los Angeles Sees Remote Work Helping ‘No Car’ 2028 Olympic Games

Gottheimer Calls for Rail Riders to Be Reimbursed for Delays

In DNC, Chicago’s Embattled Transit System Faces a High-Profile Test

Despite clawing back nearly all its losses from a 3% drop to begin last week, the S&P 500 remains about 6% off its record after four consecutive weeks of declines. With volatility poised to persist amid concerns over the macroeconomic and geopolitical backdrop, analysts are encouraging investors to position defensively and take advantage of opportunities to pick up still-beaten down parts of the market.

“I don’t think it’s ever a bad idea when markets pull back to do a little rebalancing in a portfolio, take advantage of some of the drops,” said Rob Conzo, chief executive and managing director at The Wealth Alliance LLC.

Of course, there’s risk involved with trying to trade in an erratic market — stocks could take another leg lower, leading to future discounts, or rocket higher quickly, taking away the opportunity. For long-term investors, trading around volatility probably doesn’t make sense, according to Quincy Krosby, chief global strategist at LPL Financial LLC.

“If you have a portfolio that is poised for long-term growth, you can stay with it and ride out the volatility,” she said.

Here’s where market watchers see opportunities in stocks:

Semiconductors

Semiconductors are looking attractive after being hammered in recent weeks, according to analysts at Citigroup Inc.

The Philadelphia Semiconductor Index has shed roughly 20% from a July peak. The industry benchmark was weighed down by macroeconomic pressures, high earnings expectations and downside risk from the auto end market.

“We remain bullish on the space as the main reasons we are positive – AI and memory strength – remain intact,” analysts led by Christopher Danely wrote in a note Thursday.

Micron Technology Inc. is Citi’s top pick. Other Citi buy-rated names in the space include Advanced Micro Devices Inc., Broadcom Inc., Analog Devices Inc., Microchip Technology Inc., Nvidia Corp. and KLA Corp.

Health Care

The health-care sector is generally seen as defensive, making it a place that investors rotate into when other parts of the market look overbought. In the last month, the S&P 500 Health Care Index is up about 3%, outperforming the broader market, which has dropped more than 4%.

“I don’t think it’s over yet,” said David Harden, chief investment officer of Summit Global Investments, of the movement into health-care stocks.

Harden also sees an upside growth story in the sector around weight-loss drugs. An example is Eli Lilly & Co., whose shares had taken a sharp leg down in the selloff. The stock surged on Thursday after the company reported earnings that beat estimates and raised its 2024 revenue forecast on sales of its obesity medicine.

“That rally’s not over yet,” said Harden, who holds Lilly shares, adding that there’s “a clear runway and a lot of energy pent up.”

Big Tech

The technology sector and the so-called Magnificent Seven megacaps have been hit hard in recent weeks. A Bloomberg index tracking the group is down about 15% from a July peak.

The rout has also reined in price-to-earnings ratios for the group, which had gotten too expensive for some investors. It now trades at about 28 times projected earnings for the next 12 months, below its five-year average of 30.

“If you were underweight, this is a good opportunity to start adding,” Rhys Williams, chief strategist at Wayve Capital Management LLC, said.

Yield-sensitive stocks

Worries about the macroeconomic backdrop often make stocks sensitive to interest rates, likes utilities, REITs and dividend payers, more attractive to investors.

Currently, the S&P 500 Utilities Index yields a little over 3%. The benchmark is up about 16% so far this year, outperforming the broader market. And the real estate sector may be next.

“Real estate could be kind of a horse that surprises people to the upside as we go down the stretch and into 2025 because the Fed is signaling they’re going to cut rates, mortgage rates have already come down,” said Joe Quinlan, head of CIO Market Strategy for Merrill and Bank of America Private Bank.

In volatile markets, it also makes sense to hold — or pick up — dividend paying stocks to help balance out choppy trading.

“High-yielding dividend provides that balance within the equity component of your portfolio,” said Quinlan. In uncertain economic times, “if you’ve got the steady income from a dividend cohort, you can sleep better at night.”

Most Read from Bloomberg Businessweek

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

The Fake Indian Cricket League Created for Real Online Betting

©2024 Bloomberg L.P.