Is AGNC Investments the Best Dividend Stock for You?

AGNC Investment (NASDAQ: AGNC) is an alluring dividend stock. The mortgage-focused real estate investment trust (REIT) currently yields 14%. That's more than 10 times higher than the S&P 500's dividend yield of around 1.3%. Furthermore, it pays its dividend monthly instead of the quarterly schedule of most other dividend stocks.

Those features make it an enticing dividend stock for many income-seeking investors. However, it has some negative features that might not make it the right one for you.

The dividend makes up the entire return

Investors generally have two ways to make money from a stock investment: dividend income and stock price appreciation. Those two factors combine to produce a stock's total return. In recent decades, about 15% of a stock's total return has come from dividends. The rest came from the company's ability to retain earnings to grow shareholder value by making capital investments, completing accretive acquisitions, and repurchasing shares.

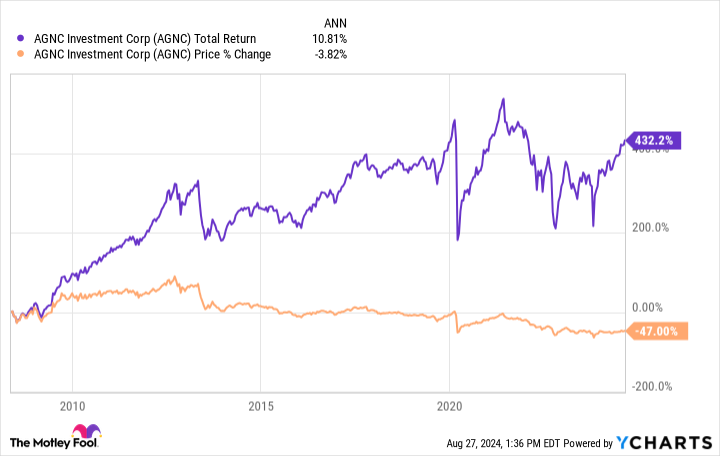

Mortgage REITs like AGNC Investment are different. REITs must pay out at least 90% of their taxable income to shareholders through dividends to comply with IRS regulations. The bulk of their total returns thus tends to come from dividend income. This factor has been even more pronounced with AGNC Investment over the years:

As that chart shows, all of AGNC Investment's total return has come from dividends. Its stock price has fallen by an average of 4% per year. That's largely because it needs to issue more stock to fund new mortgage-backed security (MBS) investments to grow its portfolio. So if you're looking for some stock price appreciation potential along with your dividend income, AGNC Investments might not be the best dividend stock for you.

The payout has faced sustainability issues in the past and could again in the future

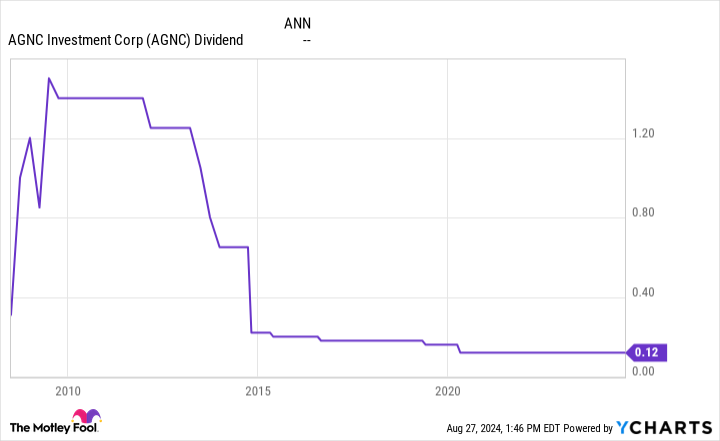

While AGNC Investments offers an attractive monthly income stream right now, the REIT has had trouble maintaining its dividend in the past. It has cut its payment several times over the years:

The REIT currently expects to be able to maintain its dividend despite shifting momentum in the fixed-income sector. The economy has started to soften while consumer spending has weakened. Despite those factors, the Federal Reserve hasn't yet cut interest rates, which has caused greater volatility in the mortgage market. On a more positive note, the company's longer-term outlook for the Agency MBS market is very favorable, since the Fed should start cutting rates soon. That gives it reason for optimism that it should be able to continue paying its current dividend level.

However, given its past cuts and the prospect of future issues in the mortgage market, the REIT's dividend might not be sustainable forever. So it might not be the best dividend stock for those seeking a very bankable payout.

Furthermore, it seems as if AGNC Investment will, at best, maintain its dividend in the future. That means investors probably won't get a raise. This factor makes the REIT best for those desiring more of a fixed-income stream.

Meanwhile, the lack of dividend growth could affect its ability to produce attractive total returns. That's because the best total returns have come from companies that increase their dividends. According to data from Ned Davis Research and Hartford Funds, dividend growers and initiators have produced a 10.2% average annual total return over the past 50 years. That compares with a 7.7% average total return for an equal-weighted S&P 500 Index.

However, it's a different story for companies with no change in their dividend policy, with a 6.7% average annual return, and dividend cutters and eliminators, at negative-0.6%. If AGNC continues to maintain its payout or eventually reduces it again, its total returns could underperform the S&P 500. Its stock price will probably continue to fall, potentially accelerating its decline if it cuts its payout.

A higher-risk, higher-yielding dividend stock

AGNC Investments offers a monster monthly income stream. However, that doesn't mean it's the best option for every dividend investor. The mortgage REIT's payout makes up most of its total return, and it might not be able to maintain its current dividend level in the future, let alone increase the payment. It's best for those seeking income over growth and are willing to take on more risk for a bigger monthly payout that's likely to make up all of your return.

Should you invest $1,000 in AGNC Investment Corp. right now?

Before you buy stock in AGNC Investment Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AGNC Investment Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Matt DiLallo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is AGNC Investments the Best Dividend Stock for You? was originally published by The Motley Fool