Israel Central Bank Says Cuts Only Likely Next Year as War Rages

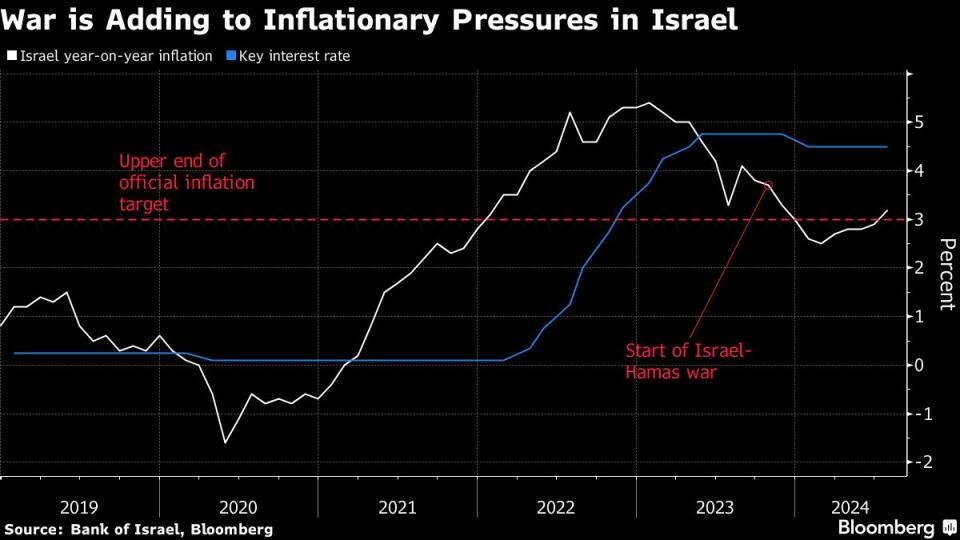

(Bloomberg) -- Israel’s central bank kept its benchmark interest rate at 4.5% on Wednesday, and said it’s likely to refrain from cuts for the rest of the year as the war in Gaza continues.

The bank’s deputy governor, Andrew Abir, said the fifth consecutive hold and similar plans for the last two meetings of the year are a result of the conflict, which started in October and has caused government spending to soar, contributing to an acceleration in inflation. At the same time, the economy is weakening.

“I would be very surprised if the conditions are in place for an interest rate cut before the end of the year,” he said in an interview after the Bank of Israel’s decision to hold. “The surprise has been how long the war has been going on. This has slowed growth but has also had an impact on inflation, and it’s one of the reasons it is now once again out of our target range.”

The annual inflation rate has climbed to 3.2%, above the top end of the official target range of 1% to 3%.

Abir said market analysts see inflation quickening to 3.5% by January. “In my estimate, it will take until the end of next year before it comes back into the target,” he said.

In a statement accompanying Wednesday’s decision, policymakers noted the economic fallout from the conflict.

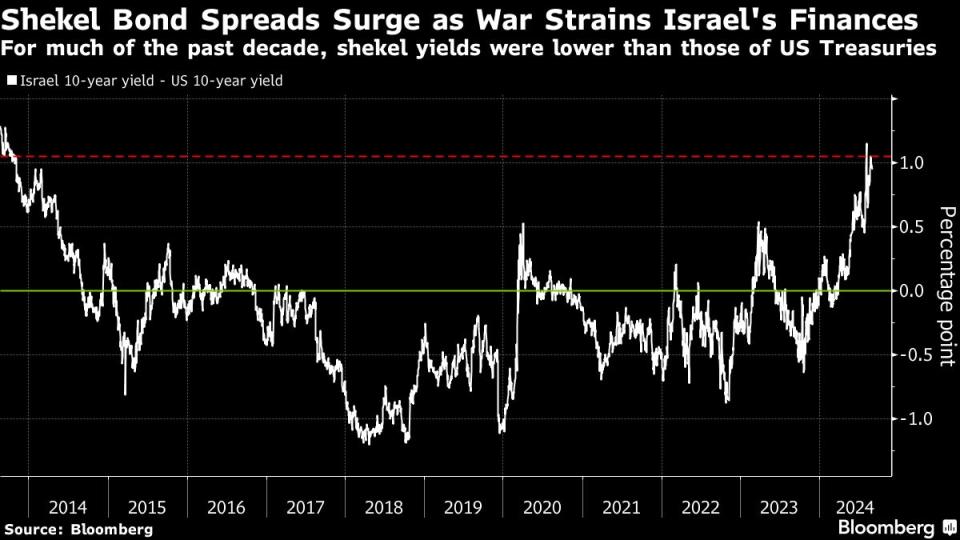

“Since the outbreak of the war, and in recent months in particular, geopolitical uncertainty and its economic ramifications have increased,” they said. “Alongside fiscal uncertainty, they are reflected in the high yield spreads between Israeli government bonds and US bonds.”

Shekel bond yields now trade at an 11-year high relative to the US Treasuries, according to data compiled by Bloomberg.

Governor Amir Yaron has been particularly concerned about fiscal policy in recent weeks, calling for budgetary cuts totaling some 30 billion shekels ($8 billion) to balance increased defense expenditures. He’s also wary of Israel’s rising debt levels. Debt to gross domestic product will climb to 67.5% this year, up from around 59% in 2022, according to the central bank.

Prime Minister Benjamin Netanyahu and Finance Minister Bezalel Smotrich have delayed discussions on the 2025 budget, set to be the most challenging in decades, despite the process usually being well underway by this time of year. That’s adding to the central bank’s concerns.

“The government should start to really take seriously the task of getting the fiscal situation under control,” Abir said. “Markets will punish with a high-risk premium if they don’t see a clear path to bringing the budget deficit and debt-to-GDP ratio down. The bar for people investing in Israel will be higher and the longer the conflict goes on, the more of an impact that will have.”

Under Israeli law, the central bank governor is the government’s top economic advisor.

Israel’s 12-month trailing deficit rose to 8.1% as of July, with the central bank anticipating a year-end figure of 6.6% — if there are no unexpected additions to the defense budget.

On Wednesday, the central bank underlined the link between fiscal uncertainty and inflation. It said the lack of spending cuts required to reduce the deficit “contributes to an increase in the risk premium and is liable to weigh on the return of inflation to its target.”

Economic Slowdown

The economy grew by 2% last year, almost half the rate the finance ministry expected prior to the outbreak of the war. The bank said weaker growth is mainly caused by supply-side limitations, primarily a shortage of workers.

Restrictions on West Bank Palestinians traveling to work in Israel have hurt the construction industry, while the military has called up reservists to bolster troop numbers in Gaza and on the Lebanese border. There, clashes with Hezbollah militants have escalated.

“It’s really the first time we’ve had such a long war,” Abir said. “That does have its own effects on the economy and will probably lead to an amount of scarring even after the war ends.”

He nonetheless expressed confidence in the economy’s outlook.

“When you look around, private consumption is more or less holding, the labor market is very tight,” he said. “You see normal wages growing at 7% over the last 12 months. So this is still a robust economy dealing with a serious environment.”

(Updates with Deputy Governor Abir interview starting in second paragraph)

Most Read from Bloomberg Businessweek

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

©2024 Bloomberg L.P.