Altria Group: Buy, Sell, or Hold?

There are many reasons to love Altria Group (NYSE: MO) stock. The most obvious is its 8% dividend yield. That payout may seem too good to be true, but the company has maintained a lofty dividend for decades. The current rate was just raised last December.

But before you dive in, there are two valuable things to know about this income-generating investment.

Altria stock might save your portfolio during a market crash

As a nicotine producer, Altria benefits from a high level of customer loyalty that few companies can match. It owns many of the industry's most reputable brands, including Marlboro, John Middleton, JUUL, and Black & Mild. Research shows that tobacco use shifts very little during economic downturns, and Altria's stock performance during market crashes testifies to that reality. In 2008, for example, Altria shares outperformed the S&P 500 by more than 7%. In 2022, when the S&P 500 lost 18% of its value, Altria stock actually gained around 4% in value.

It's important to note that Altria's dividend payment hasn't always been reliable through these periods. While the dividend was actually raised in 2022 despite market struggles, it was slashed by more than half during the 2008 crash. Then again, few companies were spared during that global collapse. And while the dividend was lowered, the stock's total outperformance during this period still speaks to the resiliency of tobacco stocks during times of turmoil.

Don't be scared about the dividend right now

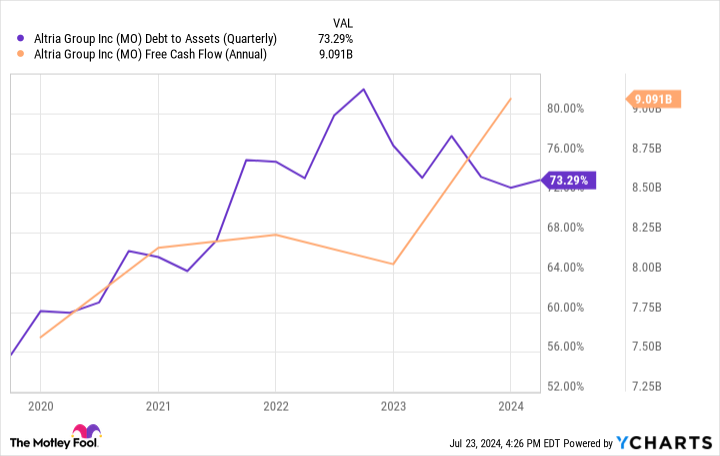

Yet despite Altria having lowered its dividend during previous downturns, it's a rare occurrence. Over the next few years, it's unlikely the company will need to slash its payout. That's because it has plenty of existing free cash flow to cover not only the dividend, but also debt payments and retirements, share repurchases, and the launch of new smokeless products. In 2023, for example, Altria paid $6.8 billion in dividends, plus another $1 billion in share repurchases. Plus, it was able to slightly reduce its debt-to-assets ratio from 0.77 to 0.73. Total free cash flow over that period was around $9 billion -- more than enough to cover all of these priorities.

Long term, there are some concerns. Combustible nicotine products -- Altria's current cash cow -- are in secular decline. And although smokeless nicotine usage is rapidly on the rise, Altria will need to invest heavily to make the transition. There's no guarantee that it will enjoy the same economics or commercial success, even if it does come to dominate the smokeless category. It has experienced early wins with brands like On!, NJOY, and Ploom. But over the next decade, the dividend's sustainability will hinge entirely on Altria's ability to replace its legacy combustibles business with a smokeless division capable of producing similar levels of cash flow. It will be a slow transition, but one that long-term investors must be bullish on in order to justify owning the stock.

Should you buy Altria shares?

Right now, Altria stock is perfect for two types of investors: Those looking to insulate their portfolios from a market crash, and those looking to generate high levels of cash income over the next few years. If you fit either of those descriptions, Altria stock could be for you.

But what about if you're looking for long-term total returns? Altria stock is likely not for you. The same factors that make Altria a reliable investment during times of trouble turn into a burden during strong bull markets. The company doesn't lose many customers during a recession, but it doesn't gain a bunch during an economic boom, either. That limits upside during bull markets. Over the last decade, for instance, Altria stock has delivered a 120% total return, while S&P 500 investors enjoyed gains of 238%. This handicap makes Altria stock a buy for some, but not all.

Should you invest $1,000 in Altria Group right now?

Before you buy stock in Altria Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Altria Group: Buy, Sell, or Hold? was originally published by The Motley Fool