Better Stock Right Now: Chipotle Mexican Grill vs. Starbucks

Chipotle Mexican Grill (NYSE: CMG) and Starbucks (NASDAQ: SBUX) are two of the most successful restaurant chains ever. Their stocks have both delivered incredible value for shareholders over many years, but the companies are in very different places today.

The case for Chipotle: resilience

Ever since CEO Brian Niccol took the reins in 2018, Chipotle has been on a nonstop ride higher. That's higher sales, profits, and stock prices. It has weathered the same economic conditions that have hurt many other restaurants, and has demonstrated resilience time and time again.

The fast-casual restaurant chain has a hard-to-replicate model that targets more affluent clientele with moderately priced fare. Customers love its fresh and healthy food, and it innovates consistently with new menu items to stay relevant.

In the first quarter, its revenue increased 14% year over year, driven by a 7% increase in comparable-restaurant sales (comps), and earnings per share (EPS) rose from $10.50 in the prior-year period to $13.01.

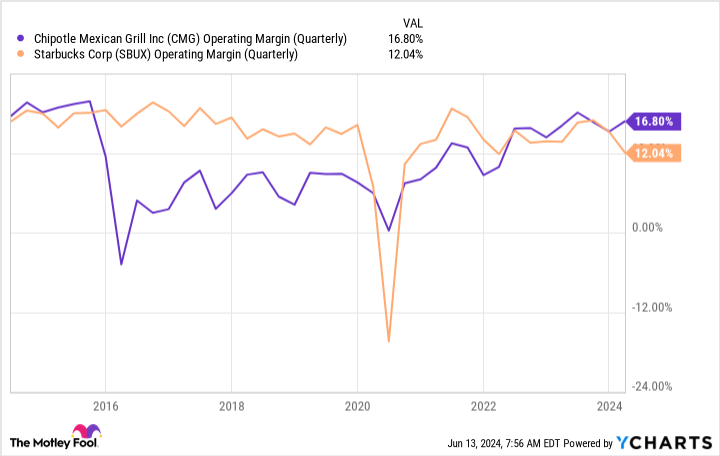

These are typical quarterly results for the chain, and they're an impressive showing in this economic environment. What's more, it has been expanding its margins despite the pressure of inflation, outperforming Starbucks and most of its competition.

It might seem like Chipotle has reached a peak. It operates 3,500 restaurants and has saturated its opportunity in many urban U.S. areas.

But Niccol believes it can still double its store count just in the U.S., and it is building out its presence in suburban areas across the country. The company has a handful of restaurants in Europe, but that is a largely untapped market for it. And it recently opened its first restaurant in the Middle East through its first franchise partnership.

Chipotle has a winning business model and plenty of opportunities for growth, and its stock should reward investors for the foreseeable future.

The case for Starbucks: value

Starbucks was a market-beating stock for years, although it's having a difficult time navigating the current macroeconomic environment. It's down 19% this year, but that could be an opportunity for investors to buy a top stock at a great price.

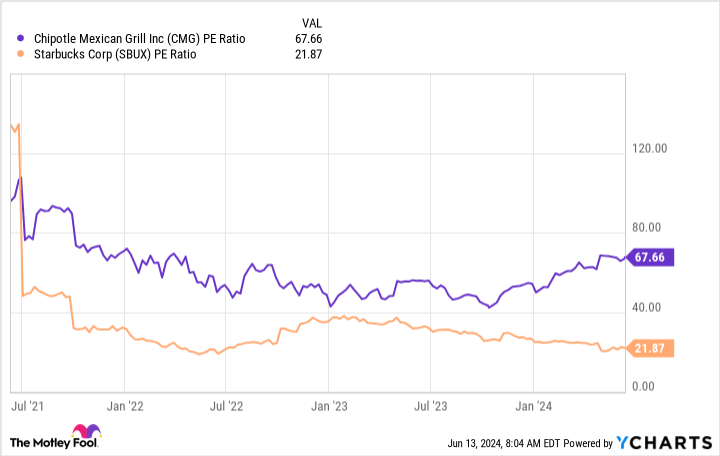

Just as Chipotle has gone through some rough times in the past, Starbucks is in the midst of a difficult period now, but could emerge from it and thrive. Shareholders who hang on and focus on the long term could end up reaping huge rewards. Its stock currently trades at a price-to-earnings (P/E) ratio of around 22, versus about 68 for Chipotle.

Chipotle's high valuation might be justified, but Starbucks stock could be too good a deal to pass up at this price.

Starbucks' revenue was down 2% year over year in its fiscal 2024 second quarter (which ended March 31), with a 4% decrease in comps. That was a rare contraction for Starbucks, which is usually reliable for growth. EPS was down 14% in the quarter to $0.68.

There are multiple factors affecting results right now. Its beverages are more expensive than the competition's, and many people are responding to the lingering impacts of inflation by shifting to lower-price options.

It's notable that the company had a 2% increase in the average ticket price in the first quarter, while the number of transactions slid by 7%. That shows that loyal customers are still willing to pay up for their favorite coffee. In fact, the number of active members in its loyalty program rose 6% year over year to 32.8 million.

Some stores have also had trouble meeting demand in a timely manner during peak coffee-ordering hours, which helps explain why a mid-teens percentage of orders begun on its mobile app were abandoned without being completed last quarter. The silver lining here is that demand is strong. Starbucks is making some fundamental changes to maintain that demand and do a better job of meeting it.

This strategy includes many parts, like installing new equipment and opening more locations that only accept digital orders. It still sees the opportunity to open thousands of new stores globally.

Which is the better buy today?

The "better buy" title between these two might have to go to Starbucks; its share price is depressed, and there's good reason to believe it can rebound and thrive. It also pays a growing dividend that yields 2.8% at the current price. If you're a value investor, Starbucks is your stock.

But if I had to choose a stock today, it would be Chipotle, and not because it's getting ready for a 50-for-1 stock split at the end of the month. It has a reliable growth model and is less risky right now. Its premium valuation might limit its upside potential for the short term, or it might not. Over the long term, though, it should continue to be a market-beating stock.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool has a disclosure policy.

Better Stock Right Now: Chipotle Mexican Grill vs. Starbucks was originally published by The Motley Fool