Bank of America Clients Ditch Stocks First Time in Three Weeks

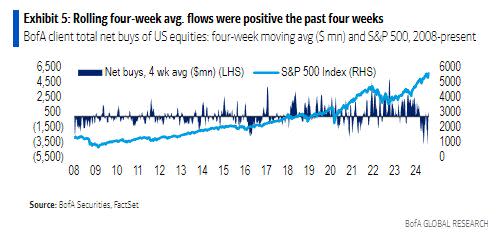

(Bloomberg) -- Bank of America Corp. clients pulled money from US stocks for the first time in three weeks, paring their exposure in the asset class that continued to hover near a record.

Most Read from Bloomberg

Nazi Bunker’s Leafy Makeover Turns Ugly Past Into Urban Eyecatcher

How the Cortiços of São Paulo Helped Shelter South America’s Largest City

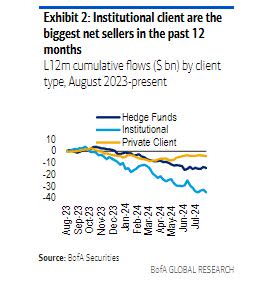

Outflows were on display among all major clients groups — excluding corporates — with $4.6 billion exiting US stocks last week, the bank’s quantitative strategists including Jill Carey Hall wrote in a note to clients on Tuesday. The 500-member index finished the week at 5,634.61, or 0.9% away from an all-time high.

The withdrawal from US equities comes amid uncertainty about how much longer the risk-on momentum that pushed the S&P 500 up 18% this year can continue. It’s also a departure from the buying clients had previously done over the past two weeks. The week before, Bank of America clients shelled out $2.7 billion for US equities as the S&P 500 Index notched its best week of the year.

Read: BofA Hedge Fund, Institutional Clients Buy Stock Rally Last Week

The offloading was seen across seven of the 11 industry groups but was most prominent in technology stocks, which saw their first outflow in three weeks. Clients pulled money from energy stocks for the fifth week in a row, while consumer discretionary posted its first outflow in six weeks. Communication services was a winner yet again, extending its 21-week buying streak.

The outflow from single stocks came as clients purchased ETFs of all sizes, styles and sectors — except mid-caps — for a third consecutive week. Unlike single stocks, tech ETFs saw the largest inflows while energy ETFs saw the largest outflows.

Meanwhile, BofA corporate client buybacks slowed last week, dropping below seasonal levels for the first time in 24 weeks, the strategists wrote. Still, on a year-to-date basis, buybacks are on pace for a record year, according to the firm’s data history.

Most Read from Bloomberg Businessweek

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Losing Your Job Used to Be Shameful. Now It’s a Whole Identity

FOMO Frenzy Fuels Taiwan Home Prices Despite Threat of China Invasion

©2024 Bloomberg L.P.