In This Article:

(Bloomberg) -- Apple Inc.’s iPhone set a new high for its share of profits from global smartphone sales in 2022, after navigating a dire year for the industry better than competitors.

Most Read from Bloomberg

-

Quake Toll Hits 4,000 in Turkey, Syria as Overseas Aid Flows

-

Trump Charges in Georgia Over 2020 Could Lead to Bigger Fed Case

-

Wall Street Goes Risk-On Without Powell’s Pushback: Markets Wrap

The Cupertino, California-based tech giant collected 85% of operating profit and 48% of revenue from smartphone sales over the course of the year, new Counterpoint Research estimates showed. Both were new peaks for the company, 15 years into the iPhone’s time on the market, and the firm’s flagship device also scored its biggest proportion of global smartphone shipments.

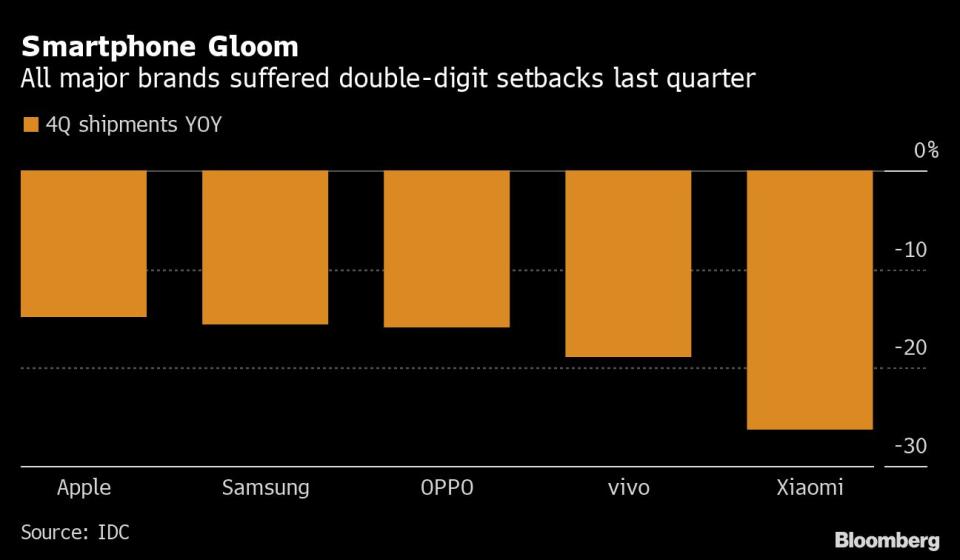

The smartphone industry churns on notoriously thin margins for handset manufacturers — eliminating storied but uncompetitive brands like Nokia, BlackBerry, Palm and HTC over the years. Apple and, to a lesser extent, Samsung Electronics Co., are the notable exceptions. In 2022, worldwide smartphone shipments fell by double digits, most severely in China, and those profits dwindled for the majority of companies.

Apple and Samsung were the only big brands to register revenue growth, of just 1% each, according to Counterpoint, after both sold a higher proportion of premium devices like Apple’s iPhone 14 Pro series. The company’s profit lead on peers would have been even greater if it had been able to ship more of its top-tier devices in the final quarter of the year, the research firm said.

Apple’s 2022 performance comes despite its worst holiday performance in four years, after supply snags and a softening economy hurt iPhone revenue. The iPhone and Mac were particular weak spots for Apple last quarter, dragged down by a broader slump afflicting mobile devices and computers. The Covid restrictions in China added to Apple’s woes, making it harder to ship enough of the most popular versions of the iPhone.

While the end to Covid Zero is spurring optimism for a rebound led by Chinese demand, the outlook is far from certain, cautioned analysts.

“It is currently uncertain whether China’s reopening would help recovery of the global smartphone market,” said MengMeng Zhang, analyst at Counterpoint. A more than 20% smartphone sales rise during the first two weeks of January could be due to pent-up demand from the prior two months, when the pandemic limited mobility in China, she said. “The economic situation does not point to an immediate recovery of the smartphone market in the first half, although we expect to see some level of rebound happening in the second half.”