Autodesk (NASDAQ:ADSK) Surprises With Q1 Sales

Design software company Autodesk (NASDAQ:ADSK) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 11.7% year on year to $1.42 billion. The company expects next quarter's revenue to be around $1.48 billion, in line with analysts' estimates. It made a non-GAAP profit of $1.87 per share, improving from its profit of $1.55 per share in the same quarter last year.

Is now the time to buy Autodesk? Find out in our full research report.

Autodesk (ADSK) Q1 CY2024 Highlights:

Revenue: $1.42 billion vs analyst estimates of $1.40 billion (1.3% beat)

EPS (non-GAAP): $1.87 vs analyst estimates of $1.77 (5.7% beat)

Revenue Guidance for Q2 CY2024 is $1.48 billion at the midpoint, roughly in line with what analysts were expecting

The company reconfirmed its revenue guidance for the full year of $6.04 billion at the midpoint (also reconfirmed full year operating margin guidance)

Gross Margin (GAAP): 90.3%, in line with the same quarter last year

Free Cash Flow of $487 million, up 14.1% from the previous quarter

Billings: $1.11 billion at quarter end, down 5.3% year on year

Market Capitalization: $47.13 billion

"Autodesk is ahead of its peers in 3D AI and the industry clouds, platforms, and business model evolution that will be needed to deliver 3D AI products and services at scale. We can already use generative AI to quickly generate functional 3D shapes from a variety of inputs including 2D images, text, voxels and point clouds. We are well on the way to reasoning about all CAD geometry," said Andrew Anagnost, Autodesk president and CEO.

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

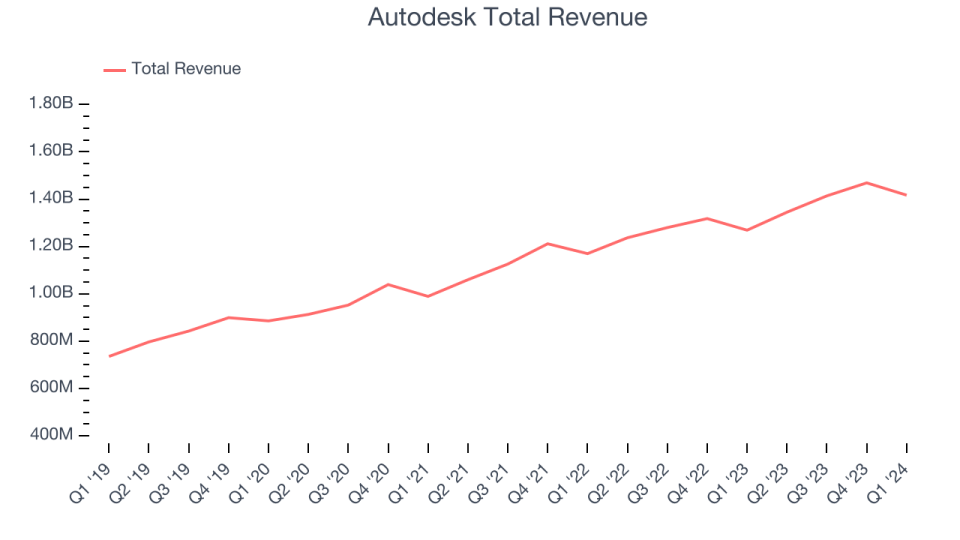

As you can see below, Autodesk's revenue growth has been mediocre over the last three years, growing from $989.3 million in Q1 2022 to $1.42 billion this quarter.

This quarter, Autodesk's quarterly revenue was once again up 11.7% year on year. However, the company's revenue actually decreased by $52 million in Q1 compared to the $55 million increase in Q4 CY2023. Regardless, we aren't too concerned because Autodesk's sales seem to follow a seasonal pattern and management is guiding for revenue to rebound in the coming quarter.

Next quarter's guidance suggests that Autodesk is expecting revenue to grow 10.2% year on year to $1.48 billion, improving on the 8.7% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 10% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

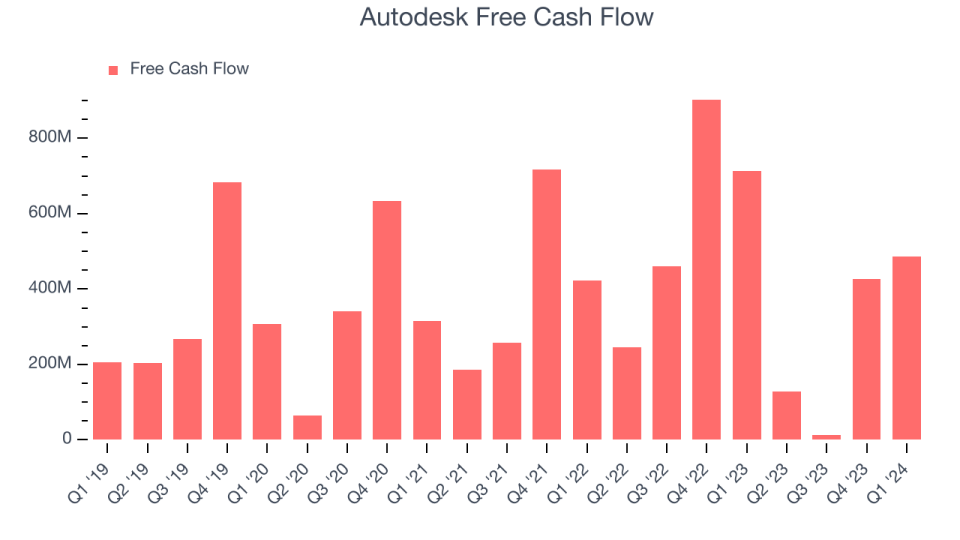

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Autodesk's free cash flow came in at $487 million in Q1, down 31.8% year on year.

Autodesk has generated $1.06 billion in free cash flow over the last 12 months, a solid 18.7% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Autodesk's Q1 Results

It was encouraging to see Autodesk narrowly top analysts' revenue expectations this quarter. On the other hand, its billings unfortunately missed analysts' expectations and its gross margin decreased. Next quarter's revenue guidance was roughly in line with expectations and both full year revenue and operating margin guidance was reaffirmed, showing that the company is on track with no major surprises. The stock is flat after reporting and currently trades at $211.50 per share.

Autodesk may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.