Veteran fund manager resets Nvidia stock price target after supplier update

Chip giant Nvidia (NVDA) has had a huge 2024.

The stock is up nearly 179% this year, 2.4% last week, and 13.6% in October alone.

The Friday close of $138 was just below its peak close of $138.07, set on Oct. 14. The shares are up nearly 40% from their August lows.

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter.

Nvidia's market capitalization stands at $3.4 trillion, just behind that of Apple's (AAPL) $3.6 trillion and ahead of Microsoft's (MSFT) $3.1 trillion.

Related: Veteran fund manager delivers blunt words on stock market

No wonder analysts and investors are boosting price targets for the maker of semiconductors and related software crucial to the development of artificial intelligence.

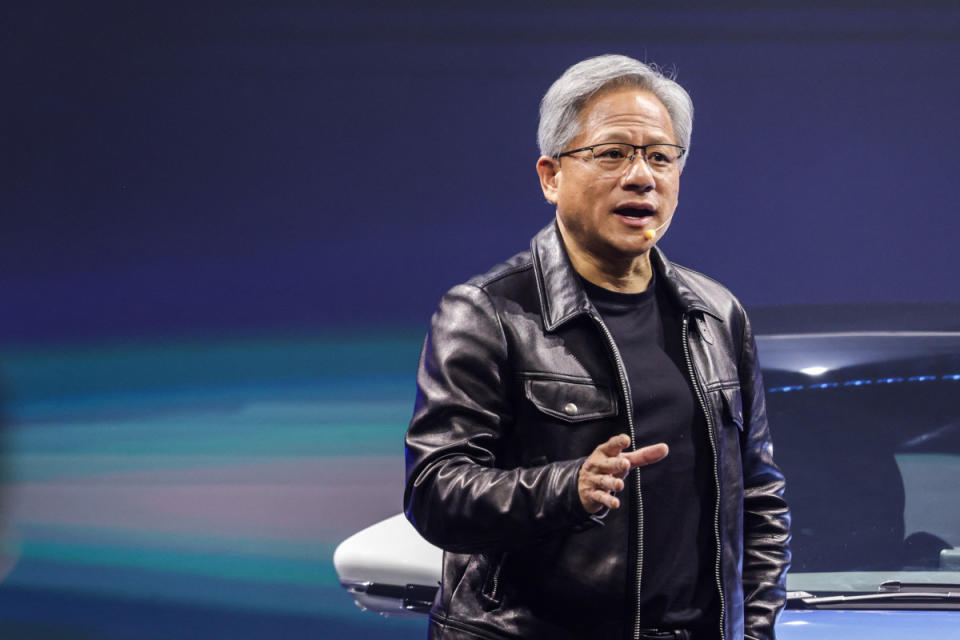

I-HWA CHENG/Getty Images

A big boost to Nvidia's stock price target

On Friday, Chris Versace, a veteran analyst and portfolio manager of the Street Pro portfolio, boosted his price target on Nvidia from $155 to $175, a 12.9% increase.

Based on Friday's close, that would imply Nvidia's shares could rise nearly 28% over the next 12 months.

If you follow TheStreet Pro's portfolio, you know he signaled the target price hike on Thursday. Then, he cited "the robust earnings and guidance" from Taiwan Semiconductor (TSM) , the world's largest manufacturer of semiconductors.

Related: Nvidia's biggest problem might be about to get even worse

Because Taiwan Semi's results were so strong, Versace promised he "would need to revisit our NVDA price target."

Revisit the target he did, and he pushed it higher.

Versace conceded his boost wasn't as big as the 18.2% price-target boost issued by Bank of America Securities. BofA boosted its Nvidia target from $165 to $195.

More on Investing and markets

Another Nvidia price-target boost ahead?

But Versace had his reasons, and that may mean he would boost his Nvidia target again soon.

The big reason, he wrote, is he wants to see if there are any revisions to the capital expenditure plans from four key users:

All four have been investing heavily in AI-related applications and equipment and have revised capital expenditure estimates repeatedly this year.

Alphabet reports third-quarter earnings after its Oct. 29 close.

Microsoft and Meta report results after the Oct. 30 market close.

Amazon reports results after its Oct. 31 close. Apple (AAPL) also reports that afternoon.

Taiwan Semi sees great times, too

Meanwhile, Taiwan Semiconductor suggested in its third-quarter report that its growth prospects were really strong because all the semiconductor heavyweights want the company to manufacture their chips.

Related: Nvidia stock hits record high as key AI player smashes Q3 earnings

"It's the world's best," Nvidia CEO Jensen Huang said last month.

Taiwan Semiconductor reported revenue of $23.5 billion (USD), up 36% from a year earlier. Gross profit margin was 57.8%. Net profit margin was 42.8%.

Taiwan Semi's shares are up 15.6% in October and 93% in 2024, and the company has joined the ranks of companies with market capitalizations of $1 trillion or greater.

The others are Apple, Nvidia, Microsoft, Alphabet, Amazon.com and Meta Platforms.

The big risk Taiwan may face is if the People's Republic of China decides to invade the island nation. China considers Taiwan to be a part of mainland China. Taiwan has resisted the idea.

The company is now trying to build a plant in Arizona, but numerous construction and staffing problems have delayed the project.

Related: Veteran fund manager sees world of pain coming for stocks