Airbnb Sell-Off: Buy or Sell This Disruptive Tech Stock?

Airbnb (NASDAQ: ABNB) is one of the most divisive stocks out there. Bulls think the company is revolutionizing travel and has many years left to grow, while bears think regulations and consumer pushback will lead to an "Airbnb Apocalypse." Bears look more correct this summer after the stock fell 13% following its second-quarter earnings release, when it highlighted slowing demand in North America.

The stock is now down 47% from its all-time high. This sounds like a perfect time to take a closer look at Airbnb and its prospects.

Slowing North American bookings

Financials looked strong overall for Airbnb in the second quarter. Revenue grew 11% year over year to $2.75 billion. Gross booking value (GBV), or the total dollar amount flowing through the Airbnb network, was up 11% as well to $21.2 billion. Earnings and cash generation remain strong.

So what went wrong? Airbnb stock fell due to commentary around lead times in North America. Essentially, people are still making bookings in the region for stays that are coming up shortly. However, for stays further out into the future (say, Thanksgiving or Christmas), there has been a slowdown in bookings.

Investors are concerned since weakening demand at longer lead times indicates people are less confident they will be able to take winter trips, which could lead to slowing growth for Airbnb. North America is its most important region, and Wall Street likely revised down its growth estimates for the coming quarters following the update.

Plenty of room to grow internationally and into new verticals

North America may be Airbnb's most important region today, but the company is working to diversify and become an increasingly global business over the next few years. Today, it has five core countries that drive revenue growth: the United States, Canada, France, the United Kingdom, and Australia. In the coming years, it will be investing heavily to increase supply and demand for alternative lodging in new markets. These include Japan, South Korea, Latin America, India, and Southeast Asia.

Given how popular these regions are as travel destinations, investors should be quite bullish on Airbnb's long-term growth. If market share in other countries can reach what it has in more mature markets, Airbnb's GBV could be two or three times as large as it is today in five to 10 years' time.

Don't forget its plans to diversify outside of just lodging/vacation rentals as well. Airbnb is planning to relaunch its Experiences segment soon. Experiences include tours and activities for travelers, a perfect add-on for Airbnb customers. With a new product interface, investments in supply, and a revamped marketing strategy, Airbnb plans to grow bookings for Experiences to a much larger level. This can contribute to overall revenue growth even if North American demand slows down.

Buy or sell Airbnb stock?

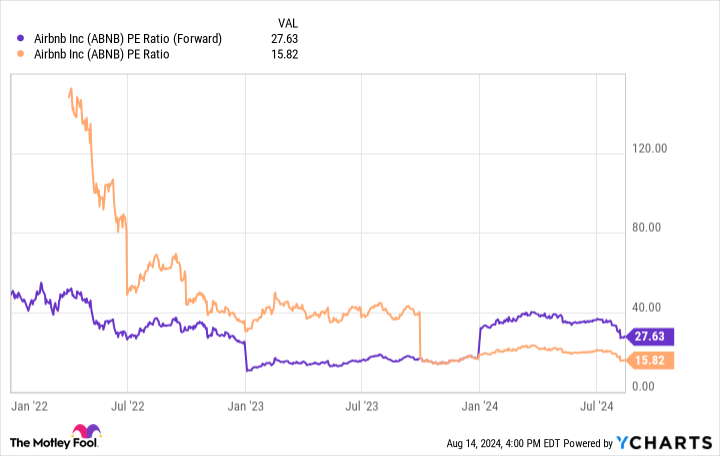

Even though Airbnb stock is down close to 50% from its peak, it still trades at a high forward price-to-earnings ratio (P/E) of 28. Its trailing P/E is lower, but that's due to a one-time accounting charge that benefited earnings. A P/E of 28 is high, given the S&P 500 sports a forward P/E ratio below 22.

Airbnb has a long runway to grow, which should boost earnings and further bring down its valuation. The stock might be a buy if you're extremely bullish on the company's international expansion and Experiences projects. However, for someone like myself who looks for a margin of safety in investing, Airbnb stock still looks too expensive to me right now.

It will remain on my watchlist, though, as this is a high-quality business, just one I prefer to buy at a cheaper price.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Airbnb. The Motley Fool has a disclosure policy.

Airbnb Sell-Off: Buy or Sell This Disruptive Tech Stock? was originally published by The Motley Fool