Bank of Nova Scotia's Strategic Reduction in Manulife Financial Corp Holdings

On December 29, 2023, Bank of Nova Scotia executed a significant transaction involving its holdings in Manulife Financial Corp (NYSE:MFC), marking a strategic adjustment in its investment portfolio. The firm reduced its position by 1,189,026 shares, which resulted in a 4.96% decrease in its holdings, impacting the portfolio by -0.07%. This move adjusted Bank of Nova Scotia's total shares in Manulife to 22,763,139, representing a 1.35% position in its portfolio and a 1.26% stake in the company.

Profile of Bank of Nova Scotia

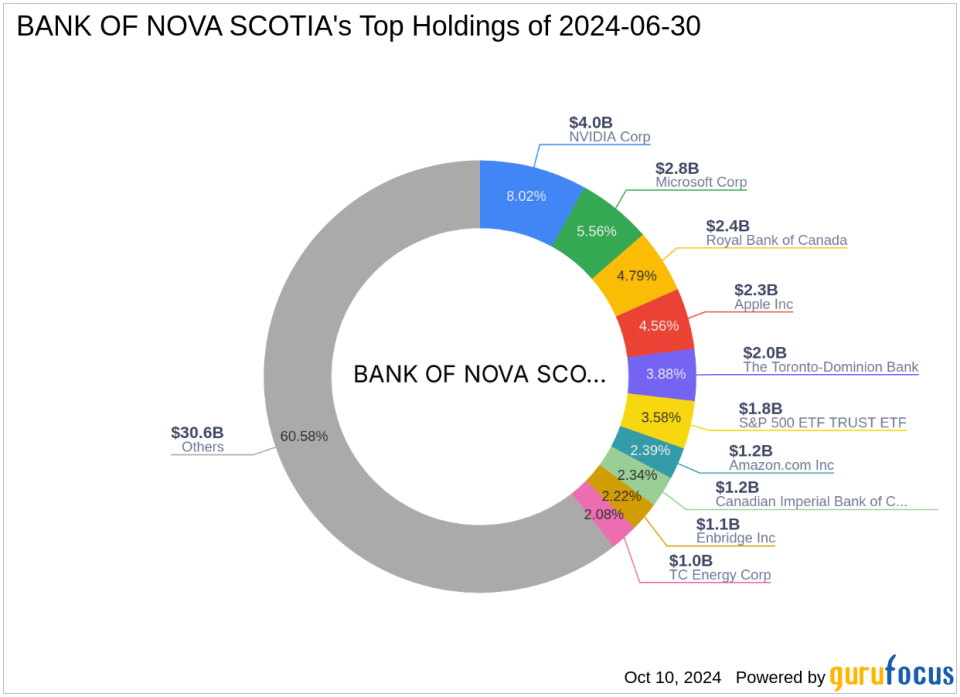

Bank of Nova Scotia, headquartered at 44 King Street West, Toronto, is a prominent financial institution known for its robust investment strategies. With a diverse portfolio of 982 stocks and top holdings in major corporations like Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT), the firm manages an equity portfolio valued at approximately $50.51 billion. The firm's investment philosophy emphasizes strategic diversification, focusing heavily on the technology and financial services sectors.

Understanding Manulife Financial Corp

Manulife Financial Corp, based in Canada, is a leading provider of life insurance and asset management products across North America and Asia. As of the end of 2023, the company manages approximately CAD 1.05 trillion in assets, with significant contributions from its global wealth and asset management businesses. Manulife's diversified operations help mitigate risks and capitalize on growth opportunities in various international markets.

Financial Metrics and Stock Performance of MFC

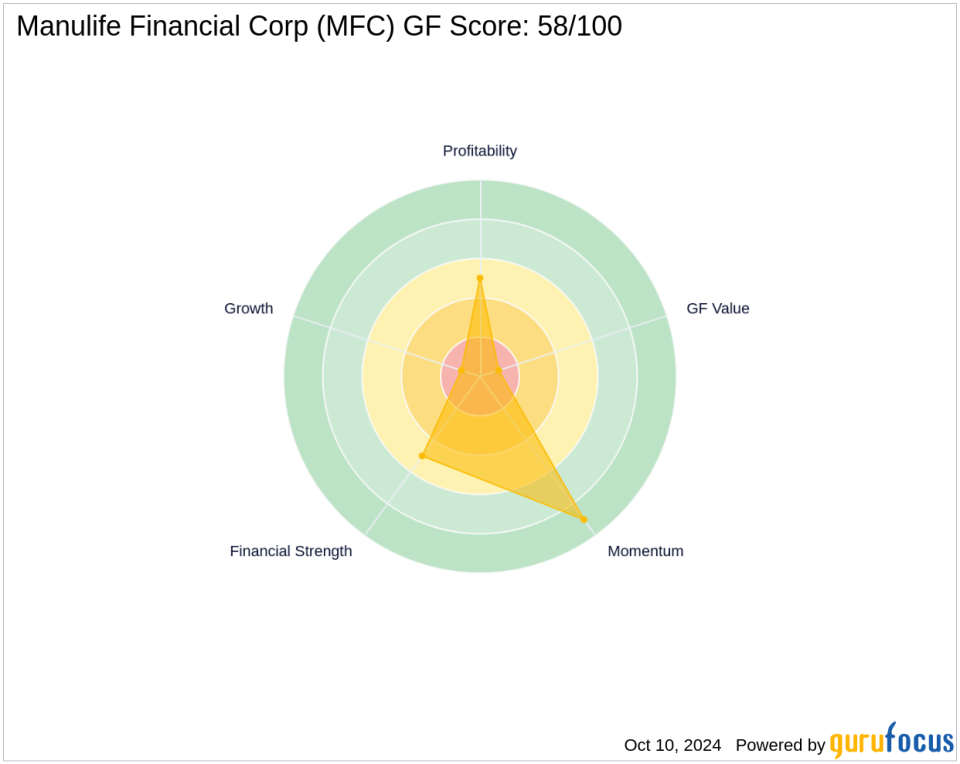

Currently, Manulife's stock is priced at $29.99, slightly above its GF Value of $28.18, indicating it is fairly valued. The stock has shown a robust gain of 35.7% since the transaction date and a significant year-to-date increase of 37.38%. With a PE ratio of 17.35, the company maintains a solid position in the market, underscored by a GF Score of 58/100, suggesting moderate future performance potential.

Impact of the Trade on Bank of Nova Scotia's Portfolio

The recent transaction reflects a minor yet strategic reduction in Bank of Nova Scotia's exposure to Manulife, aligning with its broader portfolio management objectives. Despite the reduction, Manulife remains a significant holding, illustrating the firm's continued confidence in the insurer's long-term value.

Market and Sector Analysis

The insurance industry, where Manulife operates, is currently experiencing a phase of growth and transformation, influenced by technological advancements and changing consumer preferences. Bank of Nova Scotia's sustained investment in this sector indicates a bullish outlook on these trends.

Comparative Insight

Comparatively, Gotham Asset Management, LLC holds a substantial position in Manulife, suggesting differing investment strategies among top investors. These strategic variances highlight the diverse approaches to portfolio management in the financial sector.

Future Outlook and Implications

The adjustment in Bank of Nova Scotia's holdings in Manulife Financial Corp could be indicative of a strategic shift or a realignment of its investment portfolio. Looking forward, the firm's investment strategy will likely continue to adapt to market conditions and the evolving landscape of the financial services industry.

This analysis not only sheds light on the specifics of the transaction but also provides insights into the strategic movements within Bank of Nova Scotia's portfolio, offering valuable information for investors and market watchers alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.