Almost Every Ark Fund Is Now Underperforming The Overall Market. Here's Why.

Are you a fan of Cathie Wood's Ark Invest exchange-traded funds? You're not alone. She and her company made quite a name for themselves in 2020 when many of these ETFs were easily outpacing the already bullish market. It was a time when investors readily embraced -- and bid up -- stocks of companies with novel business ideas. Ark's fund owned a bunch of these names.

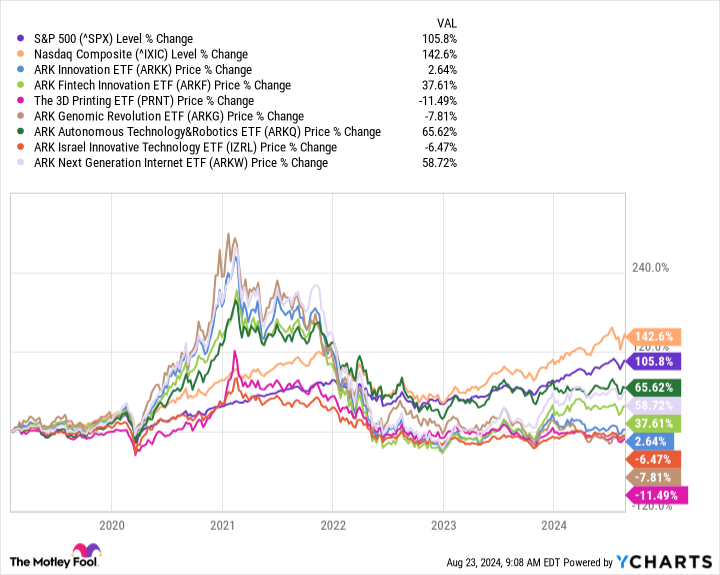

Things have changed since 2021, however, and not for the better. Although the S&P 500 (SNPINDEX: ^GSPC) and the Nasdaq Composite (NASDAQINDEX: ^IXIC) are both within sight of recently reached record highs, most of the Ark funds are still trading well below their 2021 peaks. In one example, the Ark Genomic Revolution ETF (NYSEMKT: ARKG) is down more than 20% in the past five years compared to the broad market's roughly doubling in value.

What went wrong? Nothing's gone wrong, per se. Ark's funds are still exactly what they're supposed to be.

There's the rub though because, in this market environment, what they are is the exact wrong thing.

Ark Funds were red hot ... until they suddenly weren't

On the off-chance you're reading this and aren't familiar with them, Ark Invest manages a family of exchange-traded funds intended to "focus solely on investing in disruptive innovation." Each fund simply focuses on a different area of innovation. The Ark Fintech Innovation ETF (NYSEMKT: ARKF), for instance, holds several of the market's most promising fintech stocks. Its flagship Ark Innovation ETF (NYSEMKT: ARKK) consists of a wide range of tickers. Its biggest holdings right now are EV maker Tesla, streaming technology outfit Roku, cryptocurrency wallet company Coinbase Global, and video gaming/metaverse platform Roblox. The aforementioned Genomic Revolution ETF of course invests in genetic technology and therapy companies.

These are all promising industries, each of which is home to at least a few compelling investment prospects. Many of these prospects have performed well (even if erratically) during their history too. In fact, most of Ark's funds outright soared when the market began bouncing back from its pandemic-prompted plunge in early 2020.

These rallies unraveled beginning in 2021, however, and never really stopped unraveling even though the market tide turned decidedly bullish again early last year.

What gives?

The fault isn't in the premise of investing in disruptive technologies. The fault is in the execution of the idea, and the fact that such funds are only apt to perform well in certain kinds of economic environments.

Ark Fund's oversized risks come back to haunt investors

Hot technology stocks are an obvious favorite of aggressive, growth-minded investors, and for good reason. In the long run, these are where the market's biggest gains tend to come from.

These big gains are logged rather inconsistently though. They typically require a very particular sort of economic environment. That's one marked by low interest rates (which makes for cheap growth capital) and a robust economy like the tech-led one seen in the late 1990s and the stimulus-driven one in 2020. Anything less, and tech stocks aren't especially well-positioned to thrive. Cathie Wood even says as much herself. In a recent letter penned to Ark's fund owners, Wood concedes "Ark's strategies, beginning with ARKK, have paid the dues associated with higher interest rates."

As for the execution of the idea of only owning stocks of potentially disruptive companies, this is where the critique becomes a bit philosophical.

Perhaps first and foremost, although each of Ark's ETFs is industry-focused, Wood and Ark's fund managers aren't buying and holding stocks and then letting time do most of the heavy lifting. They're trading pretty frequently even if they're limiting a particular fund's trades to stocks in an assigned industry. The Ark Next Generation Internet ETF's (NYSEMKT: ARKW) most recently reported annual turnover, for example, is 33%, meaning one-third of the portfolio's stocks have been swapped out for others within the 12-month stretch in question. Not only does this above-average turnover raise a fund's yearly taxability potential, but it potentially crimps performance. Data consistently shows that funds meant to outperform the overall market by more frequent buying and selling of stocks actually underperform it far more often than not. Trade timing is just hard to do!

In this vein, it would be amiss to not point out that (too) many of Ark's buys and sells appear to be reactive rather than proactive, when much of the opportunity in question is already in the rearview mirror.

And it's worth adding that most of Ark's ETFs aren't necessarily well-balanced. Tesla accounts for a little more than 13% of the Ark Autonomous Technology & Robotics ETF's (NYSEMKT: ARKQ) value, while its second-biggest makes up more than 10% of the fund's value. That's not a great deal of diversification. Also know that while Tesla is a major piece of the Ark Autonomous Technology & Robotics ETF, the electric vehicle company accounts for over 13% of the Ark Innovation ETF's value as well, underscoring overconcentration risks for Ark's family ETFs as a whole.

Let's also not pretend that a wide swath of Ark's picks soared on actual prospective profits rather than hollow, unproven hype.

End net result? Sweeping underperformance for long stretches of time. Any Ark fund that's been in existence for long enough to compare is currently trailing the S&P 500 on three-year and five-year timeframes.

A good allocation strategy works in at least most environments

None of this is to suggest Ark's funds can't or won't thrive again in the future. They might. Indeed, they probably will.

Even patient buy-and-hold investors, however, can't ignore the fact that remaining patient with these particular funds is translating into a major missed opportunity in the meantime. Again, the Nasdaq as well as the S&P 500 both recently hit record highs while some (arguably too many) Ark funds are lingering near multi-year lows. A sound allocation strategy should capture at least most of the market's gains most of the time. And that perhaps is the big takeaway for investors -- most people don't have several years to wait and hope a focused industry bet works out. Sometimes they don't work out at all. Just ask most of the meal kit companies ... the ones that are even still around.

It's just some food for thought if you're trying to figure out how you feel about Ark's aggressive, industry-focused stock-picking approach.

Should you invest $1,000 in Ark ETF Trust - Ark Innovation ETF right now?

Before you buy stock in Ark ETF Trust - Ark Innovation ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ark ETF Trust - Ark Innovation ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Coinbase Global, Roblox, Roku, and Tesla. The Motley Fool has a disclosure policy.

Almost Every Ark Fund Is Now Underperforming The Overall Market. Here's Why. was originally published by The Motley Fool