Is Apple Stock Overpriced?

Apple (NASDAQ: AAPL) is currently the largest company in the world by a decent margin, but some may be unsure if it deserves that lead. From a few perspectives, Apple's stock looks very expensive and might be overpriced.

Is that the case? Or is there more to the Apple story?

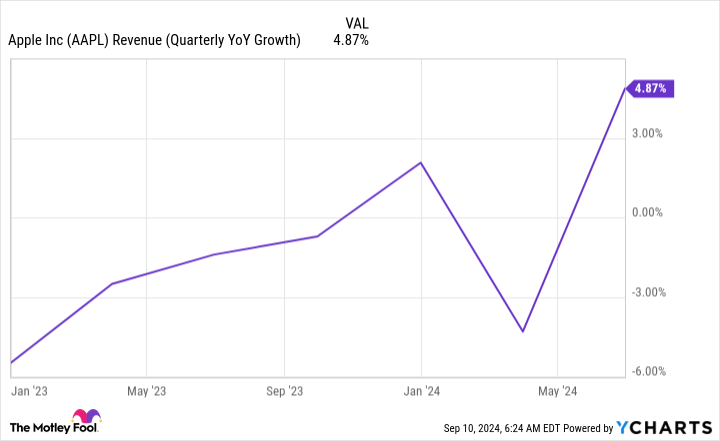

Apple's sales growth has been nonexistent

Apple is one of the world's most recognizable companies, and its products likely need no introduction. However, Apple's sales haven't kept up with its reputation over the past two years. Apple has struggled to meaningfully increase revenue in any capacity, and its sales would have likely dipped if not for the strength of its subscription services.

Although Apple is coming off of its best quarter in some time, 5% revenue growth isn't all that impressive, especially compared to some of its big tech peers. If you look at Apple's latest quarter (the third quarter of fiscal year 2024, ended June 29), it's clear that Apple is still struggling.

Category | Q3 FY 2024 Revenue | Revenue Growth (YOY) |

|---|---|---|

iPhone | $39.3 billion | (1%) |

Mac | $7 billion | 2% |

iPad | $7.2 billion | 24% |

Wearables, home, and accessories | $8.1 billion | (2%) |

Services | $24.2 billion | 14% |

Data source: Apple. YOY = Year over year.

Although iPad sales may be up from last fiscal year, they're still generating about the same amount of revenue as they did in fiscal year 2022 ($7.2 billion) and fiscal year 2021 ($7.4 billion). Services once again saved the day, as its growth has been meaningful and sustainable for some time.

The biggest problem is iPhone sales, which have been flat since fiscal year 2022 ($40.7 billion) and fiscal year 2021 ($39.6 billion). In 2021 and 2022, Apple launched the iPhone 13 and 14, respectively. The pricing points for the basic model are the same as this year's iPhone 16: $799. So, with no pricing bumps to the starting price, it's clear Apple hasn't been able to sell any more iPhones than it normally does.

But could that be changing?

iPhone 16 gives consumers a reason to upgrade

There hasn't been a real reason for many people to buy the new iPhone recently. Yes, battery life may have improved, and the cameras get a slight upgrade from year to year, but has there really been a game-changing feature launched over the past few years?

That sentiment may change with the iPhone 16, as these phones (along with the iPhone 15) will have access to Apple Intelligence, which is Apple's take on generative AI. Time will tell if this feature is truly a game changer or just Apple following the rest of the tech world.

But is it enough to make Apple stock reasonably priced even if Apple Intelligence is a hit?

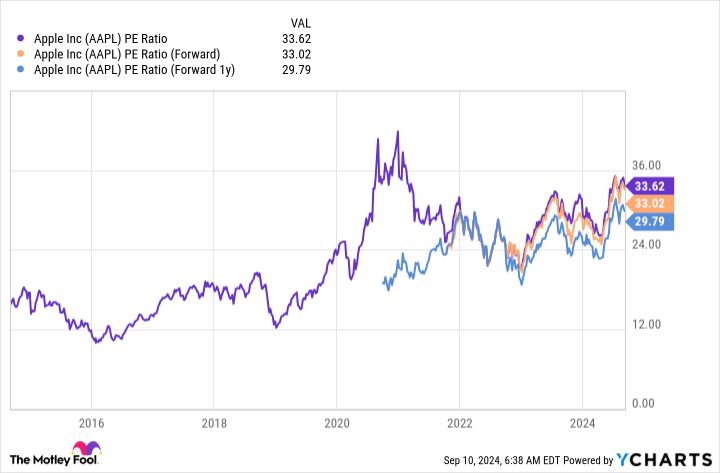

Apple's stock is very expensive for its growth

Apple's stock trades at the high end of its recent valuation at 33.6 times earnings.

If you look at forward earnings, it's clear Wall Street analysts don't expect much growth either, with just 2% growth expected until the end of this fiscal year and 13% growth next year.

A growth rate of 13% is normally acceptable for a stock valued slightly above the market (measured by the S&P 500). However, Apple's stock trades at a significant premium to the S&P 500's 22.6 times forward earnings.

So, with Apple still having a huge premium over the S&P 500 even after how much growth Wall Street believes it will get from its new iPhone launch, I think Apple's stock is vastly overpriced.

If you compare it to other big tech companies in its class, there are plenty of worthy alternatives. Apple isn't the stock it once was, and investors need to recognize that and move on to better picks.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Is Apple Stock Overpriced? was originally published by The Motley Fool