Is Advanced Micro Devices (AMD) Stock a Buy Now?

Semiconductor company Advanced Micro Devices (NASDAQ: AMD) recently reported second-quarter earnings. While archrival Nvidia posted triple-digit revenue growth on AI tailwinds in recent quarters, some laggards in AMD's business have muffled its top-line performance.

However, there are signs that AMD is becoming increasingly competitive in AI, which could accelerate the company's total growth.

With shares down over 30% from their high, this could be an excellent opportunity to buy a stock with multiple growth opportunities ahead.

Gaming and embedded weighing down AMD's growth

AMD's AI business had a fantastic quarter. Yet total revenue grew by just 9% year over year in Q2.

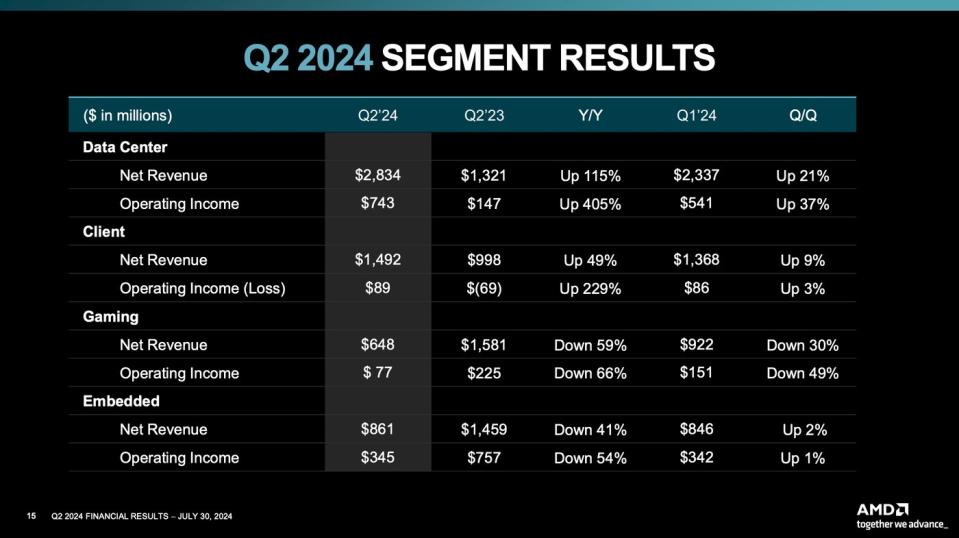

Sharp declines in AMD's gaming and embedded segments offset stellar AI uptick in the data center and client segments:

The gaming segment, which is cyclical, is enduring a downturn between gaming console generations. Meanwhile, customers in the embedded segment are working through high inventory levels that have cooled sales. Embedded revenue did grow 2% over Q1, which management noted as a bottom, so it should continue rising from here.

But every dollar of revenue counts the same. AMD's underperforming gaming and embedded segments, which represented $1.5 billion of AMD's total $5.8 billion Q2 sales, brought total year-over-year revenue growth down to 9%. The good news is that total growth is poised to accelerate as the data center, client, and embedded segments grow, and gaming represents a smaller portion of total sales.

Examining AMD's AI growth potential

It's no secret that Nvidia is the market leader in AI chips. However, a strong runner-up can still make lots of money. AMD has the opportunity to expand by taking market share from Nvidia and riding the tide as AI chip demand grows. CEO Lisa Su believes the AI chip market will reach $400 billion by 2027. AMD is on pace to capture just a fraction of that figure -- around $12 billion in data center sales this year.

AMD's data center segment revenue rose 115% year over year in Q2, faster than Q1's 80% growth rate. Microsoft mentioned in its recent fiscal year Q4 earnings call that it had added new chips from AMD, Nvidia, and its in-house development. Understandably, some companies may want to diversify their chip suppliers to avoid putting all their AI eggs in the Nvidia basket.

The client segment, which notched revenue growth of 49% year over year in Q2, is another growth opportunity. Personal computers with AI-capable chips are poised to explode over the coming years. Research firm Canalys estimates that AI PC shipments could increase at a 44% annualized rate from 2024 through 2028, which would translate to 600 million PCs cumulatively over the next four years.

Investors could see AMD's revenue growth accelerate as these burgeoning segments contribute more to AMD's total revenue.

Is the stock a buy today?

A stabilization in AMD's embedded segment is good news, but the main story here is AI. AMD's Q2 earnings show that business is booming, which instills confidence in the company's growth outlook. Analysts currently expect AMD earnings to grow by an average of 33% annually over the next three to five years. Using estimated 2024 earnings, AMD trades at a forward P/E ratio of 40.

The stock offers solid value today if AMD delivers growth on par with estimates. Annualized 33% growth is a high bar to clear. Still, one could argue that AMD's opportunity to increase its market share from its small footprint is an advantage over Nvidia, which must defend against competition from multiple directions. Of course, that will depend on AMD's ability to execute and sell its product in the market.

So far, accelerating data center growth is a promising sign.

AMD has several opportunities right in front of it. After the recent 30% drop, those who believe in the company's ability to translate potential into results have a chance to buy shares cheaply.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Advanced Micro Devices (AMD) Stock a Buy Now? was originally published by The Motley Fool