BHP Resumes Talks With Striking Workers at Top Copper Mine

(Bloomberg) -- BHP Group resumed wage talks with union leaders in Chile in a bid to end a strike that began earlier Tuesday at the world’s biggest copper mine, according to people briefed on the matter.

Most Read from Bloomberg

In DNC, Chicago’s Embattled Transit System Faces a High-Profile Test

How Chicago’s Gigantic Merchandise Mart Is Still Thriving as Office Space

Gottheimer Calls for Rail Riders to Be Reimbursed for Delays

The main union at Escondida agreed to the firm’s request to revisit sticking points that had prevented a deal during mandatory talks ended Monday, said the people, who aren’t authorized to speak publicly. The session is scheduled to run until 8 p.m. Chile time.

BHP and the union both declined to comment.

If the two sides manage to reach a deal and get it approved by workers, it would allow the resumption of normal operations at a mine that accounts for about 5% of the world’s mined copper. The disruptions at Escondida are playing out at a time of global tightness of copper concentrate — the raw material used to feed smelters.

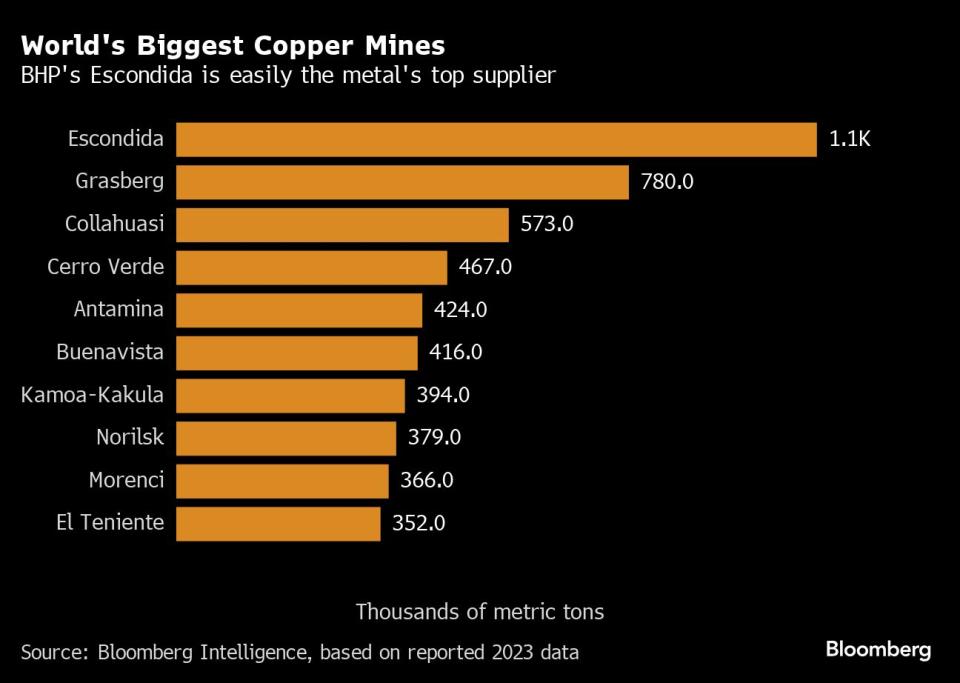

Escondida churns out more than 1 million metric tons a year, making it by far the biggest supplier of copper. Some analysts see BHP Group overtaking Codelco this year as the top global copper producer.

The union’s 2,400 members downed tools Tuesday morning after rejecting BHP’s latest proposal as part of a collective bargaining. Any breakthrough in talks would make for an unusually short strike. Escondida has been the scene of lengthy stoppages in the past, including a 44-day strike in 2017.

Benchmark copper traded in London surged to record levels in May as bullish investors placed bets on shortages. That emboldened unions seeking a share of the windfall for their members. But prices have since pulled back by roughly 18%, undermining some of that leverage as companies look to avoid big increases in fixed costs in a cyclical and capital-intensive business.

The market should be able to absorb a short strike, with demand looking “a little slack,” said Bloomberg Intelligence analyst Grant Sporre. “Anything more than a few weeks might start worrying the Chinese smelters who are already struggling with tightness in the concentrate market, with profitability under pressure.”

Copper futures fell 0.8% on the London Metal Exchange on Tuesday.

(Adds background)

Most Read from Bloomberg Businessweek

Inside Worldcoin’s Orb Factory, Audacious and Absurd Defender of Humanity

New Breed of EV Promises 700 Miles per Charge (Just Add Gas)

There’s a Gender Split in How US College Grads Are Tackling a More Difficult Job Market

©2024 Bloomberg L.P.