Best Value Stocks to Buy for June 11th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, June 11th:

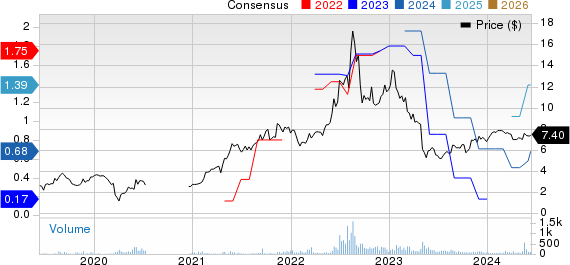

Harte Hanks HHS: This data-driven, omnichannel marketing company which offer customer data landscape as well as the executional know-how in database build and management, data analytics, data-driven creativity, digital media, direct mail, customer contact, client fulfilment and marketing and product logistics, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 33.3% over the last 60 days.

Harte Hanks, Inc. Price and Consensus

Harte Hanks, Inc. price-consensus-chart | Harte Hanks, Inc. Quote

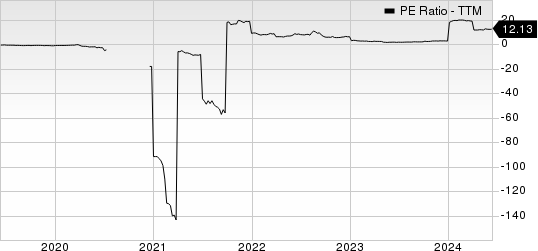

Harte Hanks has a price-to-earnings ratio (P/E) of 10.88 compared with 17.90 for the industry. The company possesses a Value Score of A.

Harte Hanks, Inc. PE Ratio (TTM)

Harte Hanks, Inc. pe-ratio-ttm | Harte Hanks, Inc. Quote

Navios Maritime PartnersNMM: This company which is an international owner and operator of dry cargo vessels, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.3% over the last 60 days.

Navios Maritime Partners LP Price and Consensus

Navios Maritime Partners LP price-consensus-chart | Navios Maritime Partners LP Quote

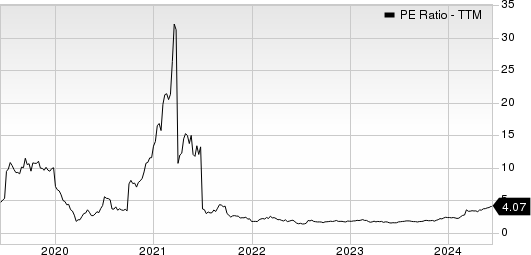

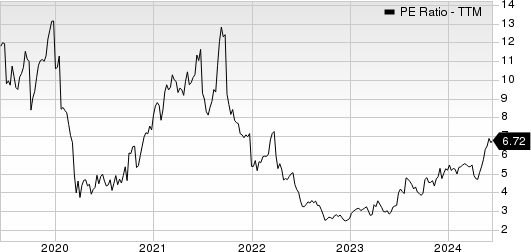

Navios Maritime Partners has a price-to-earnings ratio (P/E) of 3.38 compared with 8.60 for industry. The company possesses a Value Score of A.

Navios Maritime Partners LP PE Ratio (TTM)

Navios Maritime Partners LP pe-ratio-ttm | Navios Maritime Partners LP Quote

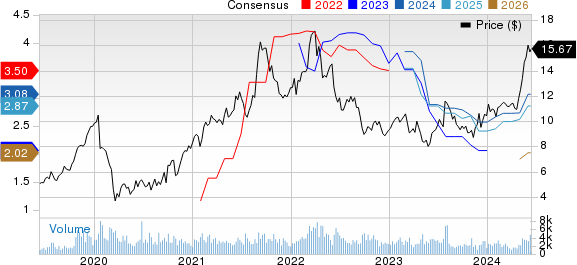

Costamare CMRE: This company which operates as a containership owner chartering its vessels to liner companies, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12% over the last 60 days.

Costamare Inc. Price and Consensus

Costamare Inc. price-consensus-chart | Costamare Inc. Quote

Costamare has a price-to-earnings ratio (P/E) of 5.10 compared with 8.60 for industry. The company possesses a Value Score of A.

Costamare Inc. PE Ratio (TTM)

Costamare Inc. pe-ratio-ttm | Costamare Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harte Hanks, Inc. (HHS) : Free Stock Analysis Report

Costamare Inc. (CMRE) : Free Stock Analysis Report

Navios Maritime Partners LP (NMM) : Free Stock Analysis Report