By Nichola Groom, Cole Horton and Simon Jessop

LOS ANGELES/NEW YORK (Reuters) - For the first time, investors seeking to pour cash into U.S. clean energy projects can count on at least a decade of generous federal subsidies, offering them long-sought confidence in the staying power of the world’s third biggest renewables market.

Tax credits for wind and solar projects have underpinned explosive growth in U.S. installations over the last decade. But they have often had short time horizons, leaving project developers scrambling to meet looming deadlines and spooking risk-averse investors.

The long-term tax credit commitments for wind and solar, wrapped up in a $430 billion bill expected to receive final passage in the U.S. House of Representatives on Friday, were joined by new credits for energy storage, biogas and hydrogen. Developers of wind and solar projects will also be able to get more support if they use U.S.-made equipment or build their projects in poorer areas.

"This is going to be a golden period of 10 years, at least," said Keith Martin, an attorney with Norton Rose Fulbright who works on financing renewable energy projects. "That is a long horizon for people to plan and really get this transition to clean energy into high gear."

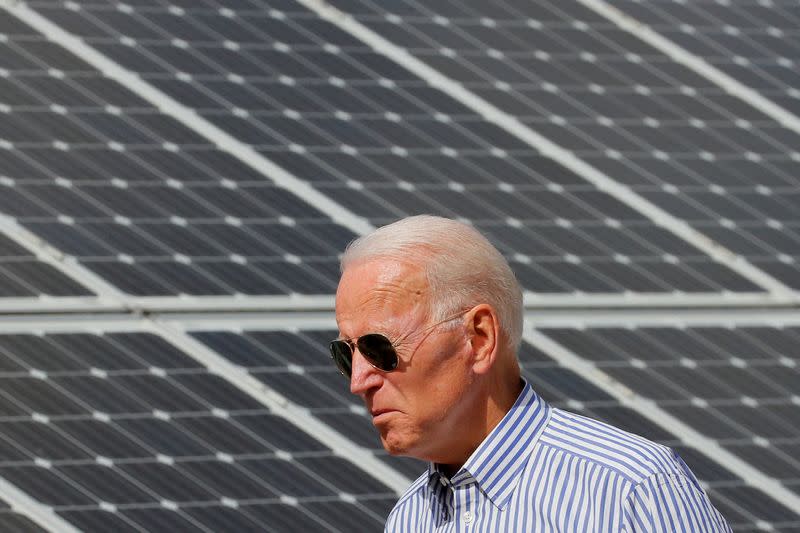

Once the House passes the Inflation Reduction Act, President Joe Biden should sign it into law shortly after that.

Shares of renewable energy companies have soared since Senate Democrats announced a deal to pass the bill on July 27. The WilderHill Clean Energy Index is up 15% during that time. The index includes U.S. market players like solar panel maker First Solar, residential solar company SunPower Corp, renewable asset owner Brookfield Renewable and battery storage company Fluence Energy, among others.

Wind and solar accounted for just 12% of U.S. electricity generation last year. But decarbonizing the nation's electricity sector by 2035, as the Biden administration has pledged to do, will require far more.

Renewable energy investment hit $215 billion in the United States in 2021, according to the International Energy Agency, lagging China and Europe. Investors, project developers, bankers and lawyers said the Inflation Reduction Act will drive a step-change in demand from a broad range of investors.

'OUR TACTICS HAVE CHANGED'

Shawn Kravetz, president of Esplanade Capital, which manages a solar-focused hedge fund, said his firm this year has focused mainly on the renewables boom in Europe. U.S. developers have struggled with pandemic-related supply chain disruptions, import tariff threats and concerns about links to forced labor in China. The legislation, with its decade of policy stability, is changing that approach.